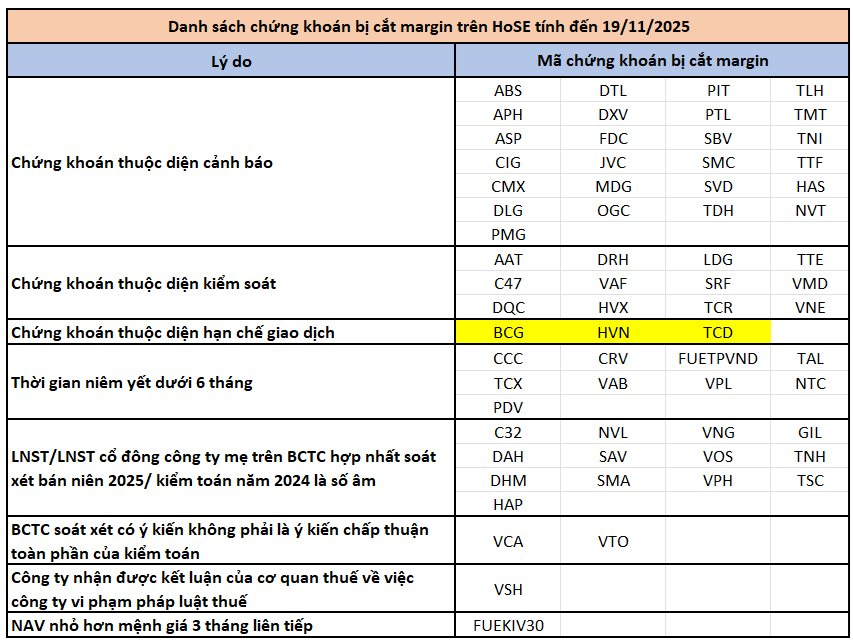

The Ho Chi Minh City Stock Exchange (HOSE) has recently updated its list of securities ineligible for margin trading. As of November 19, 2025, 66 stock codes have been removed from margin eligibility on HOSE.

Most notably, HOSE has added PDV (Phuong Dong Vietnam Transportation and Logistics Corporation) to the list due to its listing period being under six months.

On the morning of November 19, over 66 million PDV shares were officially listed and began trading on HOSE with a reference price of VND 12,450 per share. By the end of the session, PDV’s price had risen by 2.8% to VND 12,850, bringing its market capitalization to nearly VND 860 billion.

HOSE cited several reasons for the margin restrictions, including securities under warning/control/trading restrictions; negative after-tax profits with auditor opinions; and listing periods under six months.

Familiar codes on the list include BCG, HVN, NVL, LDG, OGC, TLH, and NVT, among others.

Compared to the list updated in late October, HOSE has added several stocks with listing periods under six months, as well as those under warning and control.

According to regulations, investors cannot use credit limits (financial leverage – margin) provided by securities companies to purchase these 66 ineligible stock codes.

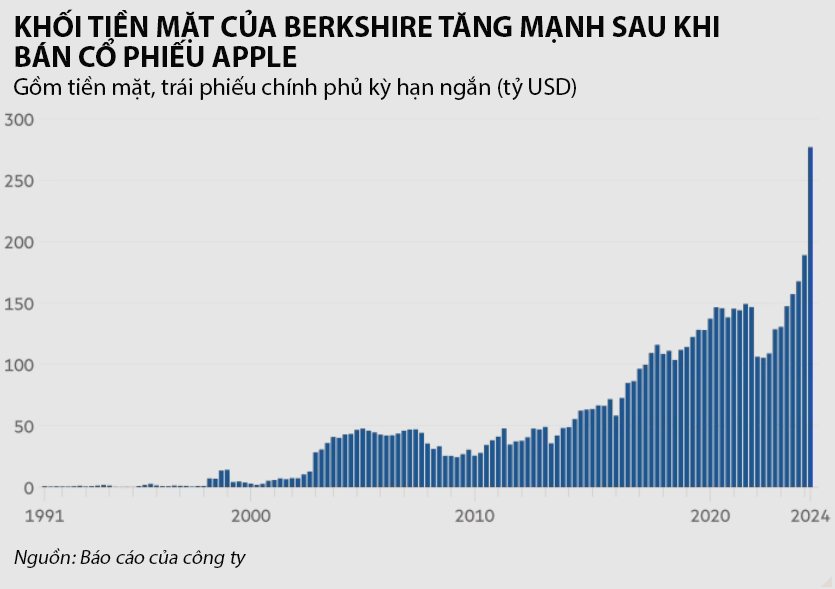

Foreign Investors Resume Net Selling on November 21: One Stock Brokerage Unloaded Over 700 Billion VND

Following a net buying session, foreign trading activity turned negative as foreign investors resumed net selling, offloading a total of VND 677 billion.

PDV Logistics Officially Lists on HOSE

On the morning of November 19th, Phuong Dong Vietnam Transportation and Logistics Joint Stock Company (PDV Logistics, HOSE: PDV) officially listed and began trading over 66 million PDV shares on the Ho Chi Minh City Stock Exchange (HOSE). With an opening price of VND 12,450 per share, PDV’s market capitalization reached VND 823 billion.

Foreign Investors Continue Net Selling Over 700 Billion VND in Session 19/11, Blue-Chip Stocks Hit Hard by Heavy Selling

Foreign investors continued their net selling streak across all three exchanges, marking another session of net outflows.