Major Changes Effective from January 1, 2026

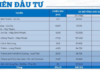

According to the guidelines supporting business households in transitioning from lump-sum tax to declaration-based models and upgrading to enterprise status, starting in 2026, business households with annual revenue between 200 million and 3 billion VND will:

– No longer pay lump-sum tax (free from fixed monthly/quarterly tax amounts set by tax authorities).

– Transition to declaring and paying taxes based on a percentage of actual revenue (similar to current methods but with self-declaration).

– Declare and pay taxes quarterly instead of monthly, reducing declaration frequency to 3 times per year.

– Continue applying the same VAT and PIT rates by industry, ensuring minimal changes in tax calculation methods.

Important Notes for Business Households

– Business households with revenue of 1 billion VND or more must use electronic invoices generated from cash registers connected to tax authorities (invoices with tax authority codes).

– For business households with multiple locations, tax declarations will be consolidated at the main office.

– Business households engaged in e-commerce (selling on Shopee, Lazada, Facebook, TikTok Shop, etc.) will receive tax authority support in determining revenue and tax amounts, with data from e-commerce platforms used for declaration and deduction purposes.

Finance Minister Confirms More Favorable Tax Policy for Household Businesses: Threshold Increased from 100 Million VND to 200 Million VND Annual Revenue

Minister of Finance Nguyen Van Thang stated that the fundamental tax calculation method remains unchanged. Previously, it was based on a fixed tax system (where business owners self-declared revenue), whereas now it relies on revenue declaration. Transitioning to this declaration system significantly reduces losses, particularly in economically developed areas.

Eliminating Lump-Sum Tax: Business Households Grapple with Input Invoice Declaration

As of January 1, 2026, the lump-sum tax will be officially abolished, requiring business households to declare taxes or transition to a corporate model. The Hanoi Tax Department has provided detailed guidance addressing key concerns, including input invoice declarations and inventory management, even for goods purchased from individuals.

Struggling Household Businesses Face Tax Transition Challenges

As the new tax regulations loom on the horizon, set to take effect in 2026, the question of “how to comply correctly?” is leaving countless small business owners and traders more perplexed than ever.

“Deputy Director of the Tax Department: The More Transparent and Open Businesses Are, the Less Likely They Are to Face Administrative Violations”

Mr. Mai Sơn, Deputy Director of the Tax Department, emphasizes: “The more transparent and compliant business households are, the less likely they are to face administrative violations. With proper collaboration with tax authorities, those who adhere to regulations will not be subject to inspections. In practice, audits are only conducted when there is a perceived risk.”