At the press conference announcing the Vietnam Real Estate Market Forum (VREF 2026) on the morning of November 21, Dr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association and Vice Chairman of the Vietnam Real Estate Association, stated that the real estate market in 2025 has recovered and is gradually rebounding.

Investment activities have been robust, fueled by the availability of cheap and accessible capital since 2024.

According to Dr. Dinh, the government’s directives have emphasized the need to study market regulation mechanisms through tax and credit policies. The Vietnam Real Estate Association has proposed a suitable roadmap, clearly distinguishing behaviors and target groups for policy application. Without proper identification, regulatory measures may impact genuine demand, while the core goal is to curb speculative activities that harm the market.

As of September, nearly 18 million trillion VND has been injected into the economy, with approximately 4 million trillion VND allocated to the real estate sector, accounting for 25%.

Press conference announcing the Vietnam Real Estate Market Forum (VREF 2026). Photo: Nguyen Le |

Dr. Dinh noted that this represents a significant effort by the banking system to support economic recovery. However, some have exploited the cheap capital to engage in speculation. With the government’s current management approach, speculative and “hot” investment activities are expected to decrease by year-end, leading to a more sustainable and stable real estate market in 2026.

Regarding VREF 2026, Dr. Dinh shared that this year’s theme is “Shaping Standards for Sustainable Market Development,” chosen based on recent significant market shifts.

A key highlight of this year’s forum is the announcement and implementation of standard sets and evaluation criteria developed by the Vietnam Real Estate Market Research and Evaluation Institute (VARS IRE).

Ms. Pham Thi Mien, Vice Director of VARS IRE, explained that these standards include: Vietnam Standard Real Estate Project Criteria; Provincial Real Estate Market Competitiveness Index; Bank Support Capability Standards in Real Estate Market Development; Vietnam Real Estate Brokerage Practice Standards; and Vietnam Real Estate Brokerage Professional Ethics and Conduct Code.

Dr. Nguyen Van Dinh added that these standards are expected to enhance market transparency, filter out low-quality projects, and elevate the accountability of participants. They also provide a reference framework for regulators, investors, and customers, paving the way for the market to align with international standards and achieve safe, healthy, and sustainable development.

Nguyen Le

– 16:25 21/11/2025

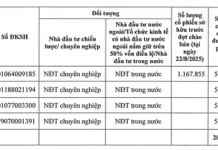

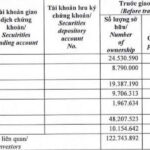

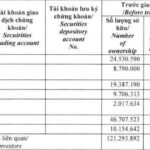

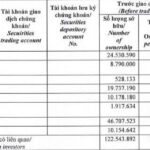

Dragon Capital Reduces Stake in Dat Xanh Group Below 12%

Dragon Capital, a leading foreign investment fund, has recently divested 1.25 million shares of DXG, reducing its ownership stake in Dat Xanh Group to 11.9046%.

Chairman of HoREA Le Hoang Chau: To Lower Housing Prices, All Costs Must Be Reduced Simultaneously, Including a Special Type of Expense

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, asserts that to effectively lower housing prices, the primary focus must be on reducing costs across the board. This includes land use fees, construction expenses, and input costs such as sand, gravel, steel, cement, electricity, and fuel. Additionally, Mr. Chau emphasizes the need to reduce a critical yet often overlooked cost: compliance expenses associated with legal and regulatory requirements.

“Van Phu Reports 56% Profit Growth in First Half of 2025”

With a boost from positive macroeconomic factors, the real estate market’s recovery has significantly impacted Van Phu – Invest Development Joint Stock Company (HOSE: VPI). The company has reported impressive financial results for the first half of 2025, with a 56% year-over-year increase in after-tax profit, totaling VND 148.8 billion.