The Vietnamese stock market witnessed a “green on the outside, red on the inside” session on November 20th. Despite the VN-Index rising by 7 points, the broader market saw 367 stocks decline, significantly outpacing the 303 gainers.

Amidst this backdrop, shares of VTC (VTC Telecom Corporation) on the HNX emerged as a bright spot, closing the session with a “purple hue” at 9,900 VND per share. This marked the highest price level for VTC in nearly 1.5 years, since June 2024. Liquidity improved significantly, with 16,700 shares changing hands, a stark contrast to the mere hundreds or thousands traded in previous sessions, where VTC often experienced near-frozen liquidity.

Equally positive, shares of ABC (VMG Media Corporation) also surged to their ceiling price before slightly retracing towards the end of the session. ABC closed at 14,200 VND per share, up 8.4%, with a sharply increased trading volume of nearly 800,000 shares.

The positive momentum in these two stocks followed VNPT’s announcement of auctioning off its entire stakes in VMG Media and VTC Telecom at starting prices significantly higher than their current market values.

Specifically, Vietnam Posts and Telecommunications Group (VNPT) plans to auction over 2.1 million VTC shares (46.67% of total issued shares based on actual contributed capital). The starting price is set at over 104.1 billion VND, equivalent to 49,200 VND per share, nearly five times the closing price on November 20th.

Registration and deposit submission procedures will take place from November 18th, 2025, to 3:30 PM on December 12th, 2025. Payment for the shares must be completed between December 19th and December 25th, 2025.

For ABC, VNPT intends to auction the entire lot of 5.77 million shares (28.3% of charter capital) with a starting price of 190.2 billion VND, or approximately 32,950 VND per share – about 2.3 times the closing price on November 20th.

According to the announcement, VNPT’s divestment from these companies is in line with Decision No. 620/QĐ-TTg dated July 10th, 2024, by the Prime Minister, approving the Restructuring Plan of Vietnam Posts and Telecommunications Group until 2025, and Document No. 1944/UBQLV-CNHT dated August 28th, 2024, from the State Capital Management Commission regarding the divestment from 24 enterprises on the approved list.

The State Capital Management Commission has also urged VNPT to expedite the divestment process to focus resources on core areas, particularly digital infrastructure and services.

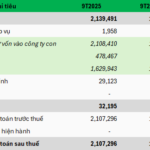

In terms of business performance, VMG Media reported an after-tax profit of 4 billion VND in Q3 2025, a 55% decrease year-on-year. Meanwhile, VTC Telecom recorded an after-tax loss of 2.9 billion VND in Q3, compared to a profit of 1.47 billion VND in the same period last year.

Stock Market Week 10-14/11/2025: Balanced Supply and Demand, Market Polarization Persists

The VN-Index edged higher in the final session of the week, capping a notably positive recovery week following an extended period of adjustment. Amid balanced supply and demand dynamics, with investor participation remaining subdued, the market’s low-liquidity divergence is likely to persist. Next week, the VN-Index faces a critical test at the Middle line of the Bollinger Bands.

Billionaire Pham Nhat Vuong’s Conglomerate Poised for Largest-Ever Move in Vietnamese Stock Market History?

Should the endeavor prove successful, Vingroup’s chartered capital is poised to surge beyond 77,000 billion VND, effectively doubling its current valuation.