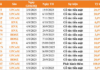

The bond with the code TXCCH2330001, the sole issuance by Thanh Xuan, was released on September 8, 2023, with a value of VND 583.5 billion, an interest rate of 10.57% per annum, and a maturity date of July 15, 2030. However, on November 14, 2025, Thanh Xuan repurchased the entire bond.

This bond is secured by assets including shares of Hung Thang Real Estate JSC, shares of Thanh Xuan JSC, and shares of another company, as well as receivables from loan agreements between a company within the ecosystem as the borrower and the lender as the guarantor.

As of mid-2025, the company reported an accumulated loss of over VND 10.5 billion.

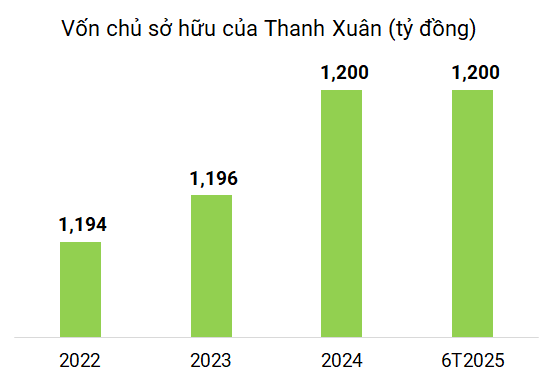

Key Financial Metrics of Thanh Xuan

Source: Compiled by the author

|

Established in 2003, Thanh Xuan initially had a charter capital of VND 60 billion. As of April 2025, the company’s capital stands at VND 1.20 billion. The founding shareholder structure includes Ms. Doan Thi Xuan Thanh (CEO and legal representative) with 43.5%, Ms. Tran Huong Giang with 10%, Mr. Tran Hoai Bac with 39%, Mr. Doan Quoc Hung with 2.5%, Ms. Doan Thu Ha with 2.5%, Ms. Doan Minh Hang with 2.5%, and Mr. Nguyen Van Phong with 1%.

In March 2021, Ms. Doan Thi Thanh Mai became the CEO and legal representative. In February 2022, the company increased its capital to VND 1,210 billion. By October 2022, Mr. Doan Quoc Huy, Chairman of the Board, assumed the role of legal representative.

– 11:38 November 21, 2025

Automotive Company to Finalize Shareholder List for 30% Cash Dividend Tomorrow

The ex-dividend date is set for November 18th, with the dividend payment expected to be disbursed on December 5th.

VietinBank Targets 2025 Pre-Tax Profit of VND 32,500 Billion, Poised to Enter Gold Market

At the investor conference held on the afternoon of November 13, 2025, Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, HOSE: CTG) forecasted a stable Net Interest Margin (NIM) with potential improvement by the end of 2026. Additionally, the bank identified emerging business segments, including the National Gold Trading Platform and digital assets, as key strategic focuses.

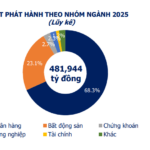

Over 57,000 Billion VND in Corporate Bonds Issued in October 2025

In October 2025, a total of 42 corporate bond issuances were recorded, amounting to a combined value of VND 57,192 billion.