Mobile World Investment Corporation (stock code: MWG, HoSE) has announced a resolution by its Board of Directors to restructure subsidiary companies, focusing on specialized business operations.

Specifically, products and services related to mobile phones and electronics, both domestically and internationally, will be organized, managed, and operated by a dedicated subsidiary in this sector.

Similarly, pharmaceutical products and services will be handled by a specialized subsidiary in the pharmaceutical field.

Illustrative image

Additionally, Mobile World has approved the transfer of nearly 10 million shares in Thợ Điện Máy Xanh JSC to Điện Máy Xanh Investment JSC, with a transfer value of approximately 100 billion VND.

Furthermore, Điện Máy Xanh will transfer 100% of its shares in An Khang Pharma JSC to Thiện Tâm Trading LLC, a wholly-owned subsidiary of Mobile World.

The total number of shares transferred is nearly 201.3 million, with a par value of 10,000 VND per share, and a transfer value of approximately 2,013 billion VND.

These transfer transactions are expected to be completed by December 31, 2025, pending approval from relevant state authorities as required by law.

Previously, Mobile World announced a resolution to restructure its subsidiaries, specializing in pharmaceutical retail (An Khang) and mother & baby products retail (AVAkids), each operated by newly established subsidiaries.

The restructuring aims to ensure each business segment has an independent, in-depth, and flexible development strategy, aligning with the company’s sustainable growth goals in the medium and long term.

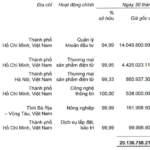

Mobile World has established two subsidiaries: Thiện Tâm Investment LLC with a charter capital of 2,200 billion VND and An Nhi Investment LLC with a charter capital of 500 billion VND.

Both companies are chaired by Mr. Đoàn Hiểu Em, with their headquarters located at 128 Trần Quang Khải, Tân Định Ward, Ho Chi Minh City.

State-Owned Enterprises Confront Six Major Challenges

State-owned enterprises are grappling with significant challenges, including an unclear leadership role, limited ability to create value chains and forge partnerships with the private sector, and untapped capital and asset potential due to restrictive legal frameworks. Their proactive stance and competitiveness remain low, with many business decisions delayed by lengthy approval processes, hindering timely opportunities.

“Retail Empire” of Nguyen Duc Tai Makes New Move with An Khang and AvaKids Pharmacy Chains

MWG is committed to restructuring its subsidiaries to specialize and streamline their business operations, fostering greater efficiency and focus across the organization.

Do Anh Tuan Increases Stake in KSF to Over 61% Following Swap Deal with SSH

Do Tuan, Chairman of the Board of Directors of Sunshine Group Joint Stock Company (HNX: KSF), has recently acquired 390 million newly issued KSF shares through a share swap with Sunshine Homes Development Joint Stock Company (UPCoM: SSH). Following this transaction, Mr. Tuan’s ownership stake in KSF has increased from 54.2% to 61.4%.

Tasco Plans to Allocate Shares to Foreign Fund VIAC

Tasco JSC (HNX: HUT) is seeking shareholder approval via written consent to facilitate the transfer of company shares to VIAC (No.1) Limited Partnership, a foreign investment fund based in Singapore. The proposal also includes a request for exemption from the public tender offer requirement for this transaction.