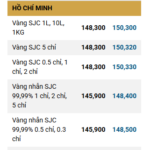

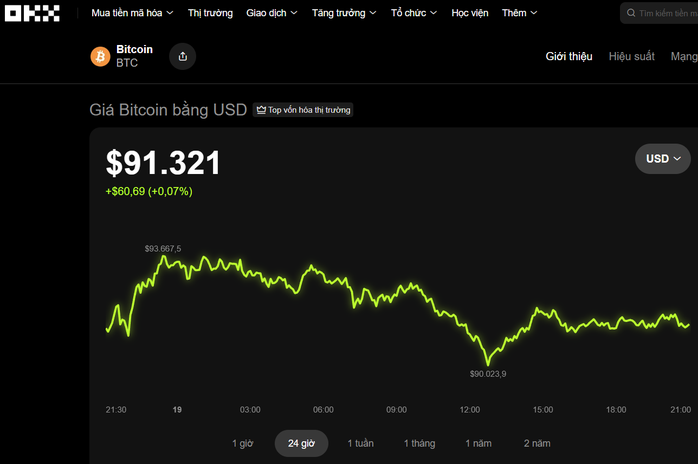

On the evening of November 19th, the cryptocurrency market experienced slight fluctuations. Data from OKX reveals that over the past 24 hours, Bitcoin rose by 0.07% to $91,320.

Other major cryptocurrencies also saw mixed movements: Ethereum climbed 0.6% to $3,050, while BNB dropped to $914, Solana fell over 1% to $136, and XRP declined nearly 3% to $2.10.

According to The Block, Bitcoin continues to hover in a fragile price range above $90,000 due to retail investor sell-offs, ongoing fund outflows, and weak market sentiment. Thin buying pressure contrasts with increased selling from short-term and institutional investors.

Conversely, long-term holders are actively accumulating Bitcoin. Approximately 32,000 Bitcoin were moved to exchanges at a loss, while large wallet addresses saw their strongest growth in four months.

Bitcoin is currently trading at $91,320. Source: OKX

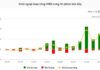

In a single day, U.S.-based Bitcoin funds saw outflows of approximately $370 million, marking the largest withdrawal since the inception of the largest fund. Ethereum and Solana-related funds also exhibited mixed movements, indicating that significant capital has yet to re-enter the market.

On the macroeconomic front, unclear signals regarding Federal Reserve rate cuts are heightening market sensitivity. Even minor surprises could trigger substantial price swings, reflecting investors’ defensive stance.

Some forecasts suggest only a 30% chance of Bitcoin surpassing $100,000 by year-end 2025, with a 50% likelihood of dropping below $90,000 this year. Ethereum shares a similar sentiment.

However, 21Shares suggests this may be a short-term correction. Selling pressure from long-term holders has eased, and assets are transitioning to more patient investors. The firm anticipates improved global liquidity, potentially attracting institutional capital back into the market.

According to 21Shares, the $98,000–$100,000 range represents strong resistance, while $85,000 serves as critical support. Sustaining above $100,000 could reignite Bitcoin’s long-term upward trajectory.

U.S. Stocks Rally Ahead of Nvidia’s Earnings Report

U.S. stocks held steady while European markets experienced slight declines during the November 19th session, as investors awaited Nvidia’s earnings report.

Asia’s Crypto Derivatives Race: Singapore Bets on Futures, Hong Kong Opts for ETFs

Amidst the volatile digital asset market, SGX Derivatives, the derivatives arm of the Singapore Exchange (SGX), has adopted a cautious approach by exclusively opening its doors to institutional investors. This strategic move by SGX Derivatives reflects a dual strategy: actively engaging in the cryptocurrency market while safeguarding retail investors from the steep declines in digital assets by restricting product access to institutional players.