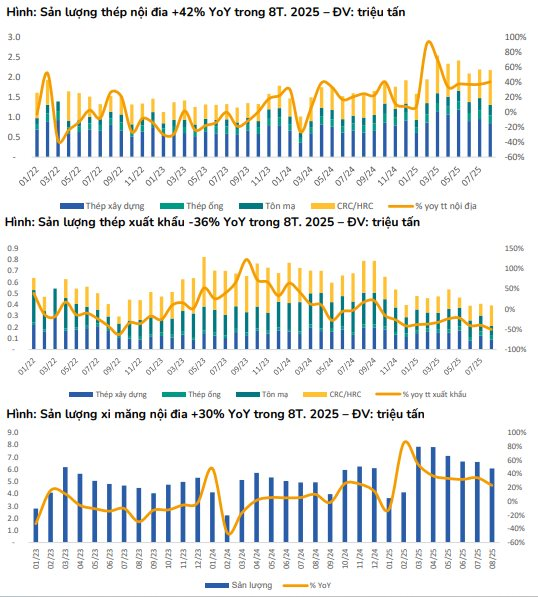

BSC Securities (BSC Research) has recently released an updated report on the construction materials sector, highlighting the continued recovery trend in the industry for Q3/2025. This is attributed to the warming real estate market and Vietnam’s implementation of anti-dumping duties on HRC steel products.

As we move into the final quarter, BSC anticipates a slight rebound in steel export volumes compared to Q3, driven by seasonal demand. In the first eight months of 2025, steel exports plummeted by 36% year-on-year due to anti-dumping duties on Vietnamese steel and volume restrictions in key markets like Mexico, Canada, and the EU. Notably, exports of coated steel sheets and HRC steel both dropped by 45% year-on-year.

Exporters of coated steel sheets report stable order expectations through year-end. In response to trade barriers erected by the US and EU, steel companies halted exports to these regions earlier this year and have since diversified into smaller markets in South America, Africa, and ASEAN to offset some of the lost volume.

Meanwhile, cement exports in the first eight months rose by 13% year-on-year, fueled by expansion into new markets, primarily in the Americas and Africa. Despite shifting US tax policies, cement volumes increased due to pre-signed contracts and reduced clinker export taxes. BSC predicts export volumes may decline again from Q1/2026 due to impending US and Taiwanese anti-dumping investigations into Vietnamese cement.

Input Cost Declines: A Key Factor to Monitor in the Upcoming Cycle

BSC believes the construction materials sector, particularly steel, faces oversupply across multiple fronts: (1) steel production facilities, (2) coal mines, and (3) iron ore mines.

Analysts attribute the steel production surplus primarily to China. Over the past three years, China accelerated approvals for new steel plants meeting environmental standards. However, the pace of new project approvals far outstripped the closure of older, state-owned facilities. These new plants are slated to come online between 2025 and 2027, exacerbating the global steel supply-demand imbalance over the next three years.

Regarding iron ore, global production surged by 25% between 2010 and 2021 to meet Chinese demand. Now, as China pivots from infrastructure development to technology advancement, iron ore demand is waning. BSC forecasts this will lead to iron ore oversupply and price declines in the coming years.

BSC projects a downward trend in raw material prices over the next 3-5 years. Based on criteria such as substantial domestic market share and existing trade barriers against Chinese imports, BSC highlights four companies poised to benefit from lower input costs: Hoa Phat (HPG), Binh Minh Plastics (BMP), Tien Phong Plastic (NTP), and Ha Tien Cement (HT1).

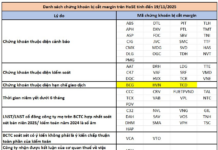

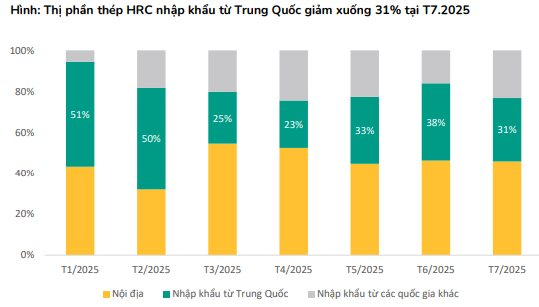

Among notable Q3 events, BSC notes the continued effectiveness of anti-dumping duties on Chinese HRC steel. China’s market share plummeted from 51% in Q1/2025 to 31% in July 2025, equivalent to 400,000-450,000 tons of HRC per month. Excluding wide-gauge HRC (>1,800 mm), BSC estimates China’s current market share at just 18%-20%, or 200,000–250,000 tons per month.

On September 10, 2025, Vietnam’s Ministry of Industry and Trade received a petition to investigate tax evasion related to wide-gauge HRC steel from China. Current wide-gauge HRC production hovers around 200,000–250,000 tons per month, up from less than 50,000 tons per month in the same period last year.

Given these figures, BSC anticipates provisional anti-dumping duties could take effect as early as Q1/2026.

Additionally, VinGroup established VinMetal with an investment of VND 10 trillion. The nature of VinMetal’s operations—whether it will produce billets or simply process purchased billets—remains unclear.

However, given the investment of VND 10 trillion for a 5 million ton steel capacity, BSC speculates VinMetal is likely a processing plant. This investment is insufficient for a full-cycle 5 million ton steel mill. (For context, Hai Duong Steel Phase 3 in 2015 cost VND 4 trillion for 0.75 million tons, and Dung Quat 2 cost VND 85 trillion for 5.6 million tons.)

Exclusive Mining Mechanism Applied to Seven Quarries in Dong Nai for Mineral Resource Extraction

Seven quarries in Dong Nai have been approved to implement a special mechanism for mineral exploitation, allowing a maximum increase of 50% compared to the previously granted permits.

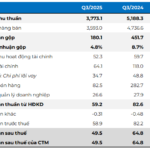

Steel Exports Face Challenges: Nam Kim Reports 24% Drop in Q3 Profits

Nam Kim Steel JSC (HOSE: NKG) has released its Q3 business results, revealing significant declines across key performance indicators.