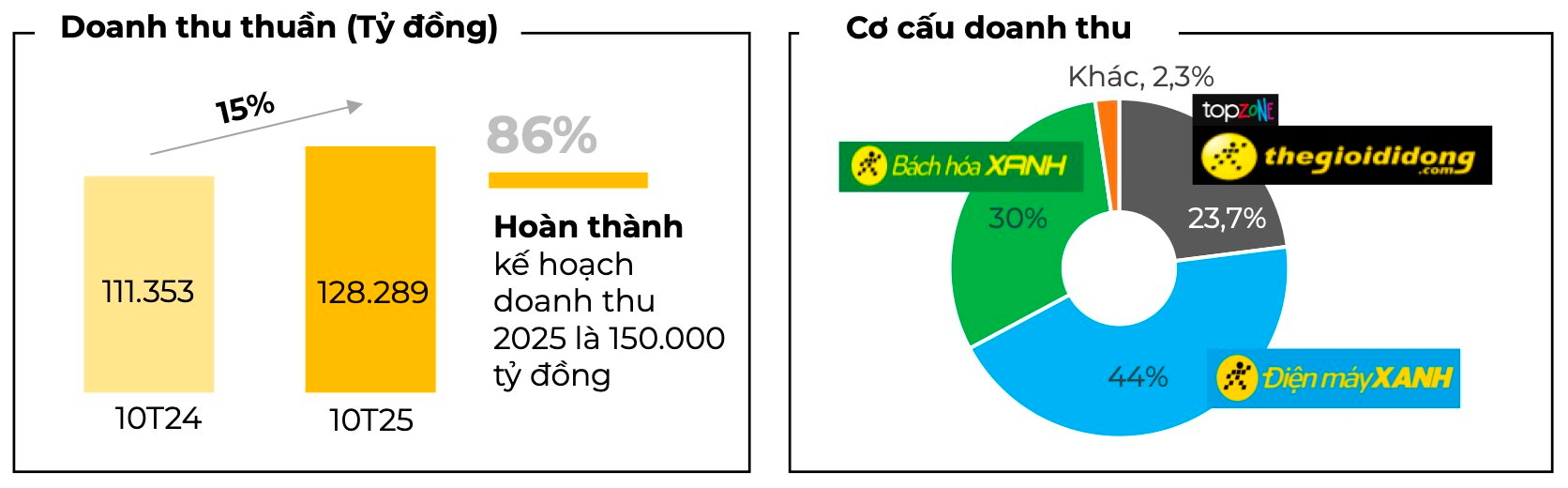

Mobile World Investment Corporation (MWG) has announced its business results for the first 10 months of 2025, reporting a revenue of VND 128,289 billion, a 15% increase year-on-year, achieving 86% of the annual plan. In October alone, Vietnam’s largest retail system generated nearly VND 14,700 billion, averaging approximately VND 474 billion per day.

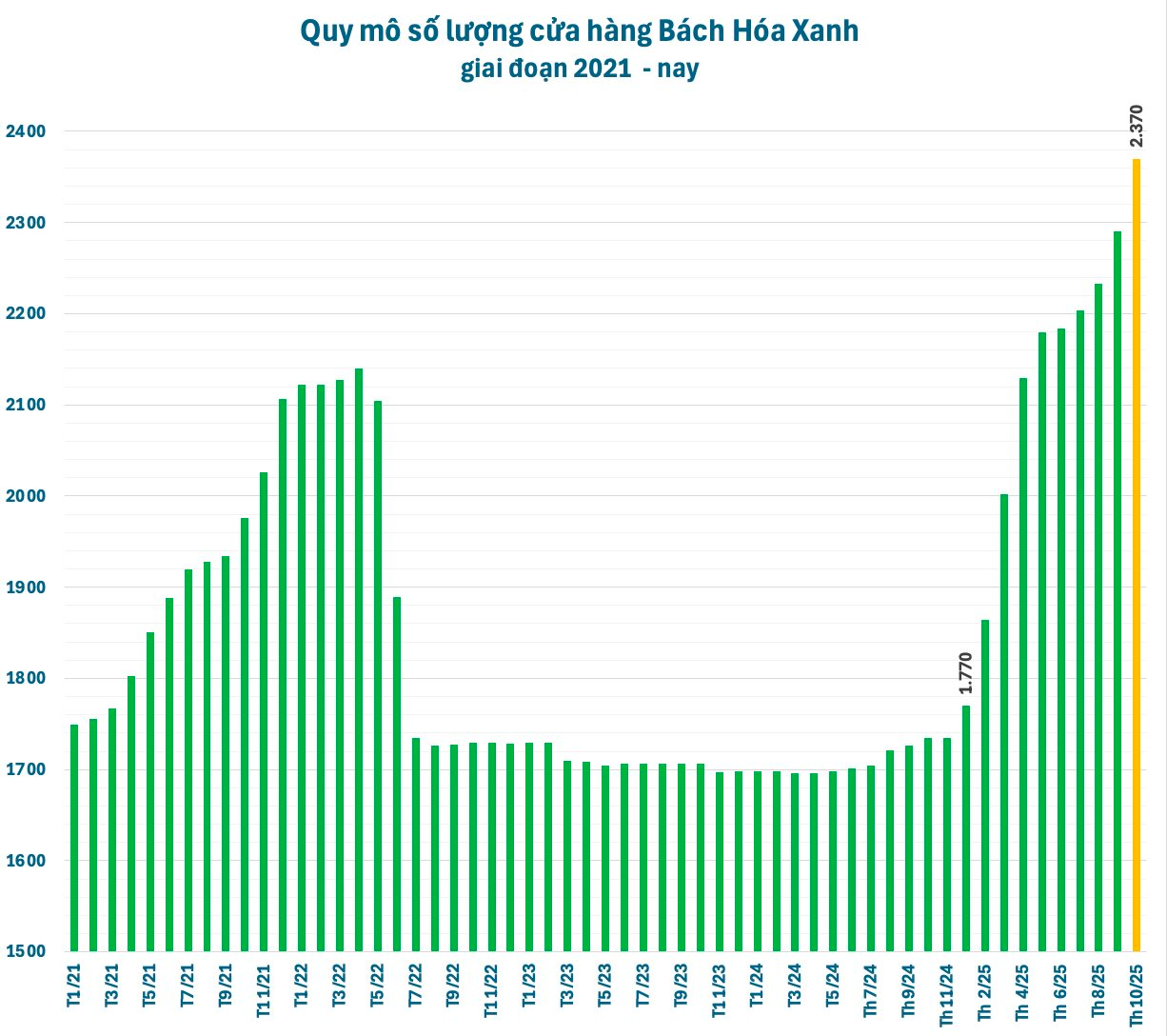

As of October 2025, the retail enterprise owned by Mr. Nguyen Duc Tai operates nearly 6,000 stores nationwide, including 1,012 The Gioi Di Dong stores, 2,017 Dien May Xanh stores, 2,370 Bach Hoa Xanh stores, 356 An Khang pharmacies, 72 AvaKids stores, and 158 EraBlue stores.

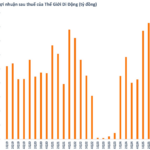

Over the 10-month period, the The Gioi Di Dong/Dien May Xanh (TGDĐ/ĐMX) chain achieved a revenue of VND 87,000 billion, a nearly 17% increase year-on-year, significantly outpacing the industry’s overall growth. Despite not opening new stores, this growth was driven by a 19% improvement in existing store revenue.

In October 2025 alone, the two chains generated VND 10,500 billion, marking the 8th consecutive month of growth and a 33% increase year-on-year. This was also the highest-grossing month of the year, surpassing even the Tet holiday period. The primary driver was the iPhone product line, which saw double-digit growth.

Bach Hoa Xanh (BHX) recorded a revenue of nearly VND 38,400 billion over 10 months, a 13% increase year-on-year. This growth was attributed to both fresh food and FMCG categories. In October, revenue reached nearly VND 4,000 billion.

BHX is accelerating its store expansion in the northern region, opening a total of 600 new stores in 10 months, with over 50% located in the Central region. These new stores have achieved overall profitability at the store level (after deducting all direct operating and warehousing costs).

Meanwhile, An Khang recorded an average revenue of VND 575 million per store in October 2025, marking the 4th consecutive month of growth, though it has yet to turn a profit. AvaKids saw double-digit revenue growth in the first 10 months, with an average monthly revenue of VND 1.8 billion per store; the chain has achieved profitability at the company level and aims for higher efficiency moving forward.

EraBlue achieved over 70% revenue growth year-on-year in 10 months and has recorded profitability at the company level. In a recent statement, Mr. Doan Van Hieu Em shared that EraBlue aims for sustainable development in its 2026–2030 strategic cycle, targeting regional expansion and an IPO before 2030 to become a new retail icon in Southeast Asia.

Restructuring Subsidiaries Ahead of IPO

In a related development, MWG recently issued a resolution approving the restructuring of its subsidiaries to specialize their business operations.

Accordingly, products and services related to mobile phones and electronics in Vietnam and abroad will be organized, managed, and operated by a dedicated subsidiary in this field. Similarly, pharmaceutical products and services will be handled by a specialized subsidiary.

The Board of Directors approved the transfer of 100% shares in Thợ Điện Máy Xanh JSC (formerly Tận Tâm Installation – Repair – Warranty JSC) to Dien May Xanh Investment JSC. This includes 9.99 million shares, valued at nearly VND 100 billion.

Additionally, Dien May Xanh Investment JSC will transfer its entire stake of over 201 million shares in An Khang Pharma JSC to Thien Tam Trading LLC, a wholly-owned subsidiary of The Gioi Di Dong. The transaction is valued at over VND 2,012 billion.

The transactions are expected to be completed by December 31, 2025, pending approval from relevant state authorities as required by law.

The Iron Fists of Nguyen Duc Tai

Following a period of quantitative growth, MWG has undergone a robust restructuring over the past two years and is now entering a new phase of growth driven by quality. This momentum is fueled by the strategic and impactful initiatives led by Mr. Nguyễn Đức Tài, often referred to as “steel punches.”

Mobile World Group (MWG) Reports Record-Breaking Q3 Profit of Nearly VND 1.8 Trillion, Surpassing Annual Plan in Just 9 Months

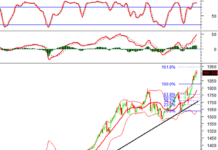

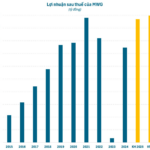

Over the first nine months, The Gioi Di Dong (Mobile World) achieved an accumulated after-tax profit of VND 4,989 billion, a remarkable 73% surge compared to the same period in 2024, surpassing its full-year target.

Record-Breaking Q3: The Gioi Di Dong Posts Nearly VND 1.8 Trillion in Profit

Mobile World Investment Corporation (HOSE: MWG) has announced its consolidated Q3/2025 financial report, revealing a remarkable performance. The company achieved a net revenue surpassing 40 trillion VND, marking a 17% year-on-year growth. Even more impressively, its net profit soared to 1.77 trillion VND, a staggering 121% increase compared to the same period last year. This outstanding result sets a new record for the retail giant’s profitability.