Leadership changes occurred after the Board of Directors unanimously agreed to relieve Mr. Vo Hung Dung of his duties to take on a new role at Southern Food Corporation – JSC (Vinafood II, UPCoM: VSF).

Mr. Nguyen Van Hien, born in 1975 in Hai Phong, graduated as a civil engineer specializing in bridges and tunnels. He previously worked in various units under the Ministry of Transport before joining the Housing and Urban Development Corporation (HUD) in 2005.

From 2015 to 2021, he served as Director of HUD Saigon and Deputy Head of Southern Investment at HUD. The newly appointed Chairman of FCS joined Vinafood II in 2022 as Chief of Staff and became Deputy General Director in 2023.

Vinafood II currently holds 59.78% of FCS‘s capital, and Mr. Hien represents over 5 million shares of the parent company at Foodcosa.

Mr. Nguyen Van Hien (holding flowers) joined Vinafood II’s Board of Directors in 2024 – Photo: Vinafood II

|

FCS has seen frequent changes in senior leadership recently. Before Mr. Hien, Mr. Nguyen Van Linh held the Chairman position for only about a year after stepping down as General Director. Mr. Vo Hung Dung, elected to the Board of Directors in April and appointed General Director, also left shortly after.

These leadership changes come amid declining business performance. In Q3/2025, FCS reported a meager after-tax profit of less than 70 million VND, despite revenue nearing 88 billion VND.

Corporate management expenses of nearly 17 billion VND almost entirely offset gross profit. Year-to-date, the company incurred a loss of over 6 billion VND on revenue of 235 billion VND. FCS paid approximately 35 billion VND in taxes, fees, and levies, further squeezing profits.

Previously, FCS recorded losses in the first two quarters of the year, extending a streak of poor results since 2024. Without a positive turnaround in the final quarter, the company is likely to face its second consecutive year of net losses, making its target of 150 million VND in profit for the year increasingly unattainable.

| FCS faces its second consecutive year of losses |

FCS was established in 1980 as Ho Chi Minh City Food Trading Company. It became part of Vinafood II in 1997, underwent corporatization in 2016, and listed on UPCoM.

Once achieving revenue of over 2 trillion VND in 2014, FCS has since scaled down operations. By 2024, revenue had fallen to 406 billion VND. From 2016 to 2021, the company experienced prolonged losses, with only modest profits in 2022 and 2023.

Management acknowledges that recent losses stem from a lack of working capital. FCS has not received financial support from any organization while bearing significant depreciation and fixed costs.

Facing financial pressure, the Vinafood II subsidiary is adjusting its strategy. Instead of expanding at all costs, FCS is focusing on the efficiency of each business segment. Revenue from discounts, subsidies, and other income is expected to offset operating expenses.

According to the 2025 semi-annual audited financial report, FCS‘s gross profit does not come from core segments like rice or petroleum. Rice trading incurred a gross loss, while petroleum and industrial chemicals generated profits of 3.6 billion VND and over 1 billion VND, respectively. Other segments contributed 28 billion VND.

Cumulative losses by the end of Q3/2025 exceeded 200 billion VND, reducing equity to below 55 billion VND. The company has long-term liabilities of approximately 569 billion VND, primarily owed to its parent company Vinafood II.

The valuation of the company since its corporatization remains incomplete, leaving four prime land plots in Ho Chi Minh City valued as intangible fixed assets at over 572 billion VND, subject to change pending official approval from authorities.

The FCS headquarters at 1610 Vo Van Kiet, Binh Tien Ward, spanning over 2 hectares, is provisionally valued at 429 billion VND but may change pending official approval from the Ho Chi Minh City People’s Committee – Photo: FCS

|

– 16:50 20/11/2025

Hodeco Boosts Capital to Nearly VND 2 Trillion Following Bonus Share Issuance

On November 12th, Hodeco successfully distributed 21.39 million shares out of a total of 21.4 million to 23,101 shareholders. This strategic move has bolstered the company’s capital to nearly 2,000 billion VND.

VietinBank Securities Rebrands: New Name, New Identity

The extraordinary shareholders’ meeting of VietinBank Securities will approve the resignation of Ms. Bùi Thị Thanh Thúy from her position as a Board of Directors member and elect a new member to fill the vacancy. Additionally, the company aims to rebrand, including a name change and a refreshed corporate identity.

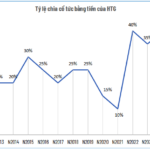

Hòa Thọ Textile to Pay Interim Dividend of VND 2,500 per Share

Hòa Thọ Corporation (HOSE: HTG) has announced December 18th as the ex-dividend date for its 2025 interim cash dividend. Shareholders will receive a 25% payout, equivalent to VND 2,500 per share.