Capital Needs Can Arise at Any Moment, Even When Least Expected

The year-end period is typically the peak season for the retail market. Missing a beat can mean losing significant revenue opportunities. Minh, a small fashion boutique owner in Ho Chi Minh City, knows this all too well. Her supplier unexpectedly raised prices and demanded an earlier deposit than anticipated.

Despite her familiarity with cash flow management, Minh faced a common challenge: most of her family’s savings were locked in fixed-term deposits across multiple banks. Withdrawing early would mean forfeiting nearly all the interest. Quick loan options were not ideal due to high costs and complicated procedures. “My supplier suddenly increased prices and required an earlier deposit than I had planned. I only needed temporary liquidity, but delaying could mean losing a valuable business opportunity because I didn’t have 200 million VND readily available,” she shared.

In reality, this scenario is common among individual entrepreneurs, small traders, and online sellers. Cash flows quickly, costs fluctuate with market changes, and traditional savings products don’t support flexible withdrawals or transfers. This is why innovative solutions like VIB’s iDepo are gaining traction, offering up to 6.8% annual interest while allowing withdrawals and transfers in any situation.

iDepo VIB: The Optimal Savings Solution for the Digital Financial Era

Four months ago, Minh opened an iDepo account via the MyVIB app with a balance of 1 billion VND. What surprised her was the product’s flexibility—she could monitor, withdraw, or transfer funds without the restrictions of traditional savings accounts.

When she urgently needed 200 million VND, Minh transferred her 1 billion VND iDepo to a friend directly through the MyVIB app for 1.02 billion VND (including four months of accrued interest). After receiving the funds, she immediately deposited 800 million VND back into iDepo, retaining the full interest for the past four months. “Previously, I used fixed-term deposits, and withdrawing early meant losing interest. This time, with iDepo, I transferred it to my cousin—both of us benefited. She got a good interest rate, and I got the cash I needed while keeping my interest. When my supplier demanded a deposit, I had the funds ready and secured a good price. This batch of goods yielded higher profits, unlike before when I had to calculate if the profit would cover the lost interest from early withdrawal,” Minh explained.

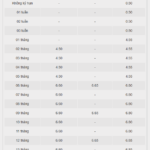

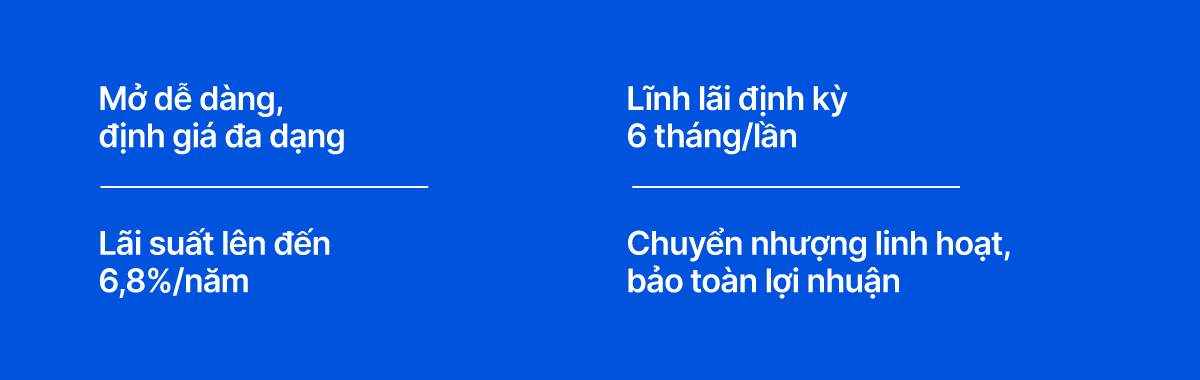

iDepo VIB combines the features of fixed-term deposits with the ability to transfer, gift, or inherit funds on a secondary market with flexible transfer fees (customers pay no fees when transferring to known acquaintances). Developed for flexibility, iDepo is a cornerstone of VIB’s Smart Depo suite, which includes Hi-Depo, i-1Depo, and iDepo. iDepo stands out with its advantages: denominations starting from 50 million VND, up to 6.8% annual interest, a 36-month term, and interest paid every six months.

The combination of strong returns and instant liquidity makes iDepo an optimal savings model, suited to the digital business landscape and modern financial management habits. Instead of locking funds in a single large deposit, users can split their funds, optimize interest, and maintain control with iDepo. This makes it ideal for those with seasonal or cyclical cash flows. All deposit, monitoring, withdrawal, transfer, and closure actions can be performed online, minimizing the risk of missing critical opportunities.

Financial Proactivity: A New Advantage for Digital-Age Entrepreneurs

Market trends show that more individual entrepreneurs are opting for flexible savings solutions. In an environment where input costs fluctuate seasonally and revenue varies by campaign or digital platform traffic, timely access to capital can significantly impact profits. A flexible savings product not only maximizes returns but also acts as a safety net, ensuring users aren’t caught off guard by business opportunities.

iDepo was developed to meet this exact need, making it a standout solution for entrepreneurs, freelancers, and young families seeking a balance between returns and liquidity.

Minh believes her biggest change has been in mindset: “I’ve realized that saving isn’t just about setting aside money—it’s about staying proactive. When banking products support this, entrepreneurs like me gain much more confidence.”

In an era where business decisions can shift in days, having a flexible savings solution that allows easy access to funds without losing accrued interest is essential. By prioritizing user experience and benefits, iDepo is reshaping the approach to cash flow accumulation—making it smarter, more flexible, and aligned with modern financial rhythms.

iDepo VIB: Safeguarding Your Cash Flow During Market Volatility

As the financial markets enter a phase of adjustment, investors are increasingly turning to safer channels. Amid this shift, iDepo by International Bank (VIB) stands out as a balanced solution, offering both security and profitability with an attractive interest rate of up to 6.3% per annum. Additionally, its flexible transfer capabilities on the MyVIB platform make it a standout choice for savvy investors.

Why Automated Profitability is the Inevitable Trend in Modern Banking?

As a pioneer in digitalization, Techcombank leverages its innovative edge and trusted financial solutions to empower over 16.5 million customers. By ushering in the era of Automated Profitability, we redefine how Vietnamese manage their finances—safely, flexibly, and around the clock—while maximizing value and experience. Our customer-centric strategy not only optimizes wealth management but also extends our legacy of success through a uniquely differentiated approach.

“Turn Idle Capital into Profits with VIB’s Super Interest Rates.”

“Cash flow is the lifeblood of any business, and for small and medium-sized enterprises (SMEs), it’s even more crucial. It’s not just about the money coming in and going out; it’s also about the moments when cash takes a pause. Whether it’s the buffer between spending and income, waiting for payments to clear, or sitting idle in a contingency fund, effective cash flow management is essential for SMEs to thrive.”