With a spirit of dedication, innovative thinking, and unwavering belief in the inherent strength of Vietnamese enterprises, Mr. Vinh emphasizes the importance of continuity and sustainable development. This commitment contributes to economic growth and solidifies the role of the private sector in accompanying the nation’s journey toward prosperity and wealth.

Private Sector: A Key Driver of the Economy

According to Mr. Do Quang Vinh, Vice Chairman of the Board and Deputy CEO of SHB, 2025 marks a significant milestone for Vietnam’s economy. Resolution 68, for the first time, recognizes the private sector as a primary engine for national development. Alongside resolutions on science and technology, international integration, and institutional reform, these strategic policies collectively propel Vietnam into a more robust growth phase, with a vision extending to 2045.

“SHB’s legacy is not only defined by its scale and stature but also by its contributions and impact across various dimensions,” Mr. Do Quang Vinh emphasized.

In a landscape shaped by digital transformation, green finance, and evolving consumer trends, Vietnamese businesses must also navigate global volatility, technological risks, and internal standardization pressures. “Leadership resilience, adaptability, and confidence will determine whether we seize opportunities or let them slip away,” Mr. Vinh stressed.

On Vietnam’s financial map, SHB ranks among the top 5 private banks with the largest chartered capital. The Vice Chairman of SHB’s Board shared that the bank’s legacy, after 32 years of growth, extends beyond its size and position. It encompasses significant contributions to the economy, culture, and society.

SHB pioneered systemic restructuring by merging with Habubank in 2012, a landmark transaction in Vietnam’s banking history. Additionally, the bank has supported numerous critical infrastructure projects, financed green energy, agriculture, and exports, and actively contributed to social welfare and community development.

Mr. Vinh highlighted another vital legacy of SHB: its corporate culture and people-centric values, rooted in the core philosophy of “Từ Tâm” (Heart – Trust – Integrity – Knowledge – Intelligence – Vision). This foundation has enabled the bank to maintain its unique, humane, and sustainable identity for over three decades.

SHB views people and corporate culture as the cornerstone of its transformation, leveraging technology and digitalization as catalysts for leadership. Sustainable development and green banking are its long-term goals, Mr. Vinh explained.

Two Generations, One Vision

During the panel discussion “New Leadership Mindset: From Legacy to Breakthrough,” Mr. Do Quang Vinh highlighted SHB’s unique governance model—the synergy between two leadership generations. The older generation provides strategic vision, experience, and business acumen, while the younger leaders, exemplified by Mr. Vinh, bring innovation, tech-savviness, and global integration.

Mr. Do Quang Vinh discusses the harmony between SHB’s two leadership generations.

Mr. Vinh acknowledged that generational differences are natural, but at SHB, they serve as positive catalysts for growth. The younger generation learns from the successes and resilience of their predecessors, while the older leaders embrace new trends, styles, and technologies. Mutual listening and a shared goal—propelling SHB’s sustainable growth—create a unified strategic voice.

“I am fortunate to have my father, SHB Chairman Do Quang Hien, who instilled in me a spirit of dedication and resilience, along with invaluable experience and knowledge. This enables me to make better, more precise decisions,” Mr. Vinh shared.

When asked how Vietnamese businesses and entrepreneurs should prepare for regional expansion, Mr. Do Quang Vinh asserted, “To go global, businesses must first meet international standards domestically.”

SHB is leading the way among financial institutions by proactively adopting IFRS, Basel, and ESG standards, while investing in technology, data, and human capital—key determinants of long-term competitiveness. Technology not only accelerates operations but also enhances scale, efficiency, and customer experience—critical factors for integration.

“The new generation of leaders must embody confidence, agility, adaptability to change, and a spirit of continuous innovation to propel businesses forward,” Mr. Vinh added.

With a strong legacy, robust innovation, and harmonious leadership synergy, SHB is entering a new phase of growth, where core values are preserved and the vision for development is expanded.

“We believe that as the private sector becomes a central driver of the nation, SHB will continue to lead, contributing to Vietnam’s goal of becoming a prosperous, high-income country by 2045,” Mr. Do Quang Vinh affirmed.

Politburo Unanimously Approves Administrative Unit Standards and Urban Classification Plan

Senior Politburo Member and Permanent Secretary of the Party Central Committee’s Secretariat Trần Cẩm Tú recently signed and issued Conclusion No. 212 by the Politburo and Secretariat. This document outlines guidelines for establishing administrative unit standards, classifying administrative units, and categorizing urban areas.

Empowering Financial Growth: Banks Leading the Nation’s Development Journey

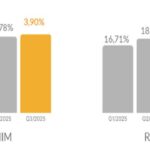

Credit recovery is robust and projected to sustain its strong growth trajectory, driven by substantial capital demand from the retail sector and businesses, as well as the ripple effects of public investment. This momentum is poised to significantly contribute to achieving the ambitious GDP growth target of 8% by 2025.

Sacombank Launches Green Finance Package: Realizing ESG Sustainability Commitments

Sacombank is steadfastly advancing its sustainable development agenda with the launch of the Green Finance Package—a pioneering product that seamlessly integrates environmental considerations into personal financial activities. This strategic initiative underscores the bank’s commitment to its ESG roadmap, marking a significant milestone in its journey toward a more sustainable future.

Unleashing Vietnam’s Potential: The Synergistic Power of Government, Businesses, and Citizens

To propel Vietnam’s ascent, reliance on a single force is insufficient. True power emerges from the seamless alliance of a visionary government, pioneering enterprises, and engaged citizens, united by shared vision and collective action to transform aspirations into reality.

Masan Consumer: Surging Growth Hand in Hand with Sustainable Development

In the fiercely competitive fast-moving consumer goods (FMCG) sector, Masan Consumer Corporation (Masan Consumer, UPCoM: MCH) stands out as a rare gem in Vietnam’s market. The company not only sustains profitability at the highest levels in the region but has also been recognized by S&P Global as one of the world’s leading sustainable FMCG enterprises.