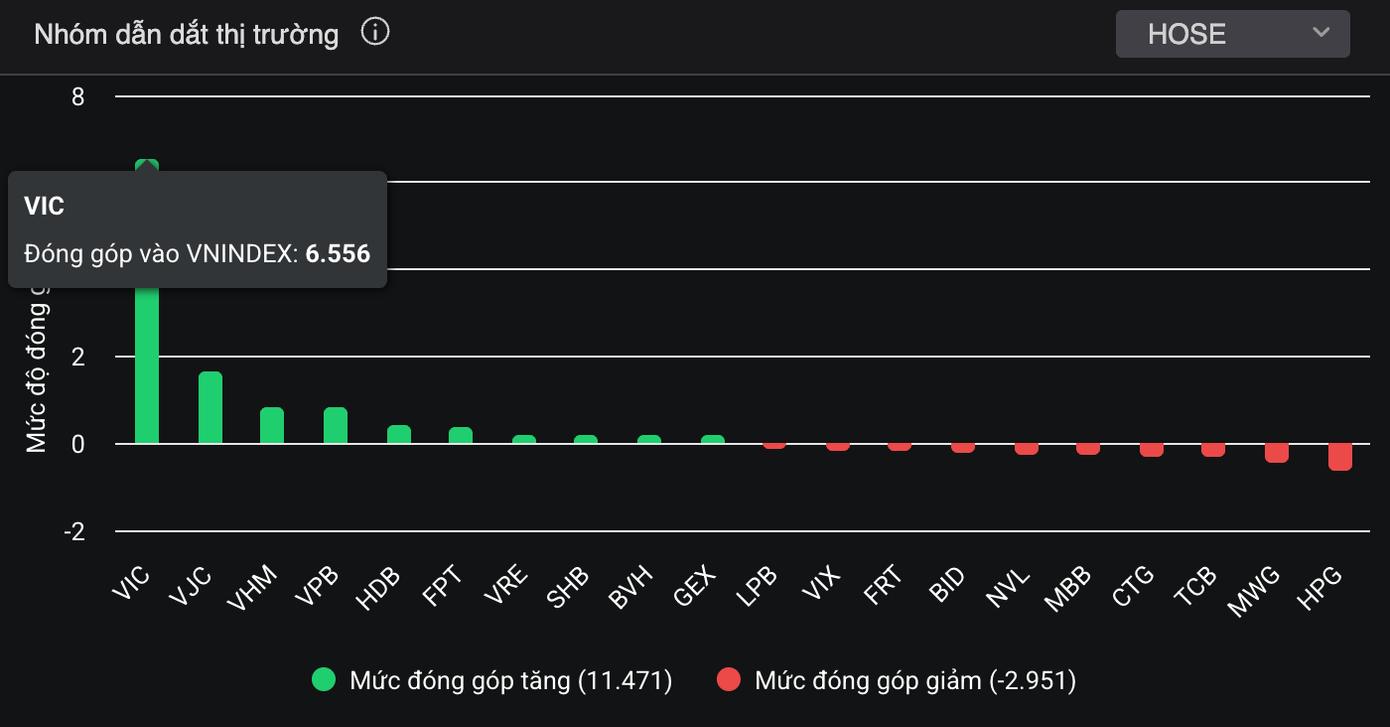

Red dominates the market, yet the VN-Index continues its upward trajectory, buoyed by heavyweight stocks that steadfastly support the market. Deep polarization persists, with weak liquidity, but the market remains resilient thanks to two key players: VIC and VJC.

Despite derivative expirations and low liquidity, the VN-Index’s sustained growth is a positive signal.

The VN-Index’s gains heavily rely on the pull of blue-chip stocks.

Leading the index, VIC surged 3.4%, contributing a substantial 6.7 points. The stock emerged as a critical market support, with liquidity surpassing previous levels, reflecting sustained and proactive buying interest over four consecutive sessions. The real estate sector also outperformed the broader market, with Vingroup, DXG, KBC, PDR, and DIG posting gains.

VJC stood out with a ceiling-hitting rally from the morning session, maintaining its gains until the close, adding 1.76 points. This session also saw a significant liquidity boost, propelling VJC back to its peak.

The banking sector witnessed positive movements in VPB and HDB, contrasting the prevailing red across the industry. Conversely, steel and retail faced downward pressure: HPG shed 1.27%, costing the index 0.59 points, while MWG dropped 1.7%, and CTG and TCB slipped slightly, further reducing the VN-Index by approximately 0.6 points.

The most notable development came from foreign investors. After 11 consecutive net-selling sessions, overseas investors reversed course in the final 30 minutes, netting purchases of over 244 billion VND. VPB saw nearly 181 billion VND in net buying, while SSI and VIC also entered the top net-buy list with over 100 billion VND each. Conversely, VCI faced the heaviest selling pressure, with net sales of 172 billion VND.

At the close, the VN-Index rose 6.99 points (0.42%) to 1,655.99. The HNX-Index fell 0.8 points (0.3%) to 264.23, and the UPCoM-Index dipped 0.13 points (0.11%) to 119.51. HoSE liquidity totaled 19.675 trillion VND, down 19% from the previous session.

Foreign Investors Resume Net Selling on November 21: One Stock Brokerage Unloaded Over 700 Billion VND

Following a net buying session, foreign trading activity turned negative as foreign investors resumed net selling, offloading a total of VND 677 billion.

Market Pulse 21/11: Selling Pressure Intensifies as Capital Flees Financial Sector

Pessimism continues to weigh on large-cap stocks, driving major indices lower. As of 10:30 AM, the VN-Index has dropped over 16.58 points, trading around 1,640.75. Meanwhile, the HNX-Index is down 1.52 points, hovering near 262.71.