Bitcoin Extends 6-Week Losing Streak as Market Panic Intensifies

The trading session on November 21st (Friday) witnessed intense selling pressure across the cryptocurrency market. By 7:30 PM Vietnam time, Bitcoin had plummeted approximately 11% within the day, hitting $80,700. Despite a slight recovery to the $83,000 level, concerns linger that the downward trend may persist.

This marks Bitcoin’s sixth consecutive week of decline—its longest losing streak since the “crypto winter” of 2022. From its all-time high of $125,300 on October 7th, the cryptocurrency has shed nearly 37%, erasing all gains made in 2025. Bitcoin’s market capitalization now stands at just over $1.6 trillion, with nearly $890 billion in value evaporating in less than six weeks.

Bitcoin isn’t alone in its struggles; numerous altcoins are also reeling. Ethereum has lost over 30%, Solana has dropped nearly 40%, and tokens from ecosystems like Cardano (ADA), Chainlink (LINK), and Polkadot (DOT) have all fallen 10-15% in the past 24 hours. The Fear & Greed Index has plunged to 11—its lowest level in over a year, signaling “extreme fear.”

Bitcoin’s 24-hour trading volume surged to nearly $128 billion, a multi-month high. Many leveraged traders, using 20-50x leverage on derivatives platforms, faced mass liquidations, further fueling panic.

“I tried to catch the bottom at $90,000, then $85,000, investing a few hundred dollars each time, but my stop-loss orders were triggered. Now, my account is down to 30%,” shared Mr. Nguyễn Hưng from Hà Đông, Hanoi. Many retail investors face similar losses after attempting to “catch a falling knife” in this steep downturn.

Since early November, Bitcoin has breached several key psychological levels: $110,000 (November 3rd), $100,000 (November 14th), $90,000 (November 20th), and now the $80,000-$82,000 range. Each support break intensifies crowd panic, triggering fresh waves of sell-offs.

Bitcoin’s sharp decline. Image: CL |

Persistent Selling Pressure and Systemic Risks Remain High

Outflows from Bitcoin ETFs in the U.S. are accelerating. According to Business Insider, in the four sessions from November 12th to 17th, ETFs saw net outflows of over $1.65 billion. Since the start of November, nearly $3 billion has exited these funds.

Bitcoin’s price has fallen below the average purchase price of ETF investors (around $89,600), leaving most institutional holders in paper losses. This creates additional selling pressure from major funds.

Technically, Bitcoin is forming a “lower highs” pattern. Surging volumes on red candles indicate sellers remain dominant. The next critical support zone is $82,000-$83,000. If this level fails, the path to $80,000, or even $74,000-$75,000 (MicroStrategy’s average holding cost of $74,433), could open up.

Many believe the market is entering the “final phase of the 4-year cycle.” Historically, after each halving, Bitcoin rallies for 12-18 months before entering a 12-24 month correction phase. Past cycles saw a 75% drop in 2021-2022 and a 30% decline from late 2024 to mid-2025.

Macro factors are also unfavorable. The U.S. September jobs report (released on November 20th) showed 119,000 new jobs, exceeding expectations. This reduces the likelihood of a Fed rate cut in December to just 20% (down from 90% in late October). A stronger U.S. dollar, equity market corrections, and heightened pressure on digital assets follow.

Additionally, credit freeze risks loom. Many tech firms and investment funds borrowed heavily (via convertible bonds, margin) to buy Bitcoin and altcoins in 2024-2025. If credit markets tighten, forced selling to repay debts could intensify.

However, long-term positives remain. Regulatory clarity is improving, major banks continue developing crypto products, and blockchain applications are expanding. Some experts view this as a “historic accumulation opportunity” for patient, well-timed investors.

For now, fear dominates. With no clear reversal in sight, many are opting to stay on the sidelines rather than rushing to “catch the bottom.”

Mạnh Hà

– 07:45 22/11/2025

Market Pulse 21/11: Buying Momentum Returns in Afternoon Session, Market Continues to Diverge

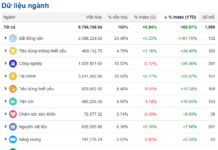

At the close of trading, the VN-Index dipped 1.06 points (-0.06%), settling at 1,654.93 points, while the HNX-Index fell 1.1 points (-0.42%), closing at 263.13 points. Market breadth favored decliners, with 419 stocks falling and 257 advancing. Similarly, the VN30 basket saw red dominate, as 17 constituents declined, 9 rose, and 4 remained unchanged.

Proposed Maximum Fine of VND 200 Million for Cryptocurrency Asset Violations

The draft decree outlining administrative penalties for violations in the cryptocurrency and digital asset market proposes a maximum fine of 200 million VND for organizations found guilty of misconduct.

Over Half a Billion USD Vanishes from the World’s Largest Bitcoin Fund

According to data from Farside Investors, investors withdrew a net $523 million from BlackRock’s iShares Bitcoin Trust (IBIT) on November 18th. This marks the largest single-day outflow since the fund’s inception.