As of September 30, 2025, the total outstanding loans of 27 listed banks reached nearly VND 13.63 trillion, a 15% increase compared to the beginning of 2025. Photo: LÊ VŨ |

Drivers of Credit Growth

According to the Q3-2025 financial reports of 27 listed banks, the total outstanding loans as of September 30, 2025, reached nearly VND 13.63 trillion, a 15% increase from the start of 2025, accounting for 77% of the total credit balance in the banking sector. This marks the highest credit growth rate in recent years for the system and many individual banks.

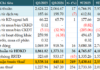

Thirteen banks recorded a loan growth rate of 15% or higher in the first nine months of the year. The top five performers were NCB (33.4%), VPBank (29.4%), Techcombank (21.4%), MBBank (19.9%), and TPBank (18.3%). SaigonBank was the only bank with a decline, dropping by 6.1%.

In absolute terms, larger banks led the growth. VietinBank increased by VND 286.6 trillion to VND 1.99 trillion; VPBank rose by VND 203.5 trillion to VND 896.4 trillion; BIDV grew by over VND 181 trillion to nearly VND 2.24 trillion; Vietcombank increased by VND 180.7 trillion to nearly VND 1.63 trillion; and MBBank added VND 154.8 trillion to reach VND 931.5 trillion.

Notably, VPBank and MBBank ranked among the top performers in both absolute and relative credit growth rates.

Several factors have driven credit growth since the beginning of the year. First, the economy has rebounded strongly, with a 7.85% GDP growth in the first nine months, second only to the 9.44% growth in the same period of 2022 between 2011 and 2025. With a Q4 growth target of over 8.4% and double-digit growth expected from 2026, businesses are optimistic about the economic outlook, driving increased borrowing for investment and production expansion.

|

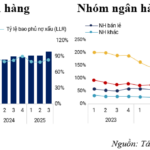

Including bond issuance, the market capital mobilization growth of these 27 banks was 11.4%, still significantly lower than the 15% credit growth. Eighteen banks saw loan growth outpace market capital mobilization (including bond issuance), with eight banks recording a gap of over 5%. |

Second, the real estate market’s recovery has boosted housing loans and investment in this asset class, significantly contributing to overall credit growth. According to the State Bank of Vietnam (SBV) data as of August 31, 2025, real estate credit exceeded VND 4 trillion, up 19% year-on-year, accounting for 23.68% of total credit—the highest in recent history.

With increased public investment in infrastructure to drive economic growth and the resolution of legal hurdles for many projects, real estate companies are actively seeking capital to accelerate existing projects and develop new ones benefiting from infrastructure improvements. Within the real estate credit, loans for real estate business grew by 24% to VND 1.79 trillion, while consumer/personal loans increased by 12%.

Third, lending rates have remained relatively attractive since the beginning of the year, encouraging borrowing. Despite upward pressure on deposit rates, banks have maintained stable lending rates in line with government and SBV directives. Attractive promotional rates during the initial phases have further stimulated loan demand.

Deposit Growth Lagging Behind

According to the General Statistics Office (GSO), as of September 25, 2025, credit institution deposits grew by 9.74% compared to the end of 2024—higher than the 4.17% in the same period last year but significantly lower than the economy’s 13% credit growth. SBV data shows credit growth reaching 15% by the end of October.

Deposit growth has generally lagged loan growth this year. Q3-2025 financial reports indicate that deposits of 27 listed banks grew by 10.2% since the start of 2025, with 21 banks recording higher loan growth than deposit growth.

Including bond issuance, market capital mobilization grew by 11.4%, still lower than the 15% credit growth. Eighteen banks saw loan growth outpace market capital mobilization, with eight recording a gap of over 5%.

The largest gaps were at TPBank (9.3%), ACB (8.1%), NCB (7.1%), Vietbank (7%), and Vietcombank (6.2%), where loan growth was 12.5% but deposit growth was only 6.3%.

Some banks, however, saw higher deposit growth than loan growth, such as ABBank (30.4% deposit growth vs. 21.5% loan growth), Bản Việt (23.9% vs. 10.6%), NamA Bank (23% vs. 4.9%), and MSB (19.2% vs. 4.2%).

Consequently, the loan-to-deposit ratio increased for 18 out of 27 banks. Six banks—VPBank (130%), VIB (111%), SeaBank (110%), VietinBank (102%), Vietcombank, and LPBank (both 100%)—saw loan volumes exceed deposit volumes (including bonds).

Banks have turned to the interbank market, trade finance, and entrusted loans to bridge the funding gap, contributing to upward pressure on deposit rates as they compete for deposits to support business growth.

With credit growth projected to reach 20% this year and seasonal deposit challenges intensifying toward year-end, banks will increasingly compete for deposits through attractive interest rates and promotions.

Additionally, banks may continue issuing bonds for stable funding. According to the Vietnam Bond Market Association, banks led bond issuance in Q3, with 27 listed banks issuing VND 278.5 trillion, up 21.7% year-to-date, including seven banks with over 50% growth.

Triệu Minh

– 16:00 21/11/2025

Q3 Non-Performing Loan Coverage Ratio Continues to Improve

The non-performing loan coverage ratio of the banking system continued its recovery trend in Q3. Effective management of bad debts has provided banks with additional time to rebuild their buffers following the previous sharp decline. Each bank implements distinct provisioning policies based on its strategic direction, leading to varying approaches in provisioning across different groups.

Empowering Financial Growth: Banks Leading the Nation’s Development Journey

Credit recovery is robust and projected to sustain its strong growth trajectory, driven by substantial capital demand from the retail sector and businesses, as well as the ripple effects of public investment. This momentum is poised to significantly contribute to achieving the ambitious GDP growth target of 8% by 2025.

2025 Q3 Banking Overview: Surging Profits, Credit Growth, Shrinking NIMs, and Intensifying Capital Raising Pressures

The banking sector is entering a robust growth phase, yet it faces significant challenges. While credit is accelerating and profitability is improving, the narrowing net interest margin (NIM) is sharply differentiating the competitive capabilities of individual banks.