DIC Corporation (DIC Corp, stock code: DIG, HoSE market) has recently announced the transaction report for the exercise of stock purchase rights by insiders.

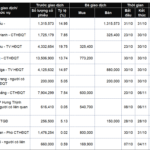

Specifically, between November 3-14, 2025, Chairman of the Board Nguyen Hung Cuong exercised only 28.89 million out of 63.94 million purchase rights, equivalent to buying 6.7 million additional shares offered by DIG. The reason for the incomplete transaction was the failure to register the purchase rights within the specified period.

Based on the issuance price, Chairman Cuong spent VND 80.4 billion to acquire these shares. Post-transaction, he is expected to own 70.64 million shares.

Mr. Nguyen Hung Cuong – Chairman of the Board, DIG

During the same period, Mrs. Le Thi Ha Thanh exercised only 8.04 million out of 16.6 million purchase rights, equivalent to buying 1.86 million additional shares offered by DIG. The reason for the incomplete transaction was the failure to register the purchase rights within the specified period.

Based on the offering price, this transaction is valued at VND 22.4 billion. Post-transaction, Mrs. Thanh is expected to own 18.46 million shares.

Similarly, Mrs. Nguyen Thi Thanh Huyen, Vice Chairwoman of the Board, exercised only 6.9 million out of 14.48 million purchase rights, equivalent to buying 1.6 million additional shares offered by DIG. The reason for the incomplete transaction was the failure to register the purchase rights within the specified period.

Based on the offering price, this transaction is valued at VND 19.25 billion. Post-transaction, Mrs. Huyen is expected to own over 16 million shares.

DIC Corp is currently offering 150 million shares to existing shareholders. The rights issue ratio is 1,000:232, meaning shareholders holding 1,000 shares will receive an additional 232 new shares. The issued shares are freely transferable.

The issuance price is VND 12,000 per share, aiming to raise a maximum of VND 1,800 billion. Of this, DIG plans to allocate VND 600 billion to supplement investment capital for the Cap Saint Jacques Complex Project (CSJ) – Phase 3 (Block C4).

Another VND 600 billion will be used to supplement investment capital for the Vi Thanh Commercial Residential Area project, and the remaining VND 600 billion will be used to repay the DIG12301 bond. The disbursement period is from Q4/2025 to 2026.

This offering replaces the previous plan to issue 200 million shares to the public, as per the Public Offering Registration Certificate No. 231/GCN-UBCK dated December 12, 2024, issued by the State Securities Commission.

Insider Trading Surge: Top Executives’ Notable Stock Transactions in Early November

In the first week of November, the market witnessed significant insider transactions, predominantly in the form of registrations. Notably, DIG announced plans to reduce its stake in DC4, while the Vice Chairman of KDH gifted 17.7 million shares to his mother. Simultaneously, the CEO of Nagakawa capitalized on the market downturn by actively accumulating shares at their lowest prices.

DIC Corp Seeks to Reduce Stake in Dicera Holdings

DIC Corp has announced the registration to sell 2.3 million shares of DC4, issued by Dicera Holdings, as part of its portfolio restructuring strategy.