Borrowers Grapple with Floating Interest Rates

Ms. Dang Thanh Mai, a client of V. Bank, shared that since the beginning of the month, the floating interest rate applied to her home loan has been 14.4% per annum, a 2% increase compared to the previous month.

Meanwhile, the first-year preferential interest rates for home loans have also risen by 1-2% per annum compared to the previous month. Specifically, ACB offers 8% per annum; ABBank 9.65% per annum; Sacombank 7.49% per annum; VIB from 7.8% per annum; and BVBank 8.49% per annum.

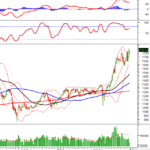

The rise in home loan interest rates comes amidst a backdrop of increasing deposit rates in recent times. Except for state-owned banks, private banks have continuously adjusted their deposit rates upward. Consequently, the 6-month deposit rate in private banks has largely surpassed 6% per annum. For large deposits, the 6-month deposit rate can be as high as 7.1% per annum.

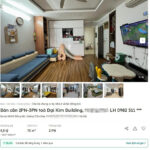

Rising interest rates will curb speculative real estate investments (Photo: Nhu Y).

|

The State Bank of Vietnam reported that as of September 30th, the average lending interest rate for new transactions by commercial banks was 6.54% per annum, a 0.4% decrease compared to the end of 2024.

However, according to homebuyers, the 6-7% per annum interest rate is only applicable during the initial promotional period, primarily as a customer attraction strategy or due to developer-supported interest rates. After the promotional period ends, the floating interest rate typically ranges from 12-14% per annum, placing significant pressure on borrowers.

Will Real Estate Speculation Decline?

In an interview, Mr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, stated that 2025 is considered a pivotal year, marking the beginning of a recovery phase after the crisis, despite lingering risks that need to be identified and managed.

Mr. Dinh noted that over the past three years, the real estate market has been severely impacted by global economic challenges and domestic economic fluctuations in Vietnam. Liquidity has decreased, capital has been tightened, many projects have stalled, and businesses have faced payment pressures, leading to prolonged market stagnation.

However, since the end of 2024 and more prominently in the first quarter of this year, the market has shown clear signs of recovery. “We affirm that the market has passed through its most difficult phase and is now rebounding,” Mr. Dinh emphasized.

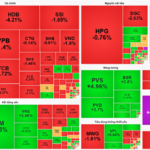

Nevertheless, this recovery is not entirely healthy. According to Mr. Dinh, part of the renewed vibrancy stems from speculative factors, as investment demand has outpaced actual home-buying demand. A key reason lies in the credit easing policy maintained throughout 2024 and continuing into the early months of this year. Cheap and accessible capital has fueled short-term investment activities, leading to overheated transactions in some areas despite insufficient real demand.

Mr. Dinh cited data showing that by September, the banking system had injected nearly 18 million billion VND into the economy, with 4 million billion VND flowing into real estate, equivalent to about 25% of total credit. This proportion reflects the banking sector’s significant efforts to support economic recovery and alleviate difficulties in the real estate market. However, it also poses challenges, as a portion of this capital has not met real demand but has instead flowed into short-term investment channels, posing risks to sustainable development.

The government has instructed ministries and agencies to research the use of various market regulation tools, such as tax and credit policies, along with appropriate management measures to curb speculation and control capital flow into overheated segments. The Vietnam Real Estate Association has also advocated for the application of these tools. However, Mr. Dinh stressed that their implementation should follow a clear roadmap, categorizing different groups to avoid conflating genuine homebuyers with speculators. “We combat speculation but cannot hinder legitimate housing needs,” he said.

One notable recent development is the adjustment of interest rates by some banks. According to Mr. Dinh, this is part of the natural banking cycle, as credit institutions must rebalance interests after a prolonged period of prioritizing economic support. Additionally, rising interest rates signal that the market is showing signs of overheating, prompting the financial system to apply a “gentle brake” to maintain stability.

“Higher interest rates will undoubtedly reduce short-term investment activities, particularly speculative transactions. However, in the long term, this adjustment benefits the market by filtering out financially weak investors, allowing capital to flow into segments with real demand and viable projects. Reducing speculation is not a negative sign. On the contrary, it is a necessary step for the market’s sustainable development,” Mr. Dinh analyzed.

According to Mr. Dinh, the government maintains a flexible management approach, closely monitoring market dynamics to make appropriate adjustments. This flexibility has been crucial in keeping the real estate market stable in recent years and will continue to play a vital role in the 2025-2026 period. “When adverse signs emerge, policies will be adjusted in a more positive direction. This fosters significant market confidence,” he affirmed.

He believes that from the end of this year and into 2026, as management measures take effect and speculative activities decrease, the market will evolve toward higher quality, greater stability, and increased sustainability.

Ngoc Mai

– 16:21 21/11/2025

Techcombank Maxes Out Savings Interest Rates

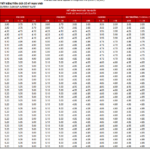

Techcombank (Vietnam Technological and Commercial Joint Stock Bank) has recently updated its deposit interest rates effective from November 20, 2025, with notable increases across various terms. Specifically, the interest rate for deposits under 6 months has been raised to the maximum allowable limit of 4.75% per annum, exclusively for Private customers utilizing online banking channels.

“After Over a Month of Construction on the $700 Million Hong River Mega Bridge Connecting the Old Quarter to Long Bien, Surrounding Real Estate Prices Begin to Surge”

Land prices in Long Biên Ward are currently averaging 214 million VND per square meter, marking a 38% increase over the past year and reaching their highest level in six years.

Shocking Listing: Old Social Housing in Hanoi Offered at Nearly 90 Million VND per Square Meter

The cost of social housing in Hanoi is skyrocketing at an alarming rate. Even decades-old apartments are being listed at prices comparable to mid-range commercial condominiums. In some areas, asking prices have reached a staggering 90 million VND per square meter, a jaw-dropping 4–5 times higher than the original launch price.