The World Gold Council’s (WGC) Q3 2025 Gold Demand Trends report reveals that global gold demand (including OTC transactions) reached a historic high of 1,313 metric tons, marking a 3% year-on-year increase. This milestone underscores gold’s enduring appeal in an evolving economic landscape.

In monetary terms, the impact is even more striking: Q3 gold demand surged to approximately $146 billion, a 44% jump from Q3 2024. This growth is fueled by both increased volumes and record-high gold prices, amplifying the asset’s value proposition.

Key Drivers: Investment Surge vs. Jewelry Slowdown

According to Reuters’ analysis of the WGC report, investment demand—encompassing gold bars, coins, and ETF inflows—was the primary catalyst for this record-breaking quarter. Total investment demand soared to 537 metric tons, a 47% annual increase.

Gold bars and coins saw a 17% uptick, while physical gold-backed ETFs witnessed a remarkable 134% inflow reversal, ending years of outflows. The Wall Street Journal attributes this shift to investors seeking safe-haven assets amid geopolitical tensions and recession fears.

Conversely, global jewelry demand contracted by 23% to 419 metric tons as soaring prices prompted consumers in key markets like China, India, and the Middle East to curb spending. WGC notes that while retail buyers are allocating more budget to gold, they are opting for smaller or lighter pieces, reducing volume but increasing overall value.

Central Banks Maintain Robust Gold Purchases

Central banks continued their aggressive gold accumulation, purchasing a net 219–220 metric tons in Q3—a 10% annual rise and 28% higher than Q2. This marks the 15th consecutive year of net central bank buying, surpassing 1,000 metric tons since 2010.

Economy Middle East highlights WGC’s observation that central banks’ appetite for gold remains undiminished as policymakers diversify reserves away from USD and developed-market bonds amid rising public debt and policy uncertainty. This trend is forecast to sustain through 2025–2026, providing structural support for gold markets.

Record Prices Fail to Suppress Demand

Spot gold prices climbed over 50% in 2025, peaking at $4,381/ounce on October 20 before modest corrections. Historically, high prices dampen physical demand, but WGC data shows investment and central bank demand intensifying despite—or because of—these levels.

In its October 30 statement, WGC emphasized, “Q3 demand hit an all-time high alongside record prices, reaffirming gold’s role as a strategic hedge in volatile environments.”

Supply Hits Record but Trails Demand

Global gold supply also reached a new peak of 1,313 metric tons in Q3, up 3% year-on-year. Mining output grew 2% to 977 metric tons, while recycled gold increased 6% to 344 metric tons. Despite these gains, supply struggles to keep pace with demand dynamics.

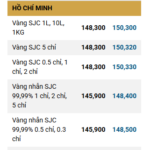

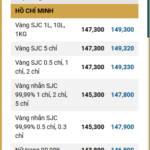

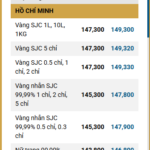

Gold Prices Plummet by 1.7 Million VND per Tael on the Afternoon of November 18th

Global gold prices experienced a significant decline during Monday’s trading session (November 17) and continued to drop today (November 18). Domestically, the prices of gold rings and gold bars have both fallen, with reductions ranging from 0.2 to 1.7 million VND per tael compared to the end of yesterday.