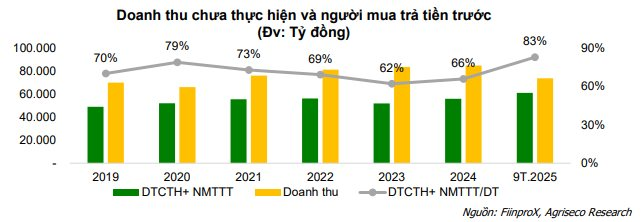

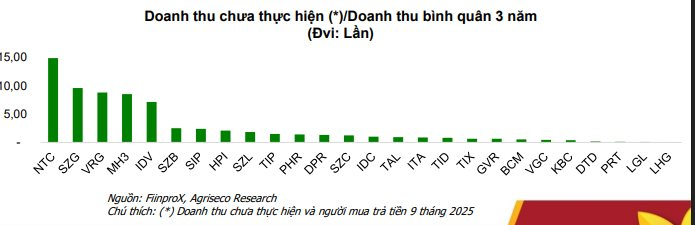

Unrealized revenue is considered a “reserve” for industrial park (IP) businesses, reflecting future earnings from completed or leased IP and factory projects. A higher ratio of unrealized to average revenue indicates stable cash flow and sustainable long-term growth potential.

Agriseco’s data shows that by September 30, 2025, unrealized revenue for industrial real estate firms totaled VND 61 trillion, up 9% year-to-date. Rental income rose over 30%.

The unrealized revenue-to-sales ratio exceeds 80%, surpassing the 5-year average, signaling improved rental collection and sustained demand. However, companies must accelerate infrastructure completion and land handover to recognize this revenue.

Currently, NTC leads with Nam Tan Uyen 1, 2, 3 projects, bolstered by the expanded Nam Tan Uyen 2 IP operational since Q2/2025, significantly boosting unrealized revenue. SIP leverages its Phuoc Dong, Dong Nam, and Le Minh Xuan 3 IPs, actively leasing spaces.

IDC’s unrealized revenue grew via expanded Phu My 2, Que Vo II, Cau Nghin, and Huu Thanh IPs, promising stable future income with strong absorption rates.

Rubber firms like PHR, DPR, and GVR attribute substantial unrealized revenue to land converted for IPs. This strengthens finances, enabling infrastructure upgrades amid fierce competition.

However, prolonged high unrealized revenue without matching actual sales may strain cash flow, requiring faster handovers to balance finances.

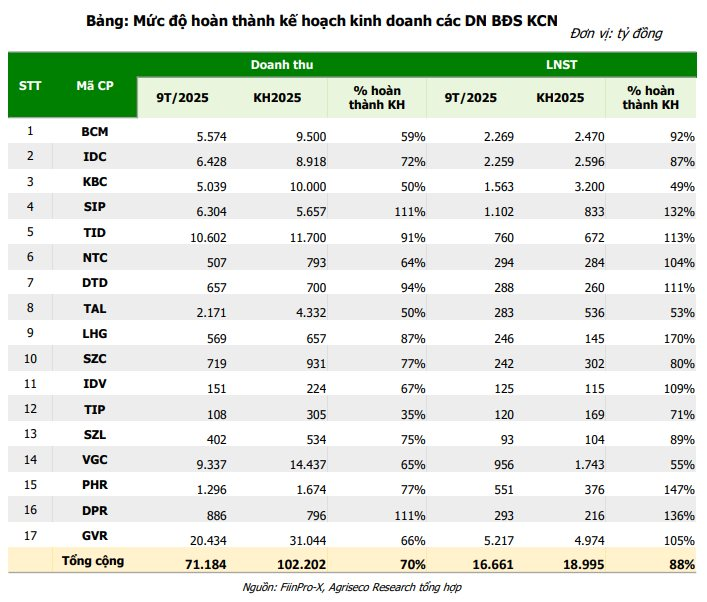

Regarding business plan fulfillment, IP firms generally achieved positive results against conservative targets due to macro concerns and tariff risks. By Q3-end, profit completion reached 88% of annual plans, ensuring target achievement or exceedance.

Companies like SIP, NTC, DTD, and LHG surpassed or neared 100% profit targets by Q3. Firms with aggressive growth goals, such as KBC and BCM, achieved modest results.

Rubber companies with large IP-converted land, including PHR, DPR, and GVR, reported 9-month profits exceeding full-year plans. This cautious planning provides safety margins and growth prospects, especially with recovering rental demand or large FDI leases.

Agriseco forecasts 5–10% profit growth for IP firms in 2025, with stronger recovery from 2026. Growth drivers include firms with ample leasable land, prior MOUs, or FDI-attractive locations. Rubber firms converting land to IPs anticipate significant profits from compensation and high rubber prices.

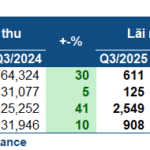

Seaports Reap Record Profits in Q3

The third quarter marked a remarkable harvest season for the port sector, as cargo throughput surged, profit margins expanded, and cash reserves reached unprecedented levels.

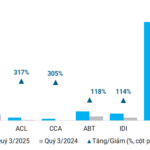

Seafood Industry Profits Surge to New Heights

Despite facing tariff pressures and a slowdown in export markets, the seafood industry group reported remarkable profit growth in Q3 2025. Several companies achieved their highest earnings in three years, with bank deposits reaching unprecedented levels.