Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 666 million shares, equivalent to a value of more than 18.2 trillion VND; the HNX-Index reached over 61 million shares, equivalent to a value of more than 1.3 trillion VND.

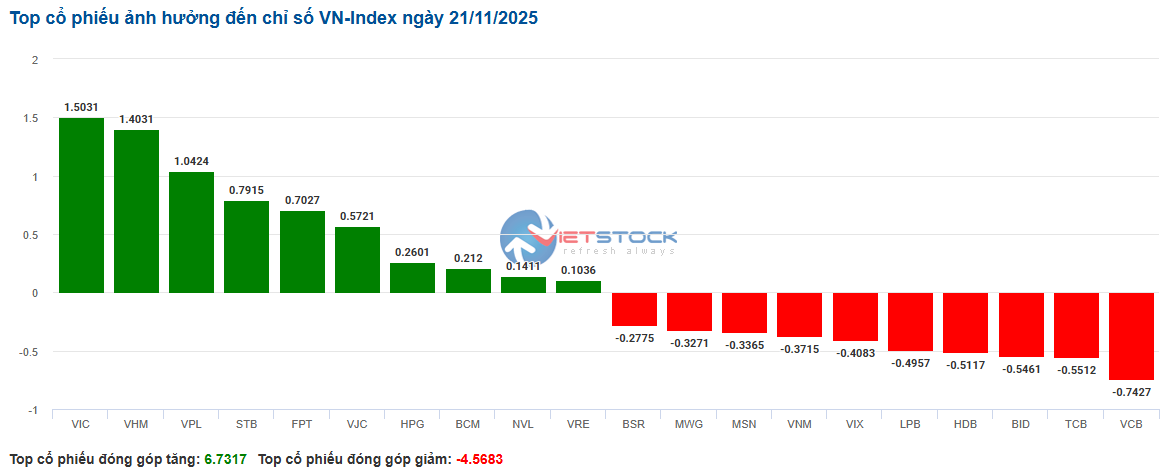

The VN-Index opened the afternoon session on a positive note as buying pressure re-emerged, helping the index recover and surpass the reference level. However, selling pressure remained dominant, causing the VN-Index to close slightly lower in the red. In terms of influence, VCB, TCB, BID, and HDB were the most negatively impactful stocks on the VN-Index, contributing to a decline of over 2.3 points. Conversely, VIC, VHM, VPL, and STB maintained their green status, adding more than 4.7 points to the index.

Source: VietstockFinance

|

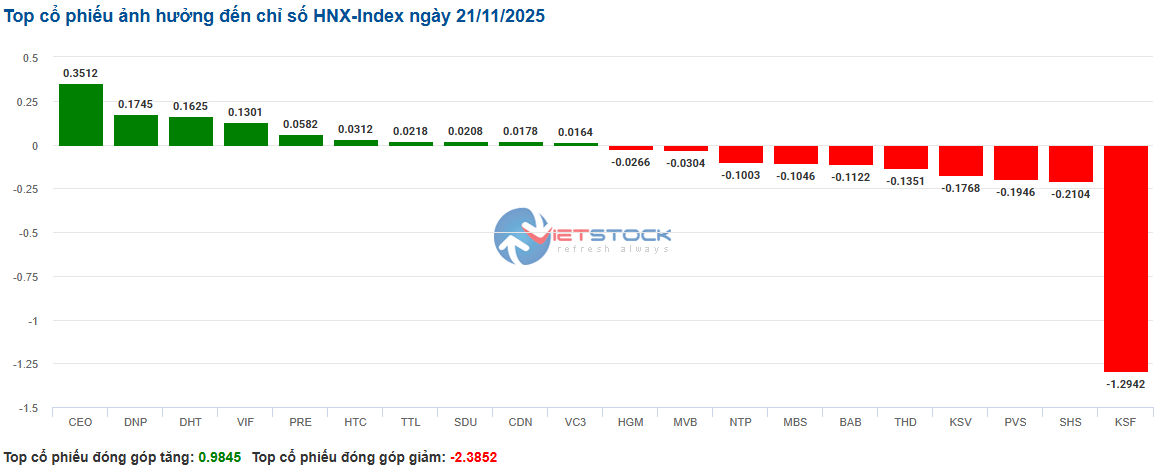

Similarly, the HNX-Index experienced a rather pessimistic trend, with negative impacts from stocks such as KSF (-3.18%), SHS (-1.82%), PVS (-2.03%), and KSV (-0.99%).

Source: VietstockFinance

|

At the close, the market declined by 0.22%, with red dominating most sectors. The communication services sector saw the sharpest decline at 1.68%, primarily driven by stocks like VGI (-2.1%), FOX (-0.49%), CTR (-1.31%), and SGT (-0.9%). This was followed by the energy and essential consumer sectors, which decreased by 1.38% and 1.03%, respectively. Notable selling pressure was observed in stocks such as BSR (-1.56%), PLX (-1.31%), PVS (-2.03%), PVD (-1.15%), MCH (-2.09%), VNM (-1.32%), MSN (-1.27%), and SAB (-0.74%). Additionally, the financial sector also ended in the red, declining by 0.57%.

On the positive side, the information technology sector maintained its green status, leading the market with a 1.67% increase, primarily driven by FPT (+1.82%), VEC (+2.91%), and DLG (+1.75%).

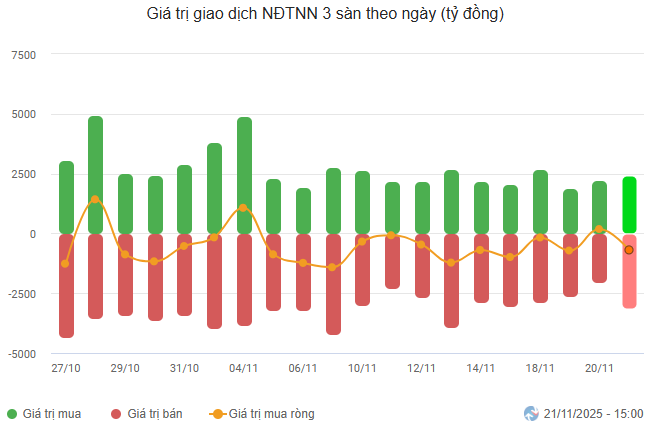

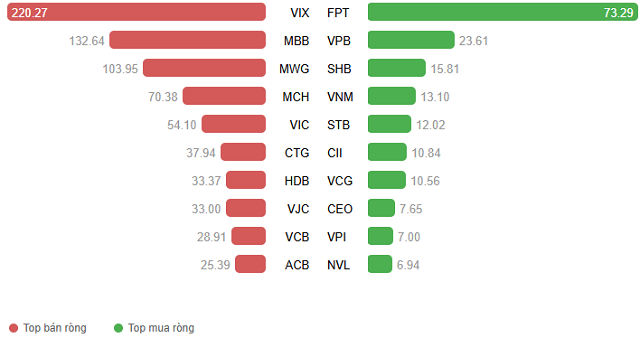

In terms of foreign trading, foreign investors resumed net selling, totaling over 601 billion VND on the HOSE floor, concentrated in stocks like VIX (704.21 billion), MBB (257.44 billion), MWG (132.98 billion), and VIC (72.2 billion). On the HNX floor, foreign investors net bought over 30 billion VND, focusing on stocks such as PVS (11.44 billion), CEO (9.52 billion), SHS (9.06 billion), and IDC (4.02 billion).

Source: VietstockFinance

|

Morning Session: VN-Index Retreats to Nearly 1,635 Points

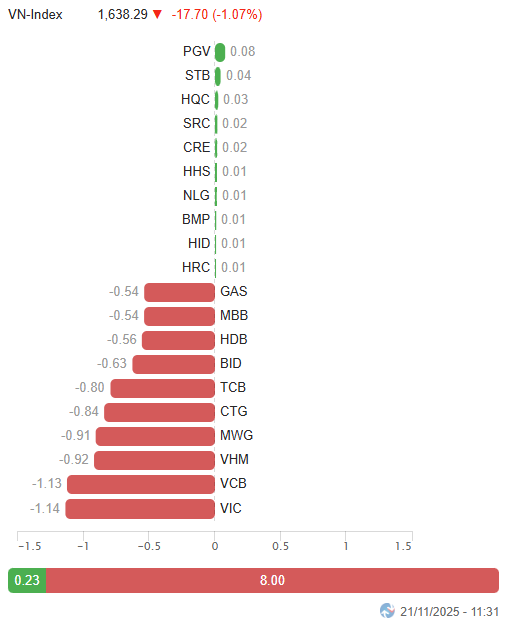

Increased selling pressure pushed the main indices further into the red by the end of the morning session. At the midday break, the VN-Index fell by nearly 18 points (-1.07%), closing at 1,638.29 points. Similarly, the HNX-Index retreated to 261.39 points, down by 1.07%. Market breadth favored sellers, with 471 declining stocks and 197 advancing stocks.

Among the top 10 stocks influencing the VN-Index, VIC and VCB were the most negatively impactful, each reducing the index by approximately 1.13 points. Following closely were VHM, MWG, CTG, and TCB, which collectively dragged the index down by an additional 2.7 points. Conversely, the top 10 positively influential stocks managed to add a mere 0.23 points to the index, highlighting the dominance of selling pressure.

Source: VietstockFinance

|

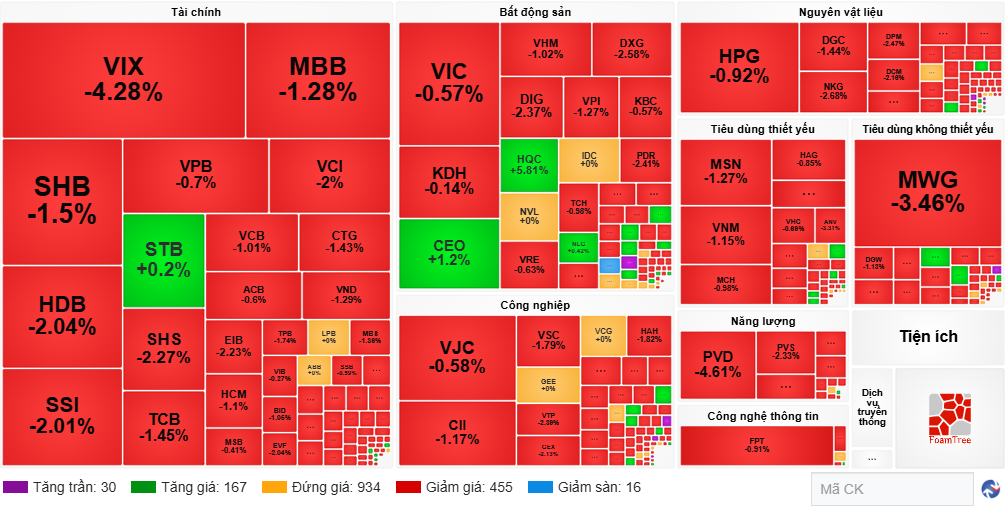

Red dominated all sectors, with the healthcare sector experiencing the smallest decline at 0.2%. The communication services sector saw the sharpest decline today, with leading stocks such as VGI (-2.1%), FOX (-0.98%), CTR (-3.06%), SGT (-3.31%), and YEG (-1.26%) all deeply in the red.

Similarly, the energy and non-essential consumer sectors recorded adjustments of over 1.6%, with selling pressure dominating stocks like BSR (-1.56%), PLX (-1.31%), PVS (-2.33%), PVD (-4.61%), PVT (-1.64%); VPL (-1.39%), MWG (-3.46%), HUT (-1.14%), DGW (-1.13%), MSH (-1.99%), and PET (-2.46%).

Large-cap sectors such as finance, industry, and real estate also weighed heavily on the overall index, with numerous stocks adjusting by over 1%, including VIX, MBB, SHB, VCI, HDB, SSI, SHS, TCB, EIB, CTG; VSC, CII, HAH, VTP, GEX; VHM, DXG, DIG, VPI, and PDR.

Source: VietstockFinance

|

Foreign investors intensified their net selling, reaching 750.97 billion VND across all three floors. Selling pressure was primarily concentrated in VIX, with a value of 220.27 billion VND. Conversely, FPT led the net buying list, with a value of only 73.29 billion VND.

Source: VietstockFinance

|

Selling Pressure Intensifies, Capital Flees the Financial Sector

Pessimism continued to grip large-cap stocks, causing the main indices to decline further. As of 10:30 AM, the VN-Index fell by over 16.58 points, trading around 1,640.75 points. The HNX-Index decreased by 1.52 points, trading around 262.71 points.

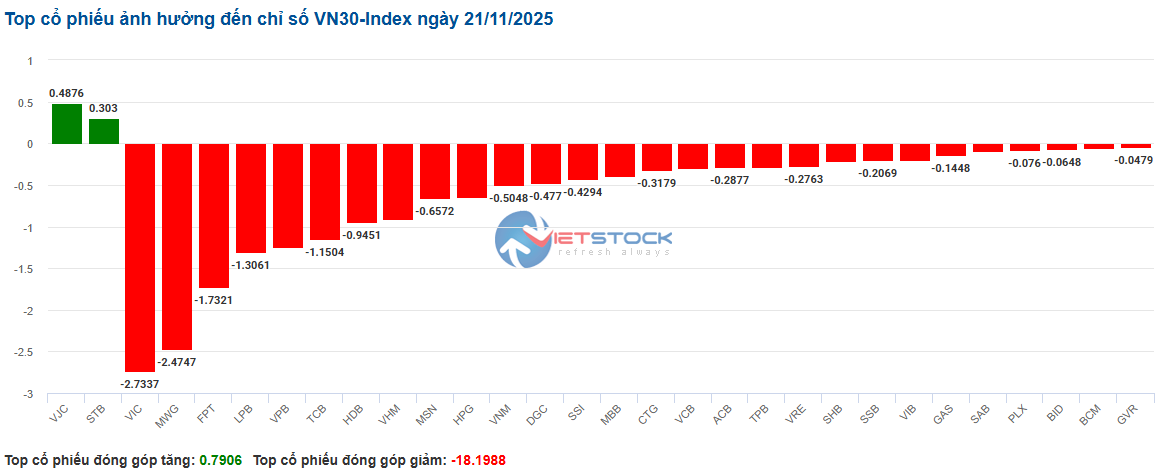

Stocks in the VN30 basket faced strong selling pressure, reducing the overall index by more than 18.1 points. Notably, VIC, MWG, FPT, and LPB had negative impacts of 2.73 points, 2.47 points, 1.73 points, and 1.3 points, respectively. Following closely were stocks like VPB, TCB, HDB, and VHM, which also recorded significant declines.

Source: VietstockFinance

|

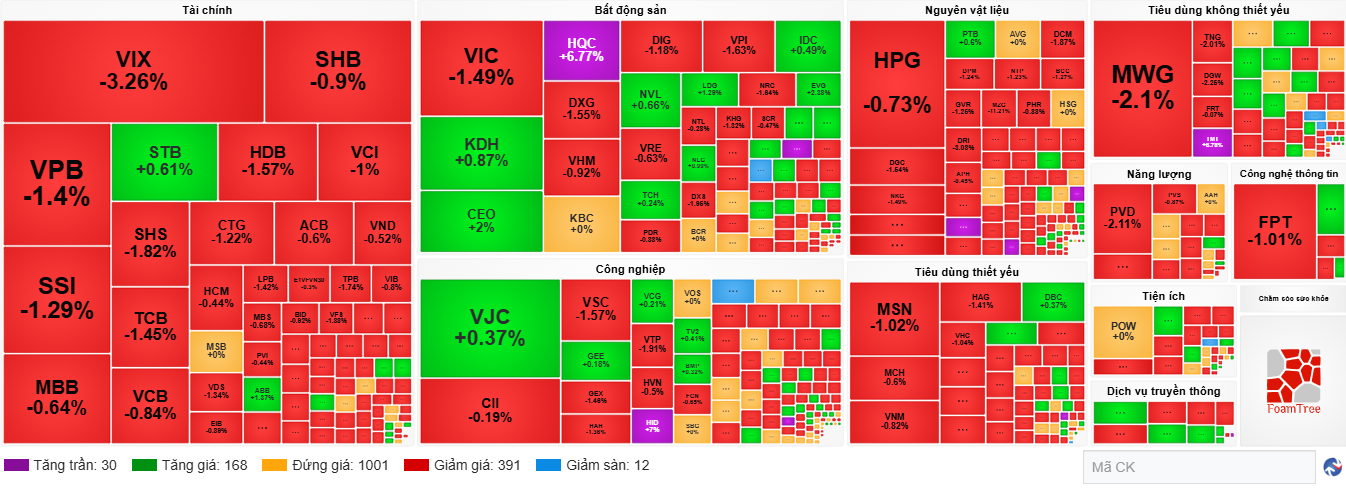

Capital is fleeing the financial sector, causing most stocks in this sector to decline. Specifically, strong selling pressure was observed in securities group stocks such as VIX (-3.26%), SHS (-1.36%), and SSI (-1.29%). Additionally, red was also present in banking stocks like VPB (-1.58%), TCB (-1.45%), HDB (-1.57%), and SHB (-0.9%).

Next, real estate stocks were in a state of strong polarization, with selling pressure slightly dominating in stocks like VIC (-1.32%), DXG (-1.81%), DIG (-1.18%), and VRE (-0.63%). In contrast, green only appeared in stocks like KDH, CEO, KBC, IDC, and NVL, but the increases were insignificant.

Compared to the opening session, the market continued to polarize strongly, with over 1,000 reference stocks and sellers maintaining dominance, with 391 declining stocks and 168 advancing stocks.

Source: VietstockFinance

|

Opening: Broad Decline, VN-Index Loses Over 8 Points

The morning session began on a negative note, with red dominating almost all sectors. The VN30 index had the most negative impact, as most stocks in this group declined.

Numerous VN30 stocks fell sharply, including FPT, VIC, VPB, MWG, HPG, and VHM… Only VJC and LPB showed a glimmer of green.

The financial sector followed suit, with stocks continuing to decline compared to previous sessions. Stocks like VPB (-1.23%), VIX (-1.83%), SSI (-1.44%), and HDB (-1.1%) all decreased.

The materials and real estate sectors were equally pessimistic, primarily due to leading stocks such as HPG (-0.37%), DGC (-0.82%), NKG (-0.85%), VIC (-0.53%), CEO (-0.4%), and VHM (-0.31%).

– 15:22 21/11/2025

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.

Two Bank Stocks Hit Hard by Brokerage Firms’ Net Selling on November 20th

Proprietary trading firms extended their net selling streak on the Ho Chi Minh City Stock Exchange (HOSE), offloading a total of VND 48 billion worth of shares.