This development follows the announcement by Vietnam National Tobacco Corporation (Vinataba) to auction its entire stake in a long-standing instant noodle company, with a starting price nearly double the current market rate.

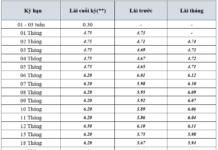

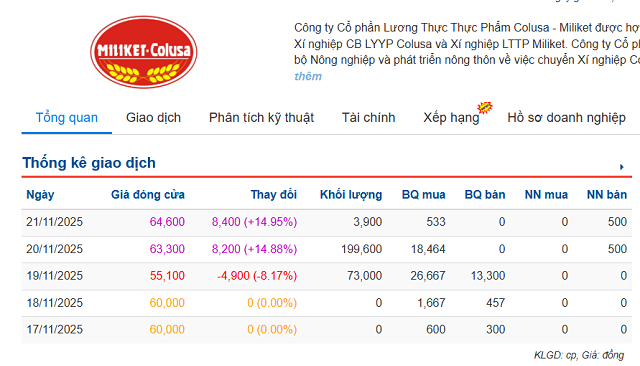

On November 21st, CMN closed at 64,600 VND per share, significantly lower than the 119,500 VND per share offered by Vinataba for the 960,000 shares (20% of CMN’s charter capital) to be auctioned on December 18th at the Hanoi Stock Exchange. The total auction value is nearly 115 billion VND.

Notably, CMN shares, which have been largely stagnant for years, saw a surge in liquidity over the past three sessions. The highest trading volume was recorded on November 20th, with nearly 200,000 shares traded, compared to 73,000 on November 19th.

Trading volume and price of CMN shares surged on November 19th and 20th

|

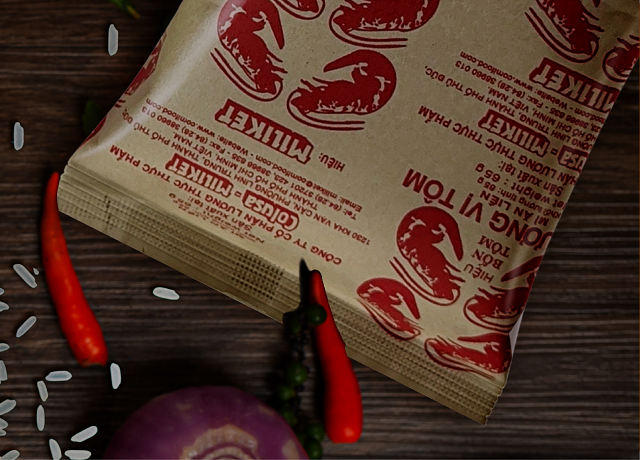

CMN, owner of the Miliket brand, is known for its half-century-old instant noodles packaged in kraft paper with the iconic image of two shrimps. Once a market leader, it has since ceded ground to competitors like Masan, Acecook, and Uniben.

Despite a modest market share, Miliket retains a loyal customer base, particularly in traditional channels such as markets, eateries, and hotpot establishments, thanks to its durable, heat-resistant noodles.

With a charter capital of 48 billion VND, unchanged since its 2006 IPO, CMN has Vinataba as one of its founding shareholders, holding 20% of shares since then. Other major shareholders include Vinafood II (30.7%) and Mesa Trading and Services (20.08%), collectively controlling nearly 86% of CMN‘s capital.

CMN’s Ho Chi Minh City plant has a capacity of 500,000 packs per day, distributed nationwide. Some products are exported to markets like France, the US, and Russia. However, the company faces challenges with limited product innovation and weak marketing efforts.

In the first half of 2025, CMN reported revenue of nearly 400 billion VND, with a gross profit margin of around 26%. Net profit was approximately 11 billion VND, half of the 2024 full-year figure. In 2024, revenue peaked at 740 billion VND, with a gross profit margin of 27.7%, but net profit remained low at 23 billion VND, far below the 2011 peak.

As of June 2025, total assets were 286 billion VND, including 160 billion VND in bank deposits. Equity was approximately 160 billion VND.

The company leases nearly 2 hectares on Kha Van Can Street for its office and showroom, mostly under long-term contracts until 2065. However, not all land used by CMN has complete legal documentation.

A notable example is the 8,590m² plot on To Vinh Dien Street, Thu Duc District, housing its production facility and warehouse. This area awaits lease formalization by relevant authorities.

| CMN’s 2024 profit hits a 5-year high |

Miliket’s iconic kraft paper packaging with two shrimps – Photo: Miliket

|

Vinataba‘s decision to sell its entire stake in CMN is part of its 2021-2025 restructuring plan, aiming to maximize non-core asset recovery and focus on core business activities.

Alongside CMN, Vinataba is auctioning its stake in Lilama Land (1.62 million shares, 15.52% of charter capital), with a starting price of over 38 billion VND.

Lilama Land, despite its real estate ventures, has struggled with incomplete projects, resulting in minimal revenue from core operations. In 2024, it reported 23 billion VND in revenue and 4.8 billion VND in net profit. In the first half of 2025, revenue was 31 billion VND, with a profit of 17 billion VND. Its assets, valued at 135 billion VND, primarily consist of 121 commercial land plots in Hoang Phat Urban Area (former Bac Lieu Province).

Despite legal issues spanning over a decade, Vinataba‘s stake in Lilama Land is appraised at approximately 37 billion VND.

Another notable transaction involves Vinataba‘s stake in Hai Ha – Kotobuki, a Hanoi-based confectionery company. With a 31 billion VND investment in a 45 billion VND charter capital, the starting auction price is 177 billion VND.

Concurrently, Vinataba is selling 385,000 shares in Nada Brewery (charter capital: 30 billion VND), with a starting price of 17.6 billion VND.

Additionally, during 2021-2025, Vinataba plans to divest entirely from Southern Airlines Trading (25.46%), reduce its stake in Northern Food (30%), and exit Dalat Beer (13.96%).

– 15:11 21/11/2025

Petrosetco Surges Following PVN’s Announcement to Auction Entire Stake at Starting Price of 36,500 VND/Share

Petrovietnam is set to auction its entire 23.21% stake in Petrosetco (HOSE: PET), a leading integrated oil and gas services company, with a starting price of VND 36,500 per share. This move, valuing the entire lot at nearly VND 910 billion, immediately sent PET shares surging to their upper limit on the morning of November 10th, despite the market price still trailing 12% below Petrovietnam’s offering price.

The Untold Story of Miliket’s Iconic “Shrimp Noodle King”: Why Did the 40-Year-Old Unchanged Packaging Legend Fade Away?

Once the undisputed “King of Instant Noodles” with its iconic red shrimp logo, Miliket now holds a mere 2% market share. The brand is embarking on a comprehensive overhaul to reposition itself and reclaim its former glory.