This move reignites the long-standing debt issue surrounding the controversial project between SII and foreign investors.

According to the resolution dated November 20, Chairman Hoàng Minh Hùng approved the payment plan for the “purchase price” arising from the share purchase agreement of Cu Chi Water Supply and Drainage JSC, signed in December 2023 with VIAC, a Singapore-based investment fund.

However, SII‘s documents do not specify the payment method. The repayment method for the VND 154 billion debt between SII and VIAC remains unclear.

VIAC (No.1) Limited Partnership is part of Vietnam Oman Investments (VOI), a joint venture between the Oman National Investment Fund and SCIC. This fund has held 12.05% of SII‘s capital since before 2013. When SII established a company to develop a water plant in the former Cu Chi district, VIAC and Manila Water South Asia Holdings Pte Ltd jointly invested in acquiring 49% of the project.

The project has been underperforming and incurring losses for several consecutive years. Consequently, the two foreign investors sought to convert their entire stake into direct ownership in SII, a listed company.

The capital swap plan was approved by SII in 2017 but faced delays due to disagreements between the parties.

In 2023, with the involvement of DNP Water (DNP Water Investment JSC), progress was made. By year-end, SII‘s Board of Directors approved the issuance of new shares to swap with VIAC and Manila Water, with a completion deadline of February 1, 2025. Simultaneously, SII recorded a payable amount of over VND 154 billion to each investor in its financial statements, corresponding to the value of the capital to be converted.

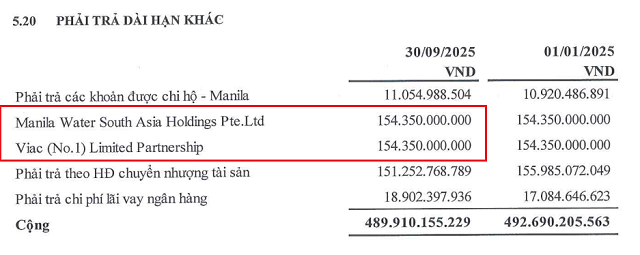

However, by the end of Q3 2025, the swap had not been executed. The debt to VIAC and Manila Water persists, prolonging the dispute. SII stated that negotiations are ongoing, but Manila Water denied this at the 2025 Annual General Meeting.

Notably, the new resolution only mentions payment to VIAC, omitting the equivalent debt to Manila Water. Currently, Manila Water and VIAC hold 38% and 10.9% of SII‘s capital, respectively.

SII still owes over VND 154 billion to VIAC and Manila Water. Source: SII‘s Q3 2025 Consolidated Financial Report

|

SII began in Ho Chi Minh City in 2004 as Viet Thanh Construction, with a charter capital of VND 550 million, operating in construction materials and equipment rental. In 2010, the company rebranded, increased its capital to VND 400 billion, and shifted to environmental infrastructure. SII‘s stock was listed on HOSE in 2012, and it officially became Saigon Water Infrastructure, focusing on clean water.

SII was once a subsidiary of HCMC Infrastructure Investment JSC (HOSE: CII), a major player in infrastructure BOT projects. Since 2023, DNP Water has consistently acquired shares and became the parent company in early 2024, holding a 50.6% stake.

During its expansion, SII established Cu Chi Water Supply and Drainage LLC in 2015, owning 99.98% of the capital to develop the Cu Chi Water Plant. Two years later, this entity was converted into a joint-stock company, with SII holding 50.98% and the remainder split equally between Manila Water and VIAC.

The Cu Chi Water Supply and Drainage project has been a significant setback for SII over the years. The water plant, launched in Q3 2015 with a total investment of over VND 2.6 trillion, aimed to supply clean water to the former Cu Chi district.

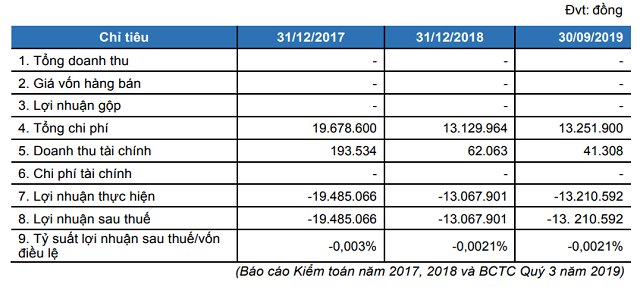

The project consistently incurred losses due to insufficient revenue to cover costs. At one point, financial expenses accounted for 61% of SII‘s revenue in the first nine months of 2019. The retail water price was not adjusted as planned, narrowing profit margins.

Cu Chi Water Supply and Drainage incurred continuous losses during its initial operation phase. Source: SII

|

Part of the challenge stemmed from locals’ reliance on well water, while many industrial zones treated their own water instead of purchasing from the plant. SII spent years on awareness campaigns and simplifying connection procedures to boost demand.

The situation worsened when the VND 600 billion government subsidy for the project ended in 2020, eliminating a crucial offset and causing SII to report a net loss of VND 105 billion.

SII‘s Chairman previously stated that core projects had improved, but the company had not paid dividends to maintain operating cash flow and repay Cu Chi-related debts. Management forecasts that the water plant will achieve financial self-sufficiency by 2032.

In other developments involving VIAC, at Tasco JSC (HNX: HUT), where Hoàng Minh Hùng serves as CEO, shareholders approved VIAC’s acquisition of shares from related parties in the swap deal with SVC Holdings (now Tasco Auto). This mechanism allows VIAC to exceed the 25% ownership threshold without a public tender offer.

| SII reported a net loss in 2020 when it stopped recognizing income from the Cu Chi project subsidy |

SII Chairman: Cu Chi Water Plant to Achieve Financial Self-Sufficiency by 2032

Tasco Plans to Allow VIAC to Acquire Company Shares

– 15:00 22/11/2025

DNP Water and Samsung E&A Launch Vietnam’s First Inter-Regional Raw Water Infrastructure Project, Providing Clean Water to 2 Million People in the Mekong Delta

DNP Water and Samsung E&A have officially launched a groundbreaking 1.820 trillion VND raw water infrastructure project in Dong Thap, marking the first step in their strategic initiative to address water security in the Mekong Delta. This ambitious endeavor sets the stage for a subsequent 11,000 billion VND project aimed at safeguarding the Ca Mau Peninsula from water-related challenges.

Tasco Plans to Allocate Shares to Foreign Fund VIAC

Tasco JSC (HNX: HUT) is seeking shareholder approval via written consent to facilitate the transfer of company shares to VIAC (No.1) Limited Partnership, a foreign investment fund based in Singapore. The proposal also includes a request for exemption from the public tender offer requirement for this transaction.

“IPA Hydropower Company Reports 14% Dip in Half-Yearly Profits”

“In the first half of 2025, Bac Ha Energy reported a remarkable after-tax profit of over 30 billion VND, reflecting a 14% decrease compared to the same period last year. The company also witnessed a significant reduction in its total liabilities, which fell by 25.6% to 551 billion VND, showcasing a strong financial performance and a positive trajectory for the remainder of the year.”

The Crumbling Apartment Complex: A Tale of Falling Ceilings and Neglect

For almost five decades, the Quang Trung apartment buildings in Nghe An have been standing tall. However, time has taken its toll, and many of these structures have fallen into a state of disrepair, causing concern and anxiety among the residents who call them home.