Vietnam Oil and Gas Group (Petrovietnam) recently announced its plan to divest its entire stake of over 24.9 million shares in Petrosetco (stock code: PET), reducing its ownership from 23.21% to 0% of the charter capital. The transaction is scheduled to take place from November 11 to December 31, 2025, through a public auction on the Ho Chi Minh City Stock Exchange.

This divestment aims to implement the restructuring plan of PVN for the period up to 2025, approved by the Prime Minister in Decision No. 1243/QĐ-TTg in October 2023. According to this plan, PVN will completely withdraw its capital from Petrosetco by the end of 2025.

Previously, Petrovietnam approved the auction of all 24.9 million PET shares at a starting price of VND 36,500 per share, with the auction set for 9:00 AM on December 11, 2025.

Compared to the market price of VND 31,900 per share at 10:40 AM on November 21, the starting price is approximately 14% higher. If successful, Petrovietnam is expected to earn a minimum of VND 909 billion from this transaction.

Investors can register and deposit from November 17 to 4:00 PM on December 3 at designated auction agents. Auction participation tickets must be submitted by 3:00 PM on December 9.

Payment for shares and refund of deposits will be processed from December 12 to December 18.

Petrosetco, a subsidiary of Petrovietnam, operates in various sectors including technology product distribution, logistics, lifestyle services, building management, and real estate. The company is also an official distributor for major technology brands such as Apple, Nokia, and Realme.

This divestment announcement comes at a time when Petrosetco’s business performance is highly positive. In Q3 2025, the company reported an after-tax profit of VND 145 billion, a 95% increase year-over-year, primarily driven by financial revenue (VND 153 billion) from a surge in trading securities profits.

In the first nine months of 2025, Petrosetco achieved revenue of VND 14,216 billion, a 2% decrease, while after-tax profit rose significantly to VND 248 billion, a 56% increase year-over-year. With this profit, the company has surpassed its full-year profit target after just nine months.

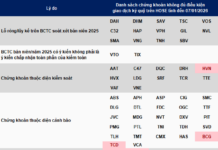

In related news, Petrosetco has seen continuous selling of shares by major shareholders and insiders.

Specifically, on August 21, HD Fund Management Company sold 755,000 PET shares, reducing its ownership from 14.27% to 13.56% of the charter capital. Earlier, from August 11 to August 18, Mr. Vu Tien Duong, a Board Member and CEO, sold over 399,000 shares, reducing his ownership from 0.37% to 0%.

During the same period, Mr. Ho Hoang Nguyen Vu, Deputy CEO, sold all his shares, reducing his ownership from 0.07% to 0%. Additionally, Mr. Ho Minh Viet, a Board Member, sold all 209,100 shares, reducing his ownership from 0.2% to 0%.

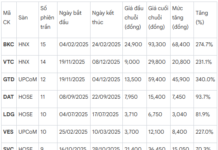

Bank Profits Surge 10x, Stock Prices Double Since Year’s Start

ABB Bank’s stock (ABB) has surged an impressive 100% since the beginning of the year, making it one of the top-performing bank stocks in the market. This remarkable rally coincides with the bank’s strong nine-month financial results and a strengthened management team. These positive developments are expected to propel ABBANK into a new phase of accelerated growth.

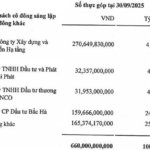

Thác Bà Hydropower Announces Second Cash Dividend Payout for 2024

The Board of Directors of Bac Ha Hydropower Joint Stock Company (UPCoM: BHA) has approved the payment plan for the second cash dividend of 2024 to its shareholders.