Illustrative image

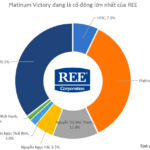

According to the Ho Chi Minh City Stock Exchange (HoSE), Mr. Nguyen Ngoc Thai Binh has submitted a document to the State Securities Commission (SSC), HoSE, and Refrigeration Electrical Engineering Corporation (Stock Code: REE), announcing the trading of shares/fund certificates/warranted warrants by insiders and related persons.

Specifically, Mrs. Thai Binh has registered to sell 400,000 REE shares through order matching and/or negotiated transactions.

The purpose of the transaction is for personal needs. The expected transaction period is from November 26, 2025, to December 24, 2025.

After the transaction, Mrs. Thai Binh’s ownership will decrease from over 10.7 million REE shares (1.98%) to more than 10.3 million shares (1.9%).

Mr. Nguyen Ngoc Thai Binh is currently a Board Member and Deputy General Director of Refrigeration Electrical Engineering. Mrs. Binh is also known as the daughter of Mrs. Nguyen Thi Mai Thanh, Chairwoman of REE’s Board of Directors. According to reports, Mrs. Mai Thanh holds nearly 69.5 million REE shares, equivalent to 12.83%.

In another development, REE recently announced Resolution No. 34/2025/NQ-HĐQT-REE dated November 6, 2025, of the Board of Directors, approving the increase in charter capital and amendments to the Articles of Association of REE Energy LLC.

Accordingly, the Board of Directors approved increasing REE Energy’s charter capital from VND 7,248 billion to VND 10,500 billion. The capital increase will be made through additional contributions from the company’s owner.

REE Energy is a wholly-owned subsidiary of REE, holding 100% of its capital as of September 30, 2025.

Earlier, in mid-October 2025, REE announced a Board Resolution approving the establishment of two subsidiaries to implement the company’s projects.

The first company, REE Duyen Hai 2 Wind Power LLC, has an initial charter capital of VND 30 billion, with a total expected charter capital of VND 677 billion.

REE established this company to implement Phase 2 of the V1-3 Wind Power Plant project, with a total investment of VND 2,257 billion. This includes VND 677 billion in equity and VND 1,159 billion in loans.

The second company, REE Duyen Hai 3 Wind Power LLC, has an initial charter capital of VND 50 billion, with a total expected charter capital of VND 1,159 billion.

This company was established to implement Phase 2 of the V1-5 and V1-6 Wind Power Plant project, with a total investment of VND 3,864 billion, including VND 1,159 billion in equity and VND 2,705 billion in loans.

Both companies are located at the Wind Power Plant No. 3 Management Building, V1-3, Nha Mat Hamlet, Truong Long Hoa Ward, Vinh Long Province.

REE will contribute capital to these companies in cash, owning 100% of the charter capital, with the expected contribution period in Q4/2025.

REE Injects Billions into Energy Sector Expansion

REE Corporation (HOSE: REE) has announced a strategic capital increase for its energy division, paving the way for significant investments in wind power projects.

The Billion-Dollar Group That Invested in Vinamilk and THACO Gets Greenlit for a Public Offer to Acquire REE at a Premium Above Historical Peaks

In 2023, JC&C achieved an impressive revenue of over $22.2 billion, marking a 3% growth compared to the previous year.