Instead of following the traditional model, VIB has chosen a completely new direction: Installment payments via international payment cards – a pioneering solution in Vietnam. This solution not only allows customers to “buy now, pay later” directly from their own funds but also empowers them to decide when and which expenses to convert into installments. This actively promotes the trend of financial action, contributing to changing the mindset of Vietnamese users.

Behind this innovative and customer-centric solution is the vision of a digital financial ecosystem, where each individual can fully control their cash flow and design their own financial journey. Ms. Tuong Nguyen, Deputy General Director of VIB, shares insights into the bank’s technology, vision, and strategy.

– With 125 million payment cards but only 13 million credit cards, how does VIB view this market gap?

Ms. Tuong Nguyen: This is not just a statistic but reflects a market reality: many people want to “buy now, pay later” but cannot use credit cards or prefer to spend their own money while still needing flexibility when necessary.

Through market research, we identified a highly potential yet underserved customer segment – those who need installment payments but are not ready or eligible for credit cards. They typically use their own funds for daily expenses but still require financial flexibility for larger purchases.

– How is VIB’s solution different from traditional approaches?

Ms. Tuong Nguyen: The core difference lies in the philosophy of “empowering” customers, alongside superior technology and interest rates.

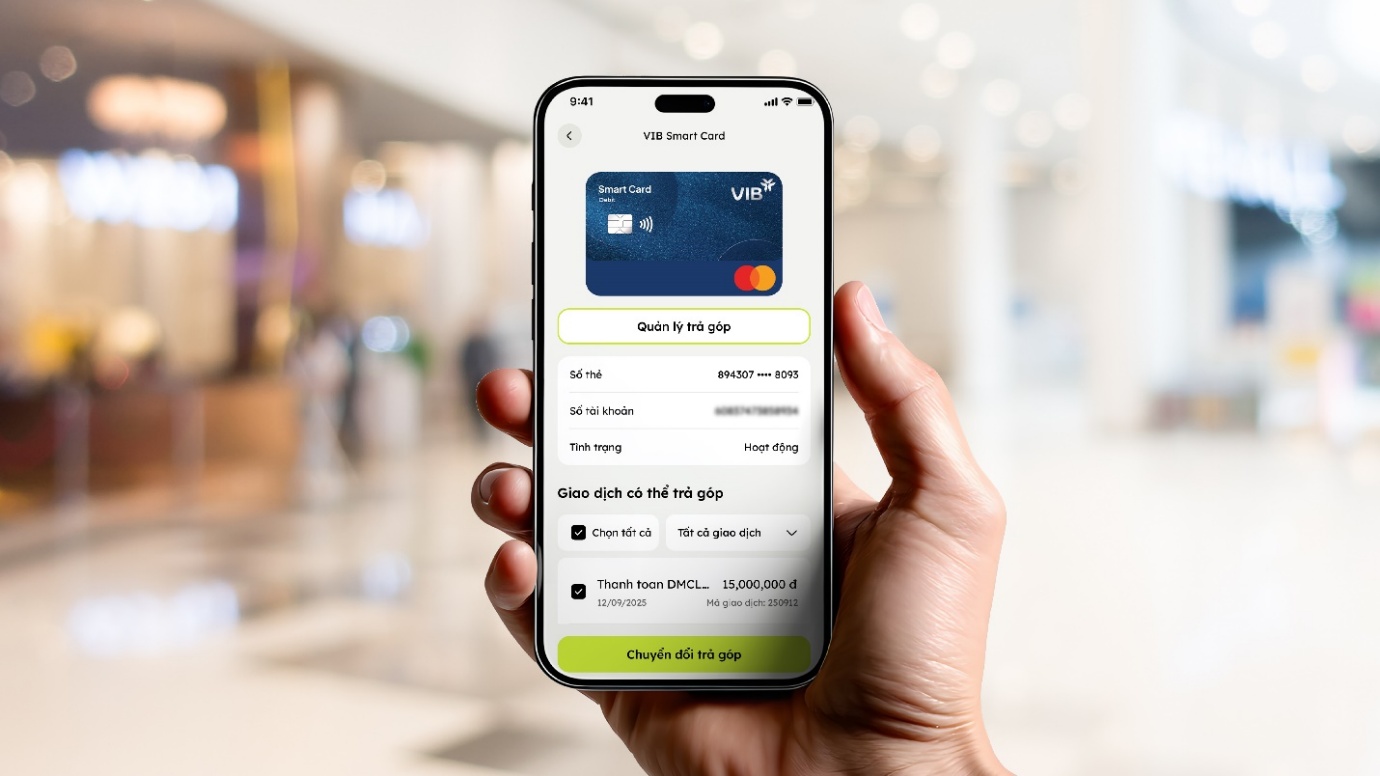

With VIB’s upgraded payment card solution, customers not only decide when and which expenses to convert into installments but also fully manage their cash flow. They spend their own money, and whenever needed, can instantly convert a transaction into an installment plan with just a few taps. This combines safety and flexibility, offering customers unprecedented control over their payment cards.

This empowerment philosophy underpins the “Financial Action” model, a synthesis of global trends like AI-powered personalization and financial empowerment. Through AI-driven solutions, big data, and flexible customization, VIB enables customers to design and execute financial journeys tailored to their needs.

– How does VIB enable instant approval and installment conversion with just a few taps?

Ms. Tuong Nguyen: As a leading bank in technology adoption, our solution excels in data and AI-powered platforms. VIB’s system instantly evaluates customers based on transaction history and financial credibility. Everything is automated and real-time within the Max app, requiring just a few taps.

While traditional consumer loans can take hours or days, our solution reduces this to minutes. Even after a purchase, customers can easily convert it into an installment plan. This level of flexibility is unprecedented in personal credit products.

– Beyond flexibility, what other benefits do customers gain from this solution?

Ms. Tuong Nguyen: We designed this solution based on a “dual benefit” principle – ensuring competitive costs while maximizing customer value from each transaction.

In terms of cost, our interest rate of 0.79%/month is among the most competitive in the market. With over 100 strategic partners, customers also enjoy 0% interest rates with no additional fees.

The real breakthrough is that customers still earn cashback and reward points on their payment cards – previously exclusive to credit cards.

According to our records, this is the only model in the market allowing customers to enjoy both flexible installments and accumulate value from spending. Previously, cashback and installments were separate benefits of credit cards; now we combine them on payment cards.

– What gives VIB confidence in managing risks when offering unsecured loans to this customer segment?

Ms. Tuong Nguyen: VIB’s assessment system considers multiple factors: card transaction history, cash flow in and out of payment accounts, frequency of banking services, and other indicators. Each customer receives an installment limit tailored to their actual financial capacity.

Additionally, we closely monitor cash flow and provide timely reminders if accounts lack sufficient funds for upcoming installment payments, reducing bad debt risks. Customers’ good installment history is recorded in both internal bank files and on CIC, paving the way for accessing higher-tier financial products in the future.

– Strategically, where does this solution fit into VIB’s digitalization journey and long-term vision?

Ms. Tuong Nguyen: With the goal of promoting financial action in Vietnam, VIB aims to build a comprehensive personal financial ecosystem, where customers can independently manage, optimize, and grow their finances on our digital platform.

The installment solution on payment cards is a key component of this ecosystem, seamlessly connecting with our Profit Solutions – from smart cash flow management and planned spending to flexible credit. Together, they create a seamless experience, not only meeting daily financial needs but also shaping how Vietnamese consumers manage money in the future.

As users become accustomed to proactively converting, tracking, and managing expenses within the app, they will gradually take more control over their entire financial journey. For example, allocating funds into high-yield savings with Super Interest Accounts, spending wisely with VIB International Payment Cards to earn cashback, and when needed, converting transactions into installments – all within the same ecosystem.

– Can we say that VIB aims to redefine personal financial experiences for customers?

Ms. Tuong Nguyen: Absolutely. Previously, customers were served individual financial products – loans, deposits, spending – based on immediate needs. But in VIB’s new model, all products are interconnected into a seamless ecosystem, based on individual behaviors and financial goals.

Our goal is not just to provide banking products but to empower customers with the knowledge, tools, and ability to scientifically and sustainably manage and grow their finances.

Especially for young people starting their financial independence journey, we not only provide tools but also accompany them in building a smarter, more flexible, and disciplined financial foundation.

Why iDepo is the Ultimate Capital Solution for Entrepreneurs

In today’s fast-paced business landscape, entrepreneurs often face unexpected decisions that demand agility and foresight. The story of Minh, owner of a fashion boutique in Ho Chi Minh City, illustrates why flexible savings solutions like iDepo from International Bank (VIB) can be a game-changer. Offering both secure returns and liquidity, iDepo empowers business owners to seize opportunities with confidence, ensuring they stay ahead in an ever-changing market.

The Ultimate A-Z Guide to Auto Loan Financing for Year-End Purchases

Owning a car through installment payments has become a popular choice, making it possible to achieve your dream of car ownership without waiting to save 100% of the cost upfront. However, without a clear understanding of interest rates and procedures, you may end up burdened with unnecessary additional fees.

SeABank Partners with MoneyGram to Boost Remittance Flows to Vietnam

Alongside its partnership with MoneyGram International, Inc., which offers fast, secure, and transparent online remittance solutions, Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) is launching the “Receive MoneyGram Remittances – Win a 30,000 VND eVoucher Instantly on SeAMobile” program from October 15 to December 31, 2025. This initiative ensures customers enjoy a seamless remittance experience coupled with exclusive benefits during the year-end peak season.