I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF NOVEMBER 17-21, 2025

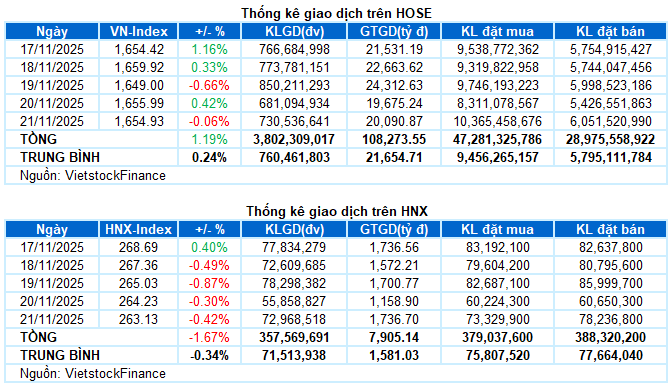

Trading Activity: Major indices closed lower on November 21. The VN-Index hovered just below the reference mark at 1,654.93 points, while the HNX-Index declined by 0.42% to 263.13 points. For the week, the VN-Index gained 19.47 points (+1.19%), whereas the HNX-Index shed 4.48 points (-1.67%).

Vietnam’s stock market exhibited clear polarization over the past week. After surging past the 1,650-point milestone early in the week, the VN-Index entered a tug-of-war phase with alternating sessions of gains and losses. While a few key pillars worked to stabilize the index, the broader market faced widespread adjustment pressures. By week’s end, the VN-Index settled at 1,654.93 points, up 1.19% week-on-week.

In terms of impact, the Vingroup trio—VIC, VHM, and VPL—made the most positive contributions in the final session, adding a combined 4 points to the VN-Index. Conversely, the “king stocks” VCB, TCB, BID, HDB, and LPB acted as significant drags, collectively subtracting nearly 3 points from the index.

Sector performance painted a polarized picture. Communication services led the decline, with sector leaders VGI (-2.1%), FOX (-0.49%), and CTR (-1.31%) all closing in the red.

Energy and essential consumer goods sectors also faced over 1% adjustments amid broad selling pressure, notably BSR (-1.56%), PLX (-1.31%), PVS (-2.03%), PVD (-1.15%), PVT (-1.64%), MCH (-2.09%), VNM (-1.32%), MSN (-1.27%), and PAN (-1.26%).

On the upside, the information technology sector shone brightly, driven by FPT (+1.82%), VEC (+2.91%), and DLG (+1.75%).

Real estate maintained its green territory, supported by strong demand for VHM (+1.53%), CEO (+4%), NVL (+1.99%), NBB (+1.02%), NLG (+1.7%), SCR (+2.34%), and HQC, which hit its upper limit. However, the sector also saw notable decliners with significant liquidity, including KBC (-0.99%), DXG (-1.03%), PDR (-0.88%), VPI (-0.9%), and SZC (-1.69%).

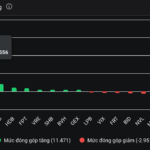

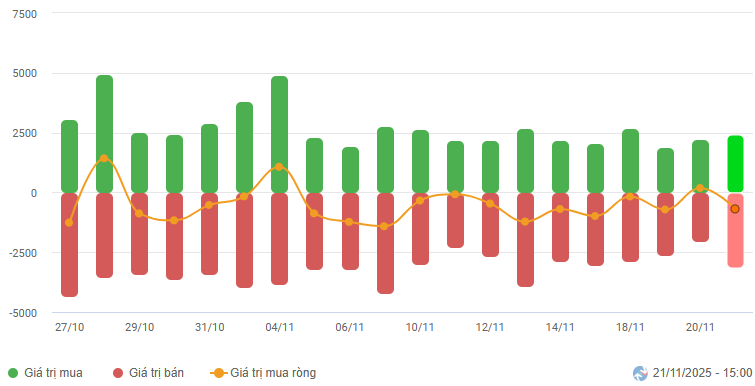

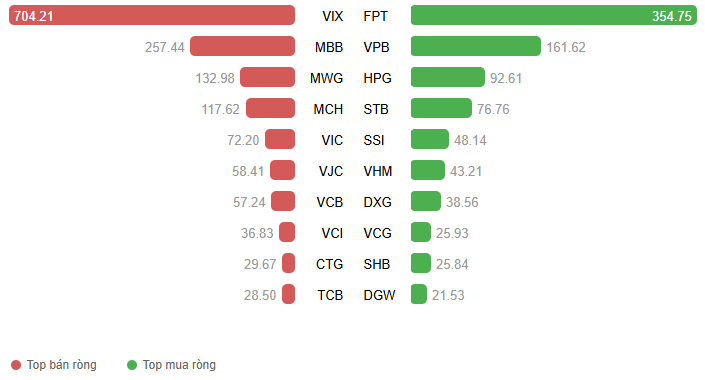

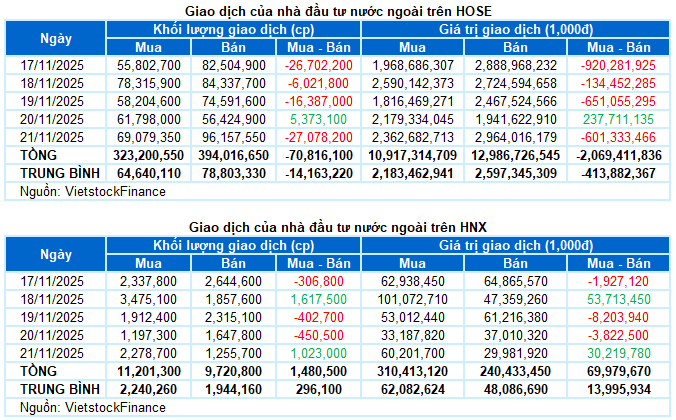

Foreign investors continued their net selling streak, offloading nearly 2 trillion VND across both exchanges this week. Specifically, they net sold over 2 trillion VND on the HOSE but net bought nearly 70 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

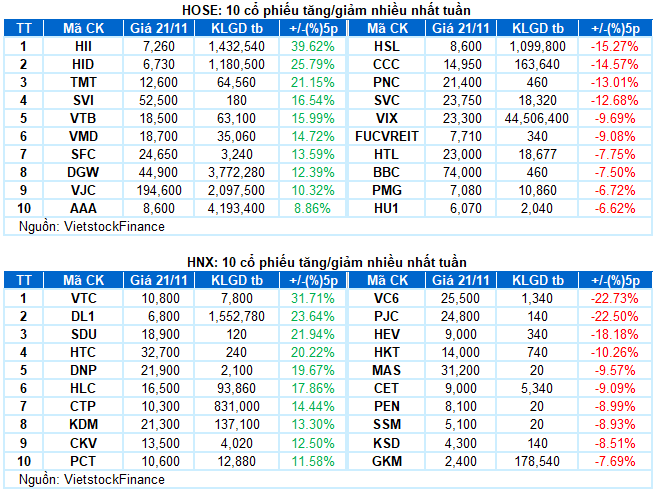

Top Gainer of the Week: DGW

DGW +12.39%: DGW enjoyed a robust trading week, with its stock price surpassing both the 50-day SMA and 100-day SMA, while closely tracking the Upper Band of the Bollinger Bands.

Trading volume surged significantly above the 20-day average, signaling a strong return of capital. Additionally, the Stochastic Oscillator and MACD indicators continued their upward trajectory, further bolstering the short-term positive outlook.

Top Loser of the Week: HSL

HSL -15.27%: HSL experienced a sharp decline this week, falling below the Middle Band of the Bollinger Bands. The impending “Death Cross” between the 50-day SMA and 100-day SMA adds to the short-term pessimism.

The MACD indicator has issued a sell signal by crossing below the Signal Line. Adjustment risks are likely to persist unless conditions improve in upcoming sessions.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 22:59 November 21, 2025

Two Bank Stocks Hit Hard by Brokerage Firms’ Net Selling on November 20th

Proprietary trading firms extended their net selling streak on the Ho Chi Minh City Stock Exchange (HOSE), offloading a total of VND 48 billion worth of shares.