Techcombank’s interest rate structure is tailored to four distinct customer segments: Private, Priority, Inspire, and Regular, with noticeable variations in rates, particularly for short-term deposits and premium clients.

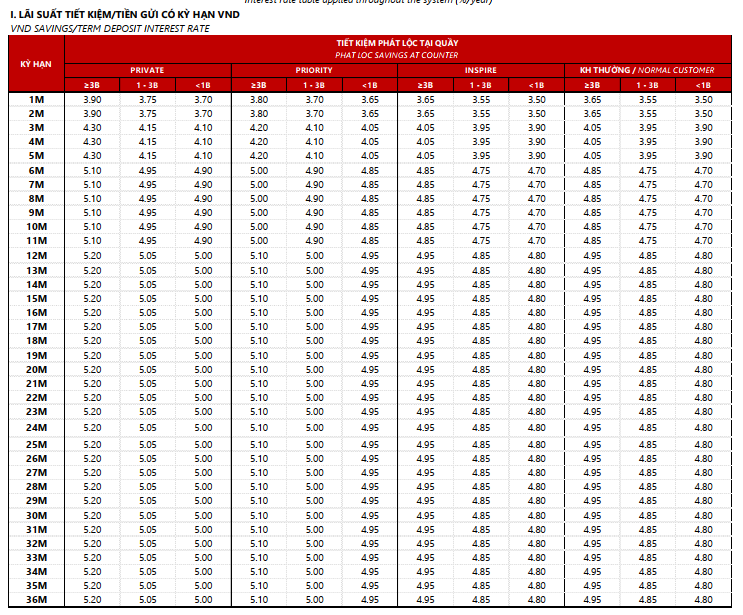

Counter Deposit Rates

The Private segment enjoys the highest rates, ranging from 3.90–5.20% per annum, depending on the term. Specifically, 1–2 month terms offer 3.90% p.a.; 3–5 months yield 4.30% p.a.; 6–11 months rise to 5.10% p.a.; and 12–36 months peak at 5.20% p.a., the highest across all counter rates. This group benefits from priority rates, surpassing Regular customers by 0.15–0.40 percentage points across most terms.

The Priority group’s rates are slightly lower than Private but still competitive. Rates for 1–2 months cap at 3.80% p.a.; 3–5 months at 4.20% p.a.; 6–11 months at 5.00% p.a.; and 12–36 months at 5.10% p.a. Generally, Priority rates are 0.10 percentage points below Private but outpace Inspire and Regular customers by 0.15–0.25 percentage points.

The Inspire and Regular segments, catering to mid-tier clients, offer attractive rates. The 1–2 month term peaks at 3.65% p.a.; 3–5 months at 4.05% p.a.; 6–11 months at 4.85% p.a.; and 12–36 months at 4.95% p.a. Compared to Priority, rates are approximately 0.15 percentage points lower, and 0.25–0.35 percentage points below Private, depending on the term.

Source: Techcombank

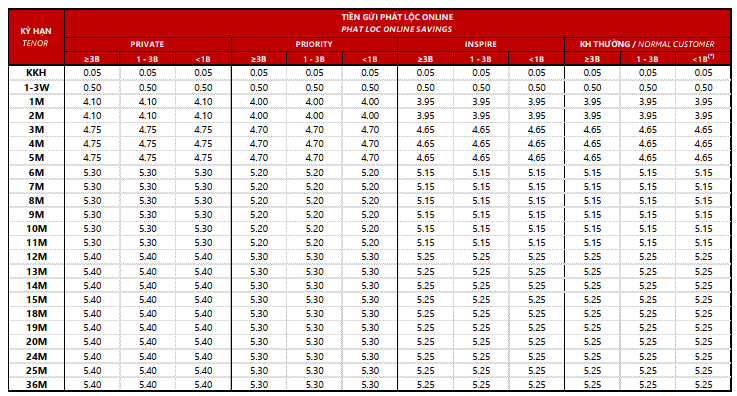

Online Deposit Rates

Online rates surpass counter rates across all terms, with the same four customer tiers. The Private segment leads with 1–2 month rates at 4.10% p.a.; 3–5 months at 4.75% p.a.; 6–11 months at 5.30% p.a.; and 12–36 months at 5.40% p.a., the highest system-wide. Online Private rates exceed counter rates by 0.20 percentage points for many terms, maintaining a consistent advantage over other groups.

The Priority group’s online rates are 4.00% p.a. for 1–2 months; 4.70% p.a. for 3–5 months; 5.20% p.a. for 6–11 months; and 5.30% p.a. for 12–36 months. While 0.10 percentage points below Private, these rates still outperform Inspire and Regular customers across all terms.

The Inspire and Regular segments offer 3.95% p.a. for 1–2 months; 4.65% p.a. for 3–5 months; 5.15% p.a. for 6–11 months; and 5.25% p.a. for 12–36 months.

Source: Techcombank

Year-End Interest Rates Surge: What It Means for You

Interest rates on deposits are heating up as multiple banks have collectively raised their rates since the beginning of November.

The Ultimate A-Z Guide to Auto Loan Financing for Year-End Purchases

Owning a car through installment payments has become a popular choice, making it possible to achieve your dream of car ownership without waiting to save 100% of the cost upfront. However, without a clear understanding of interest rates and procedures, you may end up burdened with unnecessary additional fees.

Techcombank’s Journey: A Defining Tale of a Vietnamese Brand Rising to Regional Prominence

Soaring 7 ranks, Techcombank (Vietnam Technological and Commercial Joint Stock Bank) solidifies its position among Vietnam’s Top 5 most valuable brands within the prestigious Brand Finance ASEAN 500, a global leader in brand valuation.