According to the latest deposit interest rate schedule, Orient Commercial Bank (OCB) has increased over-the-counter deposit rates by 0.3 percentage points across all terms.

Savers at OCB can now enjoy a 4.1% annual interest rate for 1-month deposits, 5.2% for 6-month deposits, and 5.3% for 12 to 15-month deposits. The highest deposit rate at this bank is 5.9%, applicable to both over-the-counter and online deposits.

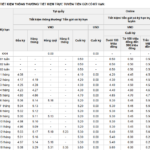

Latest deposit interest rate schedule at OCB

Tien Phong Bank (TPBank) has also raised its savings deposit rates by approximately 0.2 percentage points for 1-month, 6-month, and 9-month terms, and by 0.1 percentage point for 3-month terms.

After the adjustment, online savings deposit rates at TPBank are 4.1% per annum for 3-month terms and 5.1% per annum for 6-month terms.

The highest interest rate at this bank is also 5.9% per annum for long-term deposits of 24 to 36 months.

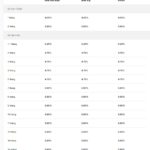

Highest interest rate at TPBank is 5.9% for long-term deposits over 24 months

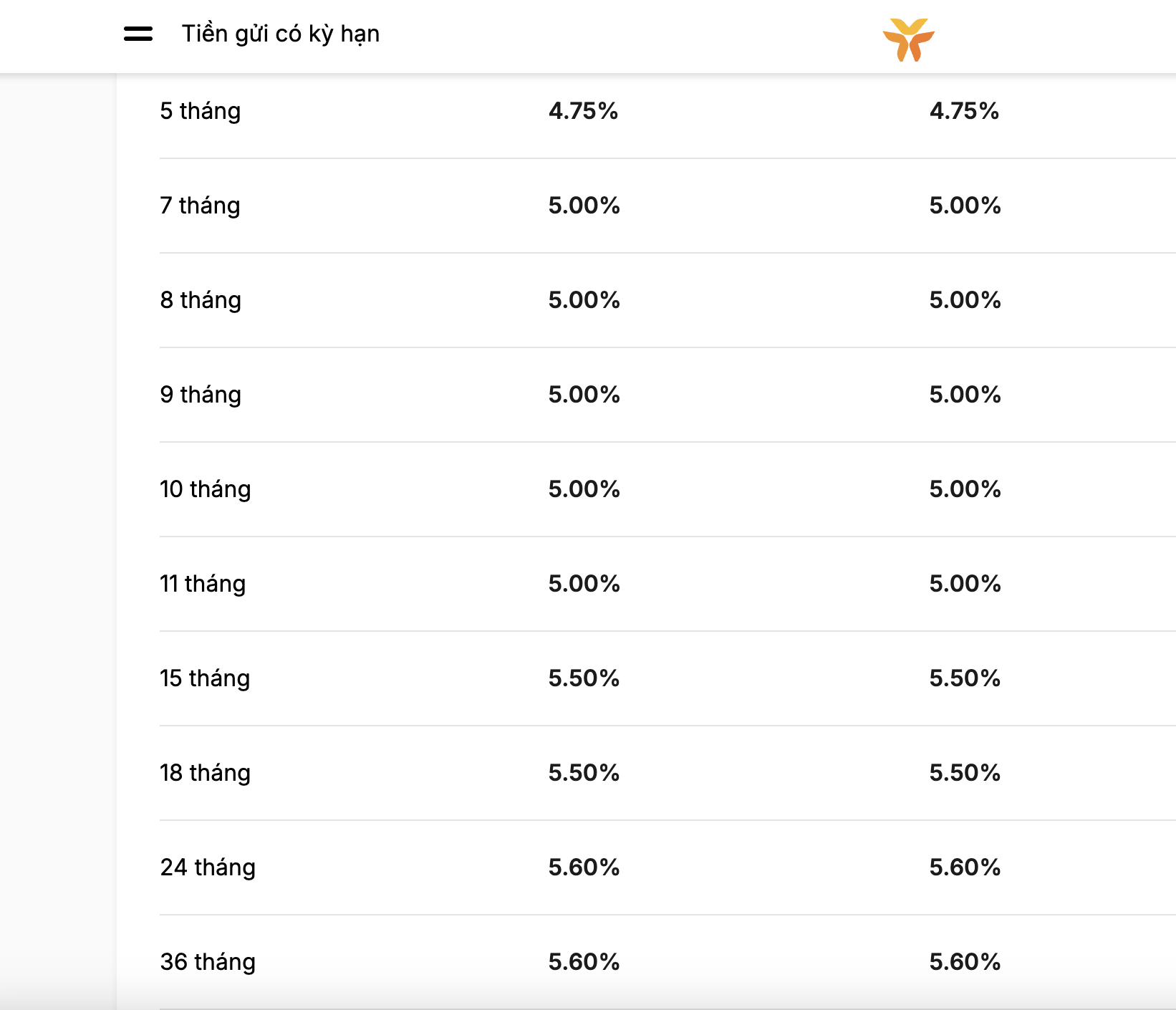

At International Bank (VIB), deposit interest rates for all terms from 1 to 36 months have been adjusted upward, with increases of up to 0.2 percentage points. In the latest interest rate schedule, 3-month deposits at VIB offer a 4.75% annual interest rate, 7 to 11-month deposits offer 5% per annum, and 24 to 36-month deposits offer 5.6% per annum.

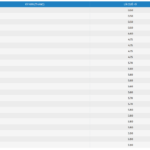

Adjusted deposit interest rates at VIB, with the highest rate of 5.6% for deposits of 24 months or more

As reported by the Labor Newspaper, OCB, TPBank, and VIB are the latest banks to adjust their deposit interest rates upward.

Since the beginning of November, several banks, including Nam A Bank, VPBank, Kienlongbank, and LPBank, have joined the trend of increasing interest rates. Some banks explain that raising input interest rates aims to attract deposits and retain customers.

The widespread increase in interest rates indicates that the competition for capital mobilization has intensified again in the fourth quarter of 2025, particularly among joint-stock commercial banks, to meet the high capital demand at year-end and narrow the gap between deposit and lending growth.

Vietcombank Securities (VCBS) forecasts that deposit interest rates may rise slightly at some joint-stock banks by year-end to meet capital needs and manage systemic risks.

However, lending interest rates are expected to remain low to support economic growth.

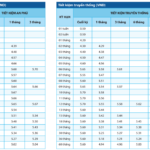

Another Bank Hits the Ceiling on Savings Interest Rates Under 6 Months on November 19th

This bank has just significantly increased deposit interest rates for 3- to 5-month terms to the maximum level allowed by regulations, at 4.75% per annum.

Savings Rates Surge: 6-Month Interest Now Outpaces 60-Month Returns

Unlock the highest interest rates available with our 10 to 12-month deposit terms. Plus, enjoy even greater returns with our 6-month term, now offering higher interest than our 60-month option. Maximize your savings today!