Foreign capital flows reverted to a net outflow of VND 690 billion, ending the sole buying session from the previous day. VIX took center stage with a sell-off of VND 704 billion, far surpassing MBB and MWG, which recorded VND 257 billion and VND 133 billion, respectively.

Conversely, FPT attracted the strongest inflow at VND 355 billion, double that of VPB in second place. HPG followed with VND 92 billion in purchases.

Since the beginning of the month, foreign investors have net sold over VND 7.7 trillion across all three exchanges, a significant reduction compared to August, September, and October, when outflows ranged from VND 23 to 30 trillion.

STB led the sell-off with nearly VND 2 trillion, followed by VIX at approximately VND 1.2 trillion. In contrast, HPG and FPT were among the most heavily accumulated, with VND 1.7 trillion and VND 1.6 trillion, respectively.

| Foreign Investors Resume Net Selling |

| Top 10 Stocks with Strongest Net Foreign Trading on November 21st |

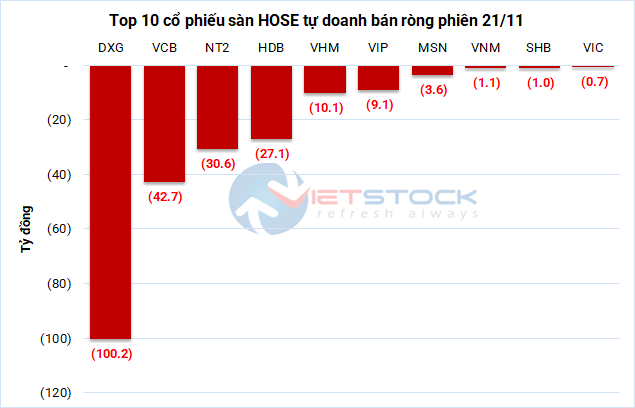

Meanwhile, proprietary trading reversed to a net buy of VND 196 billion on HOSE. CTG saw the strongest accumulation at VND 54 billion, followed by POW at VND 51 billion and MWG at VND 50 billion.

On the selling side, DXG was offloaded by over VND 100 billion, followed by VCB at VND 43 billion and NT2 at nearly VND 31 billion.

Source: VietstockFinance

|

– 21:30 21/11/2025

Two Bank Stocks Hit Hard by Brokerage Firms’ Net Selling on November 20th

Proprietary trading firms extended their net selling streak on the Ho Chi Minh City Stock Exchange (HOSE), offloading a total of VND 48 billion worth of shares.

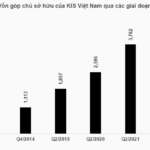

KIS Vietnam Finalizes Share Offering Plan to Raise Capital Beyond 4.5 Trillion VND

KIS Vietnam’s shareholders have approved adjustments to the plan for issuing 78.9 million shares to existing shareholders, targeting a capital increase exceeding 4.5 trillion VND.

KIS Securities Finalizes Plan to Inject Hundreds of Billions into Proprietary Trading and Margin Lending

KIS Vietnam Securities Corporation (KIS Vietnam) has successfully obtained written approval from shareholders between November 5th and 15th. The outcome confirms the adjustment of certain details within the plan to offer over 78.9 million shares, as initially approved during the Extraordinary General Meeting of Shareholders on October 15th.