During the trading week of November 17–21, the VN-Index fluctuated within a narrow range of 1,620–1,650 points, coinciding with the expiration of VN30 futures contracts. The week began on a positive note, with improved buying interest in select banking stocks driving the market into the green. However, subsequent sessions saw heightened divergence in capital flows, causing the index to oscillate between 1,630 and 1,670 points.

Conversely, liquidity surged in large-cap stocks such as the Vingroup, VJC, and HDB groups, as well as mid- and small-cap shares in sectors like chemicals and technology, which had seen limited gains in recent periods. By week’s end, the VN-Index closed at 1,654.93 points, marking a 19.47-point (+1.19%) increase from the previous week.

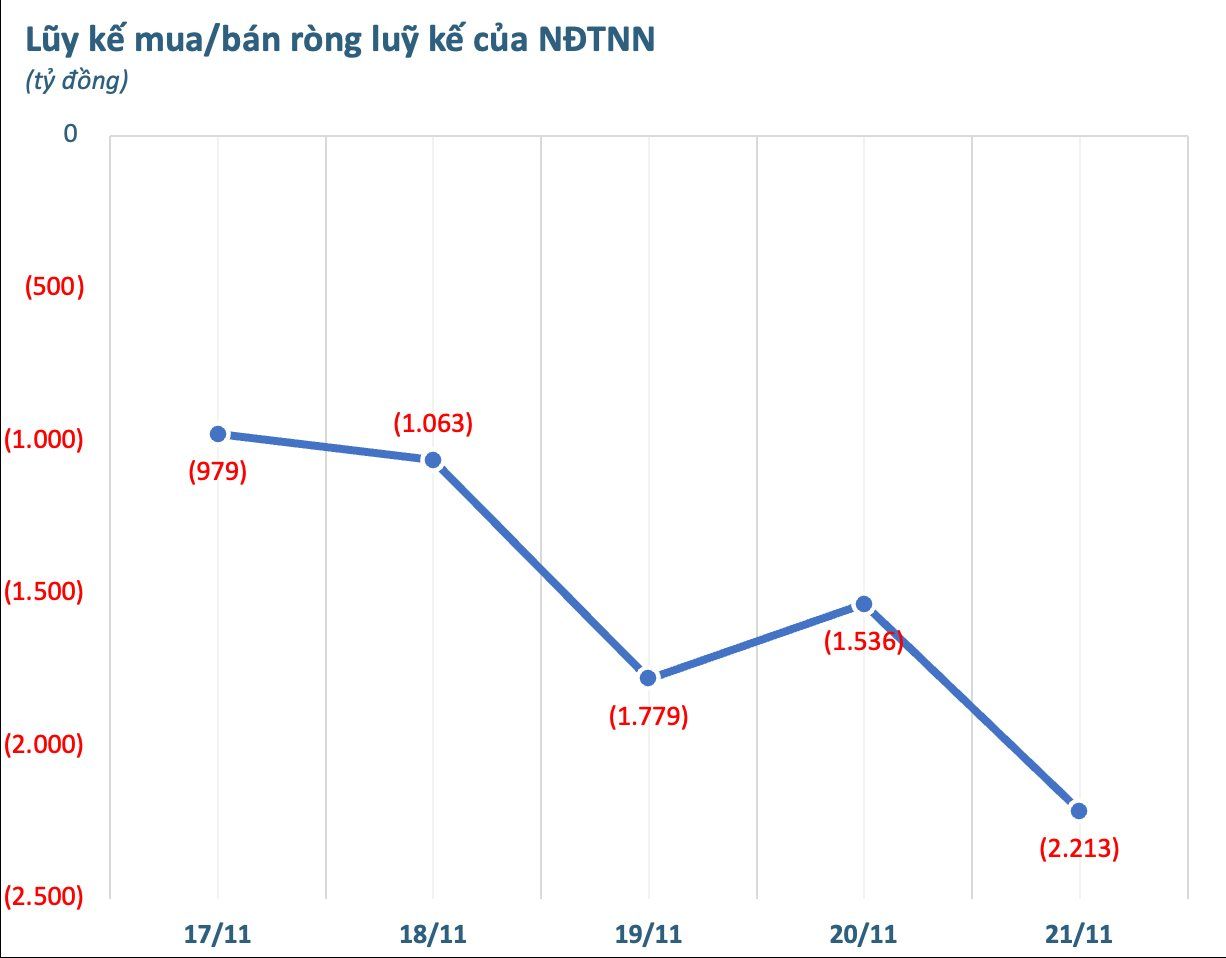

Foreign investors continued their net selling streak, with significant outflows observed across most sessions. Notably, Thursday witnessed a brief reversal to net buying, but this was short-lived, as selling pressure resumed on the final trading day. Over the five sessions, foreign investors net sold VND 2,213 billion across the market.

Breaking down performance by exchange, foreign investors net sold VND 1,904 billion on HoSE, net bought VND 70 billion on HNX, and net sold VND 379 billion on UPCoM.

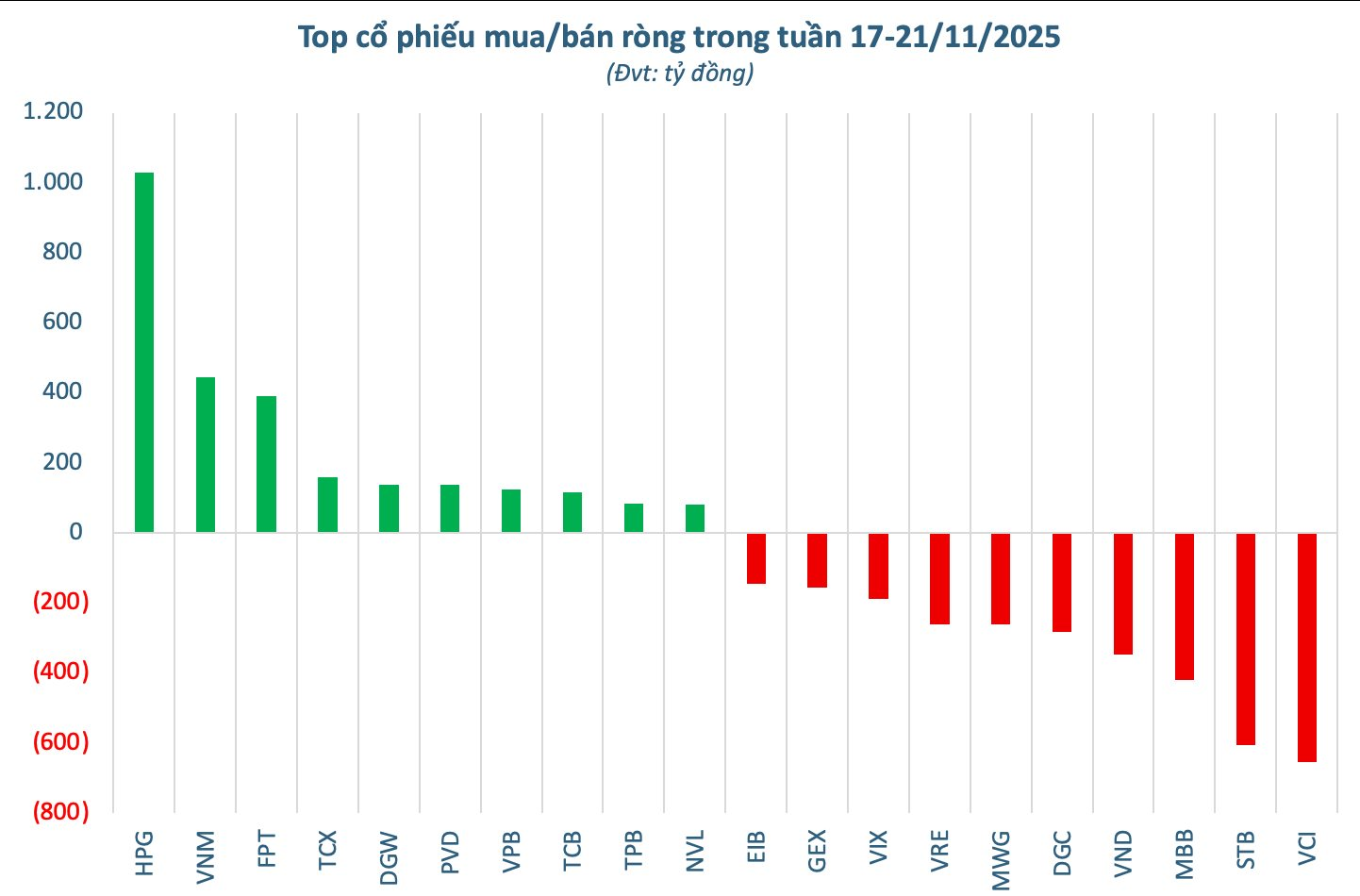

Among individual stocks, VCI topped the net selling list with outflows of VND 653 billion, followed by STB (VND 605 billion), MBB (VND 420 billion), and VND (VND 347 billion). Other notable net sells included DGC (VND 283 billion), MWG and VRE (both VND 260 billion), VIX (VND 188 billion), GEX (VND 155 billion), and EIB (VND 146 billion).

On the buying side, HPG led with net inflows of VND 1,028 billion, significantly outpacing peers. VNM (VND 446 billion), FPT (VND 392 billion), and TCX (VND 158 billion) followed. Additional stocks attracting notable inflows were DGW (VND 139 billion), PVD (VND 137 billion), VPB (VND 125 billion), TCB (VND 116 billion), TPB (VND 85 billion), and NVL (VND 81 billion).

Unexpected Power Resurges, Buying Back After Prolonged Selling Streak, Countering Massive Real Estate Stock Dump of VND 100 Billion

Proprietary trading firms made a surprising comeback, net buying a substantial VND 196 billion on the Ho Chi Minh City Stock Exchange (HOSE).

Market Pulse 21/11: Buying Momentum Returns in Afternoon Session, Market Continues to Diverge

At the close of trading, the VN-Index dipped 1.06 points (-0.06%), settling at 1,654.93 points, while the HNX-Index fell 1.1 points (-0.42%), closing at 263.13 points. Market breadth favored decliners, with 419 stocks falling and 257 advancing. Similarly, the VN30 basket saw red dominate, as 17 constituents declined, 9 rose, and 4 remained unchanged.

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.

Stocks Rebound in Green, Billionaire Nguyen Phuong Thao’s Airline Shares Hit Daily Limit

The return of net buying by foreign investors has been a pivotal factor in bolstering market sentiment, laying the groundwork for the market to sustain its positive accumulation trend.