Once a renowned brand in Vietnam, this company holds a significant place in the country’s history. Photo: GTD

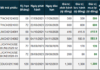

According to the Hanoi Stock Exchange (HNX), the Hanoi People’s Committee will auction off its shares in GTD (Thuong Dinh Shoe Joint Stock Company). The auction involves over 6.38 million shares, representing 68.67% of the company’s capital held by the committee.

The starting price is set at 20,500 VND per share. If successful, the committee could generate at least 130.9 billion VND. The auction is scheduled for the morning of December 16, 2025, and is open to domestic and international investors, including economic organizations, social organizations, and individuals.

A Golden Era for Vietnam’s Iconic Shoe Brand

One of the iconic shoe designs from Thuong Dinh that has been cherished by generations of Vietnamese customers. Photo: GTD

Founded in 1957 as Workshop X30 under the Military Supply Department of the General Logistics Department, Thuong Dinh initially produced hard hats and rubber sandals for military use. Over time, the company expanded its product line and became a household name in Vietnam.

Thuong Dinh currently owns a prime piece of real estate spanning over 36,100 square meters in Thanh Xuan District, Hanoi.

Since 1985, the company has exported its products to former Eastern Bloc countries and the EU. By the early 1990s, Thuong Dinh shoes were virtually unmatched in the market. The iconic canvas shoes with blue stripes on flexible plastic soles became a familiar sight across Vietnam.

However, with the influx of footwear from neighboring countries, Thuong Dinh’s golden era faded, particularly in major cities, as the brand struggled to keep up with evolving consumer preferences.

The company transitioned into a Joint Stock Company on July 19, 2016. Currently, 9.3 million shares of Thuong Dinh are traded on the UPCoM market under the stock code GTD.

GTD shares are under a warning due to audited financial reports with exceptions for three consecutive years. In the last two sessions, GTD’s stock price hit its ceiling, reaching 15,100 VND per share—a 54% increase since the beginning of the year. However, it remains 32% below its peak in late September.

Over the past decade, Thuong Dinh has reported profits in only three years. According to the 2024 audited consolidated financial report, the company recorded net revenue of nearly 79 billion VND, a slight 2% decrease from 2023. After deductions, Thuong Dinh reported a net loss of nearly 13 billion VND in 2024, 2.6 times higher than the 5 billion VND loss in 2023. As of December 31, 2024, accumulated losses totaled over 67 billion VND.

As of December 31, 2024, Thuong Dinh’s total assets decreased by 5% from the beginning of the year to over 120 billion VND. Tangible fixed assets account for nearly 43% of total assets, with inventory valued at 38 billion VND (31.5% of total assets). Notably, total liabilities rose by 7% to 94 billion VND, including nearly 29 billion VND in loans and financial leases.

Management has actively sought export orders, but global inflation and geopolitical conflicts have led to unstable demand. Domestically, despite expanding online sales channels, seeking new customers, and implementing promotional strategies, sales declined by 14.5%.

In 2025, Thuong Dinh plans to intensify efforts to secure export orders and boost domestic demand. The company is also seeking production partners, particularly from China, and exploring the production of bags and cases to diversify revenue streams and provide employment.

The company aims to produce between 700,000 and 900,000 pairs of shoes, with approximately one-third earmarked for export. Thuong Dinh has set a revenue target of 100 billion VND. If achieved, the company expects to break even and record a profit of approximately 100 million VND.

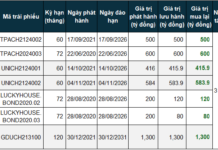

VietinBank Offers 19.6 Million Saigon Port Shares for Sale at Starting Price of VND 29,208 Each

This marks one of the largest divestment initiatives by Vietnam’s commercial banking system in Q4/2025, addressing legacy assets from non-performing loans as directed by the Government and the State Bank of Vietnam.

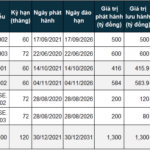

MB Plans Early Redemption of Bond Tranche

MB plans to acquire the entire issuance of 150 MBBL2330012 bonds at a price of approximately VND 1.065 billion per bond.