Growth Prospects Hinged on Key Export Markets

Agriseco Research, in a recent report, highlights that the growth prospects of the seafood sector remain heavily reliant on primary export markets. Currently, domestic seafood consumption stands at approximately $1 billion, accounting for only 10% of export value.

Several factors could influence the industry’s outlook in the coming period, including shipping costs, animal feed prices, and domestic raw material costs for processed seafood.

According to Xeneta, tariff impacts on shipping costs are expected to diminish by 2025. The freight rate index has been on a downward trend since peaking in August 2024 following Red Sea tensions. Agriseco anticipates this decline in shipping costs will bolster profit margins for seafood exporters.

After a low phase in late 2024, agricultural commodities used in animal feed production show signs of bottoming out and recovering. This is likely to soon impact farming costs, potentially narrowing profit margins for both producers and traders in the upcoming period.

VASEP data indicates that raw whiteleg shrimp prices in 2025 will see a slight increase compared to 2024, stabilizing similarly to Q2-Q3 2025 export prices. Raw pangasius prices by late Q3 2025 are expected to rise compared to previous years, reflecting higher export demand and limited domestic supply and inventory, driving up short-term domestic prices.

High product prices in the coming year will stimulate farming, increasing domestic supply in the next season and helping to adjust product prices. Groups with low seed self-sufficiency and those focused solely on processing and exporting will face volatile profits, while those with extended value chains may maintain more stable profitability.

Agriseco analysts note that demand in major import markets remains unpredictable, heightening risk. Major listed companies are shifting orders but remain concentrated in key markets: North America, Europe, and major East Asian markets.

Catfish Exporters Poised to Benefit Further

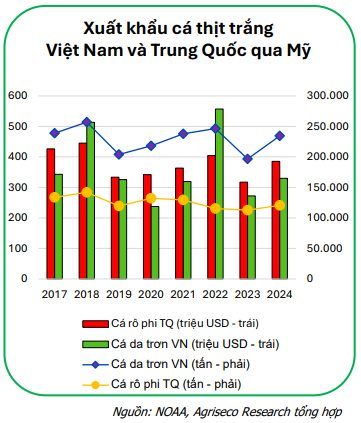

Agriseco suggests new export trends will emerge post-implementation of countervailing duties. As of 2024, tilapia remains China’s primary seafood export to the U.S., directly competing with Vietnam’s catfish products. In 2024, the export value of these products from both countries was comparable.

“Currently, Vietnamese seafood faces a 20% countervailing duty, while Chinese products face 45%. This disparity is expected to enable Vietnamese catfish products to capture market share from Chinese tilapia in the U.S. in the coming years,” the report states.

Shrimp Sector Faces Pressure from Additional Tariffs

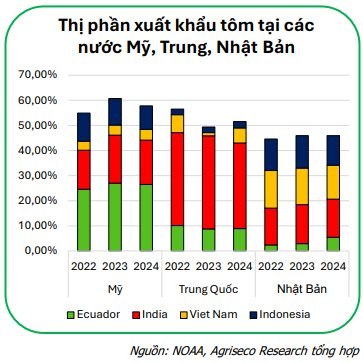

For the shrimp sector, export competition will intensify with additional tariffs. Vietnamese shrimp export prices remain higher than those from Ecuador, India, or Indonesia due to lower farming success rates, resulting in elevated production costs.

The reduction of U.S. countervailing duties on Vietnamese shrimp from 46% to 20% is positive, though still higher than competitors like Ecuador (15%) and Indonesia (19%), and significantly better than India (50% since 08/27).

The biggest risk currently is the U.S. anti-dumping investigation in POR19. Exporters to the U.S. already face significant pressure from countervailing duties. If an additional 35% anti-dumping duty is imposed after the December 2025 decision, exporters may face increased pressure to shift orders due to reduced competitiveness in the U.S. market.

Two Promising Seafood Enterprises

With the industry’s profit recovery in the first nine months of 2025 and uncertain international demand for 2026, market exploration and order shifting will be crucial for sustaining corporate growth.

Rising feed costs and increasing domestic raw material prices may impact processors’ profits. Companies with high seed self-sufficiency are expected to maintain more stable and secure profitability.

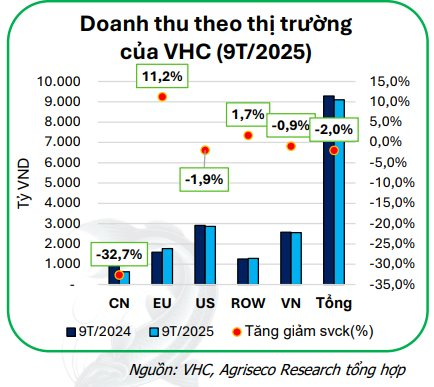

Agriseco Research highlights Vinh Hoan Corporation (VHC) for reducing reliance on the Chinese market while maintaining strong domestic sales and expanding exports to the EU and other markets. Despite U.S. market volatility, VHC’s Q3 2025 sales dipped only 1.9%. In the coming years, VHC may benefit from high tariffs on Chinese tilapia, leaving market gaps in the U.S. for Vietnamese companies.

Vinh Hoan’s product diversification reduces dependence on pangasius fillets, currently 54% of revenue. With 100% internationally certified farming areas and 70-80% seed self-sufficiency, VHC excels in cost control and stable output, especially with rising raw material prices.

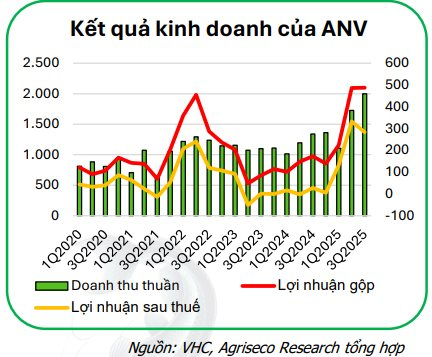

Another promising company is Nam Viet Corporation (Navico, ANV). Q3 2025 saw record revenue of VND 2 trillion, up 49% year-on-year. Nine-month 2025 net profit reached VND 748 billion, the highest ever for this period and 17 times higher year-on-year due to low comparables.

Tilapia exports were a Q3 2025 highlight, contributing 30% of export value. As one of the few listed companies exporting tilapia, ANV benefits directly from China’s reduced presence in the U.S. market. This trend is expected to continue into H1 2026 with positive pricing dynamics.

Comprehensive Joint Statement: Vietnam-U.S. Agreement on Reciprocal, Fair, and Balanced Trade

The United States of America (USA) and the Socialist Republic of Vietnam (Vietnam) have reached a consensus on the Framework for a Reciprocal, Fair, and Balanced Trade Agreement. This agreement aims to strengthen bilateral economic ties, fostering enhanced market access for each country’s exports. Building upon the longstanding economic relationship between the two nations, the Reciprocal, Fair, and Balanced Trade Agreement will expand upon existing foundations, including the U.S.-Vietnam Bilateral Trade Agreement signed in 2000 and effective since 2001.

Sao Ta Shrimp Company’s Profits Surge Despite Facing Over 100 Billion VND in Countervailing Duties

Fimex VN (HOSE: FMC), a leading shrimp processor and exporter, has announced its Q3 2025 consolidated net revenue of VND 2.98 trillion, marking a 5% year-on-year increase. The company also reported a net profit of VND 97 billion, reflecting a significant 22% growth compared to the same period last year.