The year 2025 is considered one of the most remarkable periods for the banking sector in recent years. Credit growth has reached its highest level since the post-pandemic era, reflecting a robust recovery in capital demand within the economy. Alongside this, banks have achieved significant milestones in their operations, ranging from expanding their ecosystems and implementing green banking initiatives to innovating digital financial products to keep pace with evolving consumer trends. Despite this growth, banks have maintained financial discipline, improved asset quality, strengthened capital buffers, and aggressively addressed non-performing loans.

How would you assess the performance of banks in the first nine months of the year and the projected performance for the entire year 2025?

Aggregated data from 27 listed banks shows that pre-tax profits for the banking sector in Q3/2025 increased by 25% year-on-year, driven by uniform growth across various income components and tight cost control. Specifically, net interest income (the largest share of total operating income) maintained double-digit growth, primarily due to expanded credit scale. Additionally, fee-based income (closely tied to bank lending activities) rebounded with a 20% year-on-year increase, a positive outcome compared to the previous year’s decline.

Supplementing these two primary income streams, we observe that income from foreign exchange trading, bond trading, and other sources also recorded growth of over 18% year-on-year, contributing to the sector’s overall income growth. On the cost side, both operating expenses and provisioning expenses grew at single-digit rates, indicating that operational efficiency remains a top priority for the industry.

Furthermore, in 2024, the banking sector focused on cleaning up balance sheets and provisioning for a significant portion of newly generated non-performing loans. As a result, the pressure on provisioning costs in 2025 has significantly decreased. A healthier balance sheet, evidenced by a slight reduction in gross non-performing loans to 2.01% and a stabilization or slight decline in newly formed non-performing loans across banks, will lay the foundation for a new growth cycle.

For the first nine months of 2025, pre-tax profits of listed banks reached nearly 260 trillion VND, a 19% increase, achieving 74% of the full-year business plan. Given this momentum, we anticipate that many banks will exceed their annual targets and achieve high growth.

If you were to highlight a few standout banks this year, which ones would you choose and why?

All banks listed on the Ho Chi Minh City Stock Exchange (HOSE) are major industry players, each with distinct development strategies based on their objectives.

If evaluating standout banks based on clear business strategies and successful execution, I would first mention Vietcombank. As the industry leader, it simultaneously manages multiple roles, such as maintaining high asset quality, operational efficiency, and supporting macroeconomic stability.

Among the more dynamic banks with bold business ideas, MB stands out for its “dare to think, dare to act” approach, evolving into a financial conglomerate by directly owning subsidiaries across diverse financial services sectors.

Techcombank exemplifies innovation leadership with its creative business initiatives and technology applications that enhance operational efficiency. VPBank initially targeted middle to lower-income customers with a high-risk, high-return strategy and has since expanded its customer base following its successes.

ACB represents the “slow and steady” approach, balancing high asset quality, capital safety, and strong return on equity. HDBank is also noteworthy for its comprehensive ecosystem, credit growth advantages through restructuring weak banks, high profitability, and consistent double-digit growth over many years.

These banks consistently maintain strong shareholder relations, holding quarterly earnings meetings, distributing annual dividends, and ensuring transparent communication.

How do you assess the progress of green banking initiatives?

Since 2018, the State Bank of Vietnam (SBV) has approved the “Green Banking Development Scheme,” aiming by 2025 to enhance awareness and social responsibility within the banking system, gradually “greening” banking operations, and directing credit toward environmentally friendly projects, green services, and renewable energy. Subsequently, in 2021, the government issued the National Green Growth Strategy 2021-2030, with a vision to 2050, identifying green credit and green banking as crucial tools for implementation.

The banking sector has become a key intermediary in channeling capital into environmentally friendly production and services, focusing on four pillars: (1) Developing green credit and financial products, (2) Managing environmental and social risks (ESG/ESMS), (3) Greening internal banking operations and digitization, and (4) Communication, capacity building, international cooperation, and green capital mobilization.

Over the years, banks have actively implemented solutions for these pillars, such as mobilizing green capital from international sources, financing green credit (focusing on renewable energy and green agriculture projects), and “greening” internal operations. As of Q1/2025, total green credit outstanding balances accounted for approximately 4.3% of the system’s total outstanding loans, with BIDV, Vietcombank, and MB allocating significant portions to green credit.

With the strong digital transformation, banks have launched many innovative financial products. How do you evaluate these products? Which ones impress you the most?

The robust digital transformation in banking has led to groundbreaking financial products, enabling faster service access for customers and cost optimization for banks. Today’s financial products are no longer generic but personalized based on customer experiences, integrated into ecosystems (linking financial products with ride-hailing, shopping, e-wallets, digital savings, online loans), and allowing users to conduct most transactions via mobile phones. Consequently, customers can now open accounts, invest, save, pay, and even borrow within minutes using a single app, eliminating the need for physical branch visits.

A financial product combining utility, transparency, and ecosystem connectivity is highly valued, with examples including Cake by VPBank, MoMo, and LiveBank.

How do you view the competition between traditional banks and digital banks/financial apps? Are these entities competitors to traditional banks?

Vietnam currently hosts numerous digital banks and financial apps, backed by credit institutions, financial organizations, and non-financial entities. Digital banks include Cake by VPBank, Timo, TNEX, LiveBank, VIB Digital, TPBank App, while fintechs include MoMo, ZaloPay, ShopeePay, VNPay, Viettel Money, SmartPay, Payoo, Finhay, TCInvest, Entrade X (SSI), Infina, DragonX, and MoMo Đầu tư.

Most digital banks are backed by traditional banks, whereas fintechs typically offer specialized solutions like e-payments, peer-to-peer lending, asset management, and investment, which cannot fully replace traditional banking activities. Digital banks and fintechs excel in applying AI, Big Data, and Blockchain for personalized products and superior user experiences, appealing to younger, tech-savvy customers.

However, traditional banks hold advantages in legal safety, large capital mobilization, credit provision, guarantees, and diverse corporate services. Conversely, the strengths of digital banks and fintechs are current weaknesses for traditional banks. Therefore, I believe the competition between fintechs, digital banks, and traditional banks is more complementary than substitutive.

What challenges and opportunities do you foresee for the banking sector in 2026?

Despite strong profit growth, the first nine months of 2025 revealed challenges for the banking sector, likely persisting into 2026. By Q3/2025, deposit growth was only 11.4%, while credit growth reached a five-year high of 14.5%. With credit growth consistently outpacing deposit growth, funding cost pressures may intensify during peak periods.

Another concern is the sharp decline in net interest margins (NIM), which, although recovering in some banks, remains slower than expected. This indicates intense lending competition, particularly in small and medium-sized enterprise segments. NIM levels may not return to pre-2021 peaks, prompting banks to focus on non-interest income growth and operational efficiency.

However, 2026 is expected to bring healthier asset quality, with declining non-performing loan ratios and improved recovery mechanisms under the amended Credit Institutions Law. This will enhance asset profitability. While profit growth may slow compared to 2025, the banking sector will remain one of the economy’s fastest-growing industries, driven by credit expansion, service income growth, improved debt recovery, and controlled costs.

FChoice is an annual award by CafeF, honoring outstanding events, individuals, policies, and businesses in Vietnam’s economy. Launched in 2021, FChoice serves as a “map of achievements,” highlighting transformative stories with significant national economic impact, particularly in finance. FChoice does not have fixed categories but selects winners based on annual achievements and public interest.

As Vietnam’s economy embraces digitalization and sustainability, FChoice acts as a platform to celebrate success stories, contributing to a prosperous nation. Join us in recognizing those shaping Vietnam’s economic landscape this year!

Credit Surges and Liquidity Pressures

Capital mobilization has lagged behind debt growth as a prevailing trend among banks since the beginning of the year. According to the Q3-2025 financial reports, deposits across 27 listed banks rose by a mere 10.2% compared to the start of 2025. Strikingly, 21 of these banks recorded higher growth rates in outstanding loans than in customer deposits.

Q3 Non-Performing Loan Coverage Ratio Continues to Improve

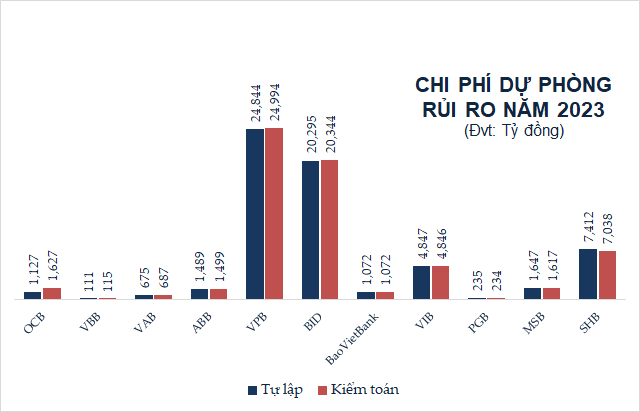

The non-performing loan coverage ratio of the banking system continued its recovery trend in Q3. Effective management of bad debts has provided banks with additional time to rebuild their buffers following the previous sharp decline. Each bank implements distinct provisioning policies based on its strategic direction, leading to varying approaches in provisioning across different groups.

OPES Ranked Among Top 5 Best Workplaces in Vietnam’s Insurance Sector

OPES Insurance Corporation has been honored in the 2025 Vietnam Best Places to Work ranking, securing a spot in the Top 50 among medium-sized enterprises and the Top 5 within the insurance sector. This prestigious recognition is awarded by Anphabe, Vietnam’s leading employer branding and workplace environment consulting firm.

Politburo Unanimously Approves Administrative Unit Standards and Urban Classification Plan

Senior Politburo Member and Permanent Secretary of the Party Central Committee’s Secretariat Trần Cẩm Tú recently signed and issued Conclusion No. 212 by the Politburo and Secretariat. This document outlines guidelines for establishing administrative unit standards, classifying administrative units, and categorizing urban areas.