Billionaire Pham Nhat Vuong sets a new record in total assets, as reported by Forbes.

The Vietnamese stock market closed on November 21st with surprising developments. The VN-Index opened in the red, dropping around 10 points, a direct consequence of the sell-off wave sweeping across major global markets, particularly the U.S.

In the afternoon, the market showed signs of improvement, driven by the real estate sector and several other blue-chip stocks. Consequently, the benchmark index returned above the reference level at the start of the ATC session, albeit at a modest level, before quickly turning red again.

At the close of the November 21st session, the VN-Index fell by over 1 point, ending near 1,655 points; the HNX-Index decreased by 1.1 points (-0.4%) to 263.13 points; and the UPCoM-Index lost 0.82 points (-0.7%) to 118.69 points. Market breadth remained skewed towards decliners, with 204 stocks, accounting for over 57% of the HoSE floor, closing in the red.

Notably, while most stocks on the market were in the red, the “Vingroup trio” of stocks made positive contributions, with VIC (+0.8%), VHM (+1.5%), and VPL (+3.5%). Additionally, the VN-Index was supported by STB (+3.6%), FPT (+1.8%), and VJC (+2.2%).

Following the November 21st trading session, Vingroup’s VIC stock concluded the week with five consecutive sessions of gains (approximately 9%). VIC closed at a record high of 229,700 VND per share. With the continuous rise of VIC, Vingroup’s market capitalization exceeded 885 trillion VND, an increase of 72 trillion VND in just one week. This marks the first time a Vietnamese enterprise has achieved such a high market capitalization.

Billionaire Pham Nhat Vuong Sets a New Record

Billionaire Pham Nhat Vuong continues to rise in the global billionaire rankings, as reported by Forbes.

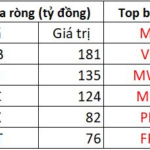

With the continuous rise in stock prices, Vingroup not only solidifies its position as Vietnam’s largest listed company but also helps its Chairman, Pham Nhat Vuong, climb higher in the global billionaire rankings.

According to the latest Forbes statistics, billionaire Pham Nhat Vuong’s net worth has reached 21.1 billion USD, ranking 109th globally. This is the highest rank ever achieved by a Vietnamese entrepreneur. Currently, the Vingroup Chairman is just 1.2 billion USD away from entering the top 100 richest billionaires worldwide. His wealth also surpasses that of billionaire Eri Li (19.8 billion USD), Chairman of Geely Holding Group, one of China’s largest automotive conglomerates.

Why is VIC Stock Continuously Rising?

Vingroup has received numerous positive updates recently. Photo: VIC

According to experts, the continuous rise in VIC stock is occurring in the context of new developments in Vingroup’s largest-ever share issuance.

Specifically, billionaire Pham Nhat Vuong’s conglomerate recently announced the completion of a written shareholder vote, approving three issues: share issuance to increase capital from equity, business line changes, and amendments to the company charter.

In the vote tally, Vingroup stated that it had sent opinion ballots to 31,273 shareholders, representing nearly 3.85 billion shares. Previously, in the 2024 annual report, the group recorded 56,857 shareholders holding over 3.82 billion VIC shares (as of the end of 2024).

In detail, Vingroup shareholders approved the issuance of nearly 3.9 billion bonus shares via written consent. The company will issue nearly 3.9 billion bonus shares to existing shareholders at a 1:1 ratio, meaning each shareholder holding 1 VIC share will receive 1 new share.

The issuance is expected to take place in Q4/2025, with the specific timing to be determined by Vingroup’s Board of Directors. The new shares will not be subject to transfer restrictions, but the right to receive the issued shares will not be transferable.

Vingroup’s Board of Directors has issued resolutions approving the share issuance dossier for submission to the State Securities Commission and resolutions on implementing the bonus share issuance plan approved by shareholders. Following this issuance, Vingroup’s charter capital is expected to double, reaching over 77 trillion VND.

Regarding business results, according to the Q3/2025 financial report, Vingroup’s consolidated net revenue for the first nine months of 2025 reached 169.611 trillion VND (up 34% year-on-year). Consolidated after-tax profit for the first nine months was 7.565 trillion VND, 1.9 times higher than the same period last year, achieving 76% of the 2025 profit target.

As of September 30, 2025, Vingroup’s total assets reached 1,087.870 trillion VND, a 30% increase compared to December 31, 2024. This marks the first time the group’s assets have surpassed 1 million billion VND.

Vingroup Climbs the Ranks: Secures Top 10 Spot in Vietnam’s Best Workplaces 2025

On November 19, 2025, Vingroup was once again honored as one of the “Top 10 Best Places to Work in Vietnam,” as announced by the professional community network Anphabe.

What’s Happening to Vingroup, the Empire of Billionaire Pham Nhat Vuong?

Vingroup’s stock continues to soar, setting unprecedented records and consistently breaking new highs on the Vietnamese stock market.