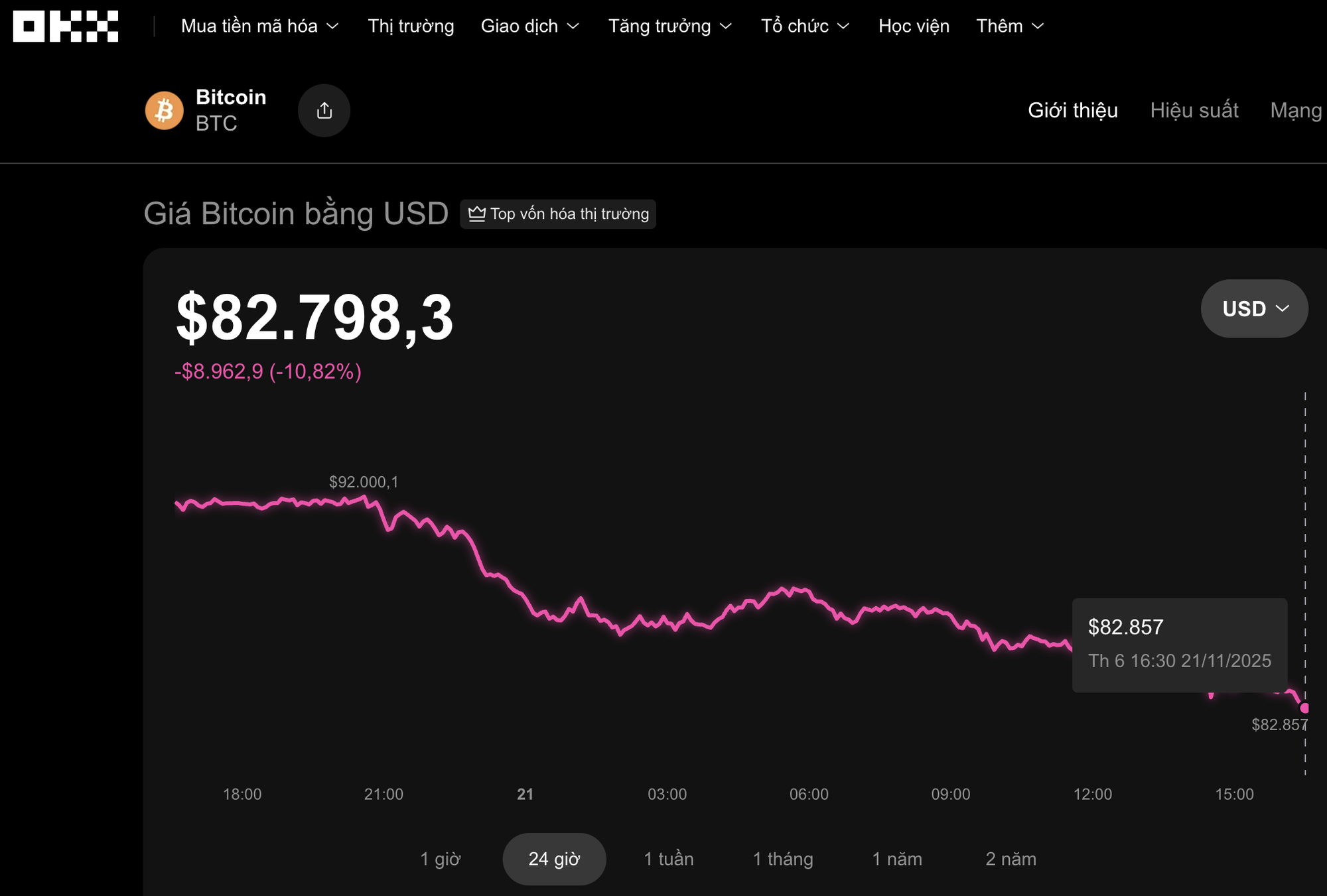

On November 21st, the cryptocurrency market experienced a significant downturn. Data from the OKX exchange revealed that Bitcoin’s price plummeted by over 10% in the past 24 hours, reaching $82,790.

Other major cryptocurrencies also witnessed substantial declines: Ethereum dropped more than 10% to $2,690, XRP fell nearly 10% to $1.9, BNB decreased by over 9% to $819, and Solana slid more than 11% to $126.

According to CoinTelegraph, the market faced a new wave of sell-offs coupled with shifting global interest rate expectations.

Bitcoin’s price has now declined by over 20% in the past month, a sharper drop compared to the stock market, which remains stable due to positive earnings reports from major tech corporations.

Market makers attribute the decline to a sudden influx of long-dormant Bitcoin being transferred to exchanges, suggesting long-term holders are selling.

Bitcoin is currently trading at $82,790. Source: OKX

This indicates that long-term investors are offloading their Bitcoin, increasing supply and overwhelming buying pressure.

In response, many investment funds and asset managers are adopting a defensive stance, prioritizing profit preservation. This has led to reduced market liquidity, particularly at critical support levels.

In the derivatives market, the negative sentiment is even more pronounced. Investors are predominantly betting on further price declines, while risk management tools are shifting to lower levels, reflecting concerns of a deeper Bitcoin price drop.

Options trading data shows that market focus has shifted from bullish expectations to scenarios where Bitcoin could fall close to $80,000.

Attention is also turning to a company holding a substantial amount of Bitcoin, as its price approaches its average cost basis of over $74,000.

If Bitcoin’s price continues to fall, the psychological and financial pressure on this company will intensify. Additionally, a major U.S. bank has warned that the company’s stock is under pressure due to concerns it may be removed from a major index early next year.

Should this occur, billions in index-tracking investments could be withdrawn, further destabilizing the already fragile cryptocurrency market.

Today’s Crypto Market, September 25: Sharp Decline Across the Board with Surprising Forecasts

Should Bitcoin breach the critical support zone between $112,000 and $110,000, a decline toward the $103,000 to $100,000 range becomes a distinct possibility.