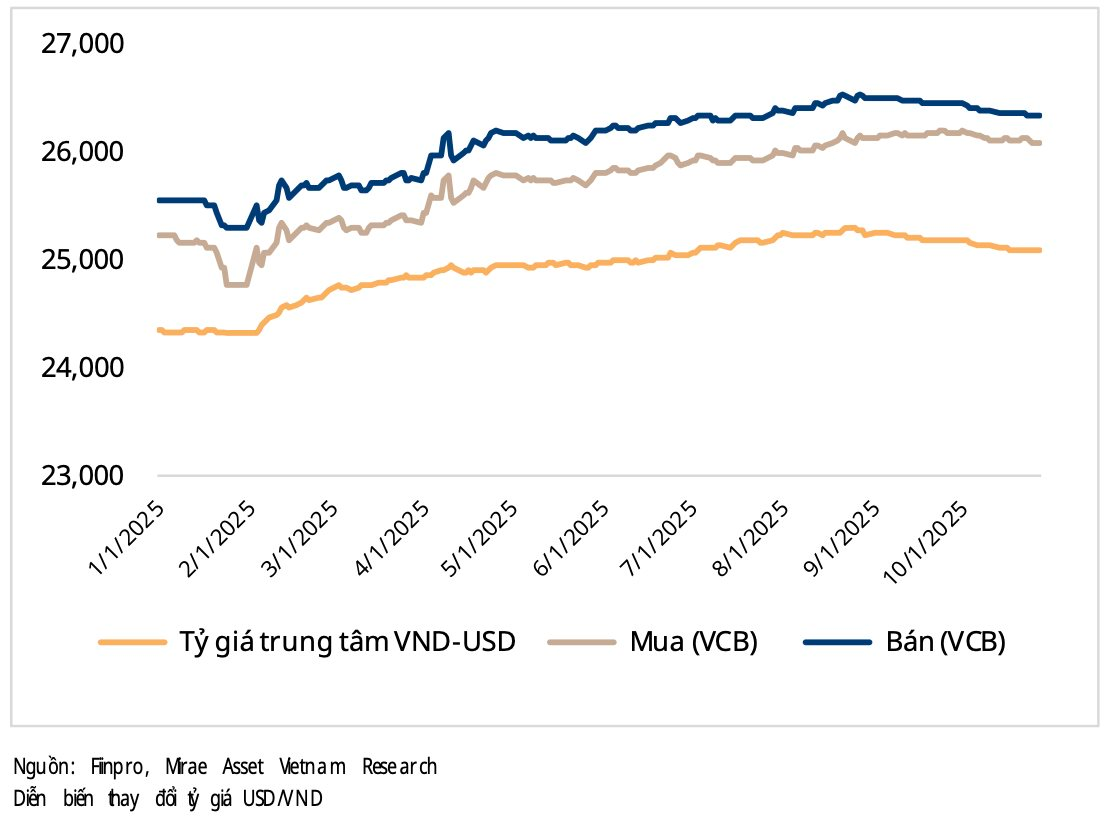

The central USD/VND exchange rate announced by the State Bank of Vietnam on November 14 reached 25,122 VND, nearing its historical peak. Compared to the beginning of the year, the central rate has increased by 3.2%, surpassing the 1.8% rise recorded in the same period in 2024.

According to a newly released analysis report, Mirae Asset attributes the widening gap between Vietnam’s interest rate cuts and the Fed’s sustained high rates as the primary driver behind the escalating exchange rate.

“Headaches” Over Exchange Rates

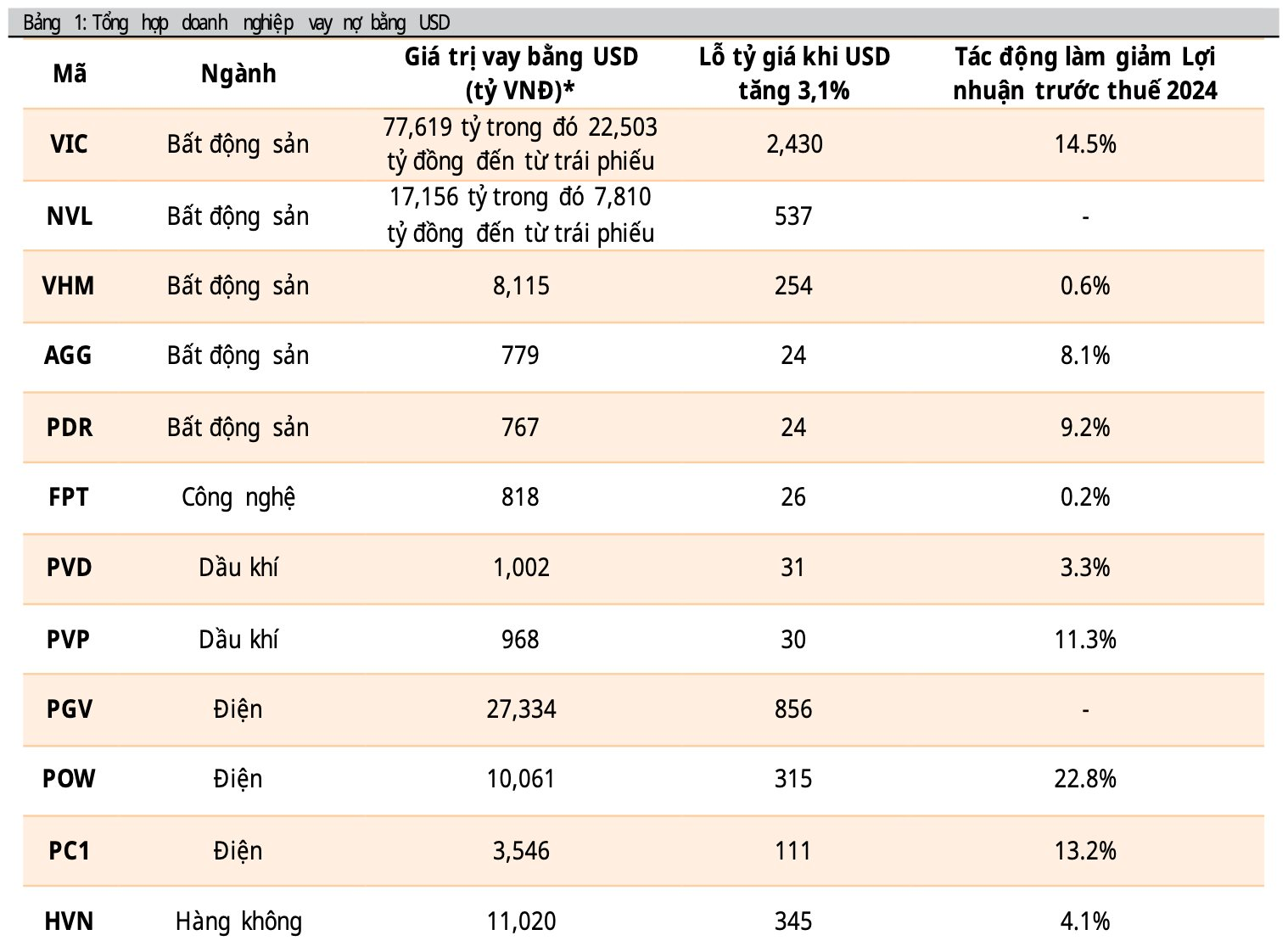

Mirae Asset highlights that companies with substantial USD-denominated debt will face significant challenges as the USD strengthens, leading to foreign exchange losses. This, in turn, erodes the profitability of USD-borrowing enterprises.

However, the impact varies depending on a company’s intrinsic operations, the balance between foreign currency assets and liabilities, and USD revenue streams. Some firms may offset forex losses through gains from other currency fluctuations.

Billionaire Pham Nhat Vuong is among the most affected by the exchange rate fluctuations. Mirae Asset estimates that Vingroup (VIC) could incur forex losses of approximately 2.43 trillion VND due to its USD-denominated debt exceeding 77.6 trillion VND, including 22.5 trillion VND in bonds. Other Vingroup subsidiaries, Vinhomes (VHM) and Vinpearl (VPL), are also projected to suffer forex losses in the hundreds of billions.

Similarly, Masan (MSN) may face losses of 1.045 trillion VND from its USD debt of 33.37 trillion VND. Novaland (NVL) is expected to lose around 537 billion VND with USD debt totaling 17.156 trillion VND. Other affected companies include EVNGENCO3 (PGV), PV Power (POW), and Vietnam Airlines (HVN).

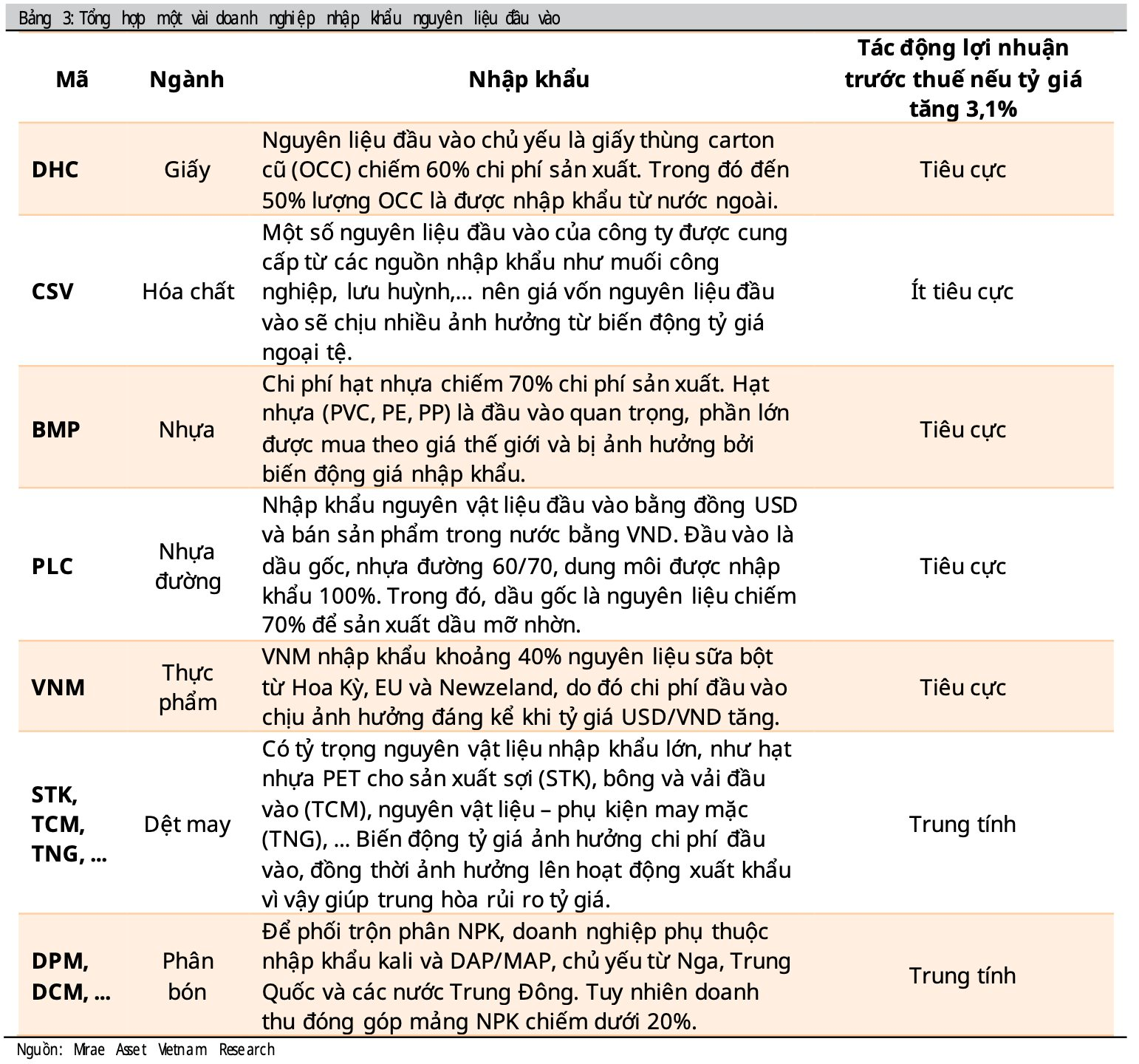

Additionally, import-dependent sectors such as paper (DHC), plastics (BMP), chemicals (CSV), and food (VNM) may face adverse effects as input costs rise with the strengthening USD/VND rate.

Many Companies “Quietly Rejoicing”

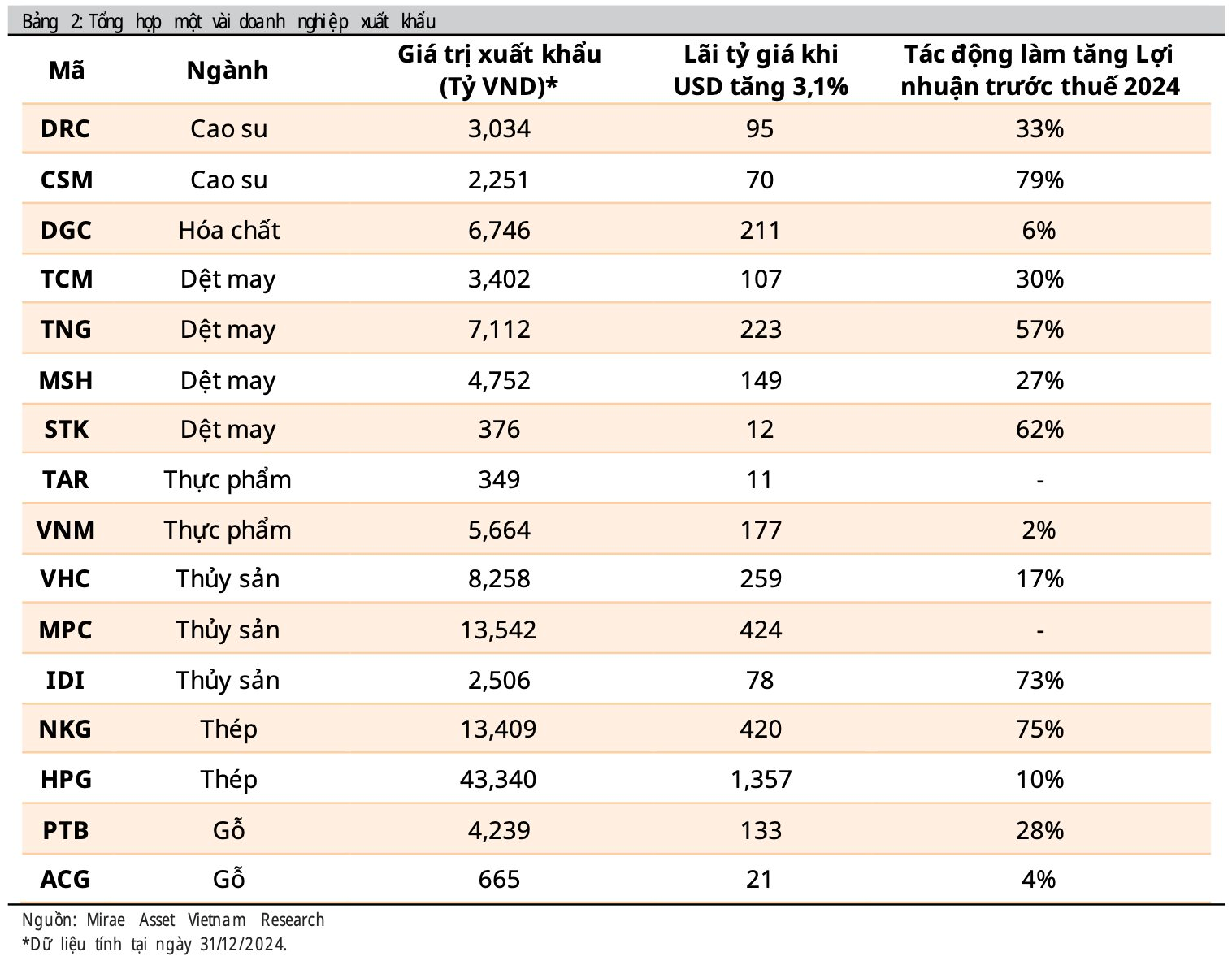

Conversely, Mirae Asset notes that export-oriented companies stand to benefit from the appreciating USD/VND rate, particularly in sectors like steel, textiles, seafood, footwear, electronics, agriculture, rubber, and wood products.

The steel industry, however, faces a dual impact due to both export revenues and USD-denominated debt. The effect varies based on individual companies’ financial structures. Mirae Asset estimates that Hoa Phat (HPG), led by steel magnate Tran Dinh Long, could realize forex gains of up to 1.357 trillion VND from exports exceeding 43.3 trillion VND. Another steel company, Nam Kim (NKG), is expected to gain around 420 billion VND from forex fluctuations.

The seafood sector, with its significant export revenues, also benefits from the stronger USD. Minh Phu Seafood (MPC) is projected to gain approximately 424 billion VND from forex fluctuations. Rubber and tire companies like Danang Rubber (DRC) and Casumina (CSM), with low USD debt and strong export focus, are well-positioned to capitalize on the rising exchange rate.

The textile industry (MSH, TCM, TNG, STK…) faces a dual impact due to its reliance on imported raw materials for export production. As a result, exchange rate fluctuations are less likely to significantly alter their business outcomes.

Food companies like Vinamilk (VNM), with predominantly domestic revenues and limited USD exposure, are less sensitive to exchange rate changes. They may experience modest benefits from exports or foreign currency holdings but face primary risks from rising import costs in case of significant forex volatility.

In summary, these figures are based on Mirae Asset’s analysis and should be considered indicative. Accurately assessing the impact of exchange rates on businesses is challenging due to continuous changes in financial structures and operational conditions. Furthermore, some companies employ financial derivatives like forward contracts, options, and swaps to hedge against forex risks.

Veteran Leader Kang Moon Kyung Steps Down from Mirae Asset’s Board of Directors

Following the extraordinary 2/2025 shareholders’ meeting on November 4th, Mirae Asset Securities (Vietnam) Joint Stock Company announced significant changes to its Board of Directors.

Mirae Asset Ascends to 12th Largest ETF Provider Globally, Managing $321 Billion in Assets

Mirae Asset Global Investments Co., South Korea’s leading asset management firm, has announced that its global assets under management (AUM) have surpassed 450 trillion won (approximately $320.6 billion). This remarkable milestone is primarily driven by the robust growth of its international business segment.

Weathering the Storm of Sell-Offs: What Does the Market Need to Turn the Tide?

Following a robust surge that brought it close to the 1,700-point mark, the VN-Index entered a consolidation phase, closing September at 1,661.7 points. While many analysts deem this adjustment healthy, the persistent net selling by foreign investors has sparked anxiety among a significant number of market participants.