In the final months of the year, deposit interest rates across many Vietnamese banks have shown signs of rebounding, particularly among small and medium-sized institutions. This shift not only directly impacts banks’ funding costs but also exerts significant pressure on the real estate market, pushing property prices downward as capital flows into savings accounts.

Rising interest rates make savings deposits more attractive, especially when new rates often surpass the growth of other investment channels, including stocks and gold, in recent times. As a result, idle funds tend to withdraw from riskier investments or less liquid assets, shifting toward bank savings for secure and stable returns.

For the real estate market, this is one of the most tangible and immediate impacts. Credit remains the lifeblood of the real estate sector, so any changes in monetary policy—whether tightening or loosening—have swift and profound effects.

Historically, Vietnam’s real estate market has repeatedly “frozen” or “boomed” in response to credit and interest rate adjustments. The periods of 2009–2011 and 2022–2023 witnessed tightened credit conditions, leading to reduced liquidity and halted projects due to capital shortages. Conversely, the years 2009–2010 and 2020–2021 saw land price surges amid low bank interest rates and abundant “cheap money” in the market.

As borrowing costs rise, homebuyers become more cautious about their repayment capabilities. This prudence leads to a decline in mortgage demand, creating a noticeable drop in market demand. If the real estate supply is not adequately absorbed, it exerts downward pressure on prices, forcing developers to introduce discounts or incentives to stimulate demand. This is the market’s self-correcting mechanism in the face of restricted capital inflows into real estate.

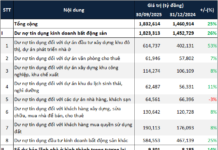

High borrowing costs and reduced loan demand have triggered a chain reaction directly affecting property prices. To maintain cash flow and boost home purchases, many developers are compelled to offer more attractive discounts or incentives. These price reductions have established a trend, preventing property prices from maintaining their rapid growth.

Additionally, rising capital costs increase financial strain on developers, particularly those with ongoing or upcoming projects. Companies must rebalance their investment and financial plans to avoid bad debt risks and ensure operational efficiency in a volatile market.

Notably, firms focusing on high-rise segments or large-scale urban developments, which require lengthy investment cycles, are more vulnerable. Although the corporate bond market has recovered, average issuance rates have climbed to 12–14% per year, complicating capital structure decisions.

Consequently, trends toward reduced investment, slower project launches, and intensified restructuring are becoming more pronounced. Many major companies have announced plans to sell non-core land assets, transfer projects, or seek foreign partners to access low-cost capital. These measures are seen as self-rescue strategies in an environment of increasingly expensive capital.

Mr. Nguyễn Văn Đính, Vice Chairman of VNREA, believes that rising interest rates will direct capital toward segments with genuine demand and feasible projects.

Mr. Nguyễn Văn Đính, Vice Chairman of the Vietnam Real Estate Association (VNREA), stated that the interest rate hikes by some banks are part of the natural banking cycle, as credit institutions rebalance their interests after prolonged support for the economy.

Furthermore, rising interest rates signal that the market is overheating, necessitating a mild financial “brake” to maintain stability.

“Higher interest rates will undoubtedly curb short-term investments, especially speculative transactions. However, in the long term, this adjustment benefits the market by filtering out financially weak investors, directing capital toward segments with real demand and viable projects. Reducing speculation is not a negative sign. On the contrary, it is essential for sustainable market development,” Mr. Đính analyzed.

According to Mr. Đính, the government maintains a flexible management approach, closely monitoring market dynamics to make appropriate adjustments. This flexibility has been crucial in stabilizing the real estate market in recent years and will continue to be effective in 2025–2026.

“When adverse signs emerge, policies will be adjusted more positively. This fosters significant market confidence,” he affirmed.

He believes that by the end of this year and into 2026, as management measures take effect and speculation diminishes, the market will evolve toward higher quality, stability, and sustainability.

Unusual Moves by Banking Giants Amid Rising Deposit Interest Rates

Leading banks such as Agribank, Vietcombank, and VietinBank are rolling out exclusive promotional programs and incentives to attract depositors, opting for innovative strategies over traditional interest rate hikes.

Reining in Real Estate Prices: Fundamental Solutions Needed

Amidst the relentless surge in property prices over recent times, experts emphasize the urgent need for fundamental solutions, particularly in effectively regulating investment capital flows. Such measures are crucial to fostering a healthy and sustainable development of the real estate market, which significantly influences both the economy and society at large.

How Rising Mortgage Interest Rates Impact the Real Estate Market

Floating interest rates for home loans at banks have surged to 12-15% per year. Experts suggest that this increase in mortgage rates will curb real estate speculation, steering the market toward higher quality, stability, and long-term sustainability.