Liquidity pressures, intense competition for deposits, and policies supporting businesses are forcing many banks to optimize costs and restructure credit to protect profit margins.

Pressure from Capital Costs

According to leaders of several banks, the Net Interest Margin (NIM) in the recent quarter faced significant downward pressure from two main factors: rising capital costs and declining asset yields. Tight liquidity has pushed up deposit costs, while asset yields have fallen as banks maintain supportive interest rate policies for businesses and customers. Additionally, the shift toward corporate lending, amid sluggish retail credit recovery, has further exacerbated the situation.

Customers transacting at AB Bank

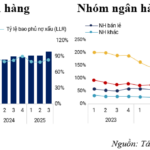

The strain on capital costs is further evident in the loan-to-deposit ratio (LDR), which exceeds 100% for many banks, reaching up to 110% industry-wide. To secure funds for high credit demand toward year-end, banks have raised deposit rates, particularly in November when smaller banks adjusted individual savings rates. However, lending rates remain constrained due to economic support requirements, further squeezing NIM.

FiinGroup’s data reveals that the average NIM of 27 banks stood at 3%, down 0.1 percentage points from Q2 and 0.3 percentage points year-on-year, the lowest since Q4/2018. State-owned banks like Vietcombank, BIDV, and VietinBank maintained NIMs between 2% and 2.6% by keeping lending rates low to support the market, despite rising deposit costs. Among joint-stock banks, average NIM fell from 3.6% to 3.4%, a multi-year low.

Some banks recorded sharp declines, such as SHB, down 2 percentage points from Q2 and 2.1 percentage points year-on-year, and HDBank, down 1.2 percentage points from Q2 and year-on-year.

However, banks like Sacombank, VPBank, OCB, MB, and VIB saw slight recoveries by maintaining credit growth and high retail lending ratios. Sacombank also benefited from interest income re-recognition on restructured loans in the Phong Phu Industrial Zone. VPBank led with the highest NIM at 5.2%, though still 0.6 percentage points lower year-on-year.

In practice, many banks have begun slightly raising lending rates after prolonged periods of offering preferential loan packages. They are also optimizing operational costs by reducing physical networks, digitizing, and automating processes, thereby cutting fixed costs and partially offsetting declining net interest margins.

Experts from Vietcombank Securities (VCBS) predict a slight uptick in lending rates to offset NIM compression, but rates will generally remain low to support production, business, and systemic safety. BIDV Securities (BSC) shares this view, noting that NIM is unlikely to return to the 4% average due to competitive pressures in deposits and lending, forcing banks to accept thinner margins to expand scale and retain customers.

Prospects for Recovery

Customers transacting at BIDV

Despite short-term NIM pressures, experts believe improvement is possible next year as public investment ramps up. Increased public spending will enhance system liquidity, easing deposit pressures and reducing input capital costs. Public investment will also drive economic growth, stimulating credit demand, improving asset yields, and supporting profit margins.

Beyond market factors, banks are proactively restructuring credit portfolios and capital sources to create room for NIM recovery. Techcombank is increasing non-term deposits (CASA) and boosting personal loans, particularly unsecured products with higher margins. ACB is restructuring its credit portfolio to focus on profitable products and developing new deposit products with flexible interest structures to optimize capital costs.

Long-term, expanding cross-selling ecosystems and increasing non-interest income, such as establishing life insurance companies as seen with Techcombank and VPBank, are expected to reduce reliance on traditional net interest margins.

Banking sector NIM is at multi-year lows due to rising capital costs and economic support pressures. However, proactive capital restructuring, cost control, shifts to retail and unsecured lending, and public investment advantages could lay the foundation for NIM recovery from 2026.

In the current challenging environment, banks with low-cost funding, high CASA ratios, strong digital ecosystems, and diversified revenue streams will maintain competitive advantages and better resilience to market fluctuations.

Unveiling the Stock Groups That Just ‘Rescued’ the Stock Market

The stock market concluded its final trading session of the week with the VN-Index rebounding to near the reference point. Strong support from blue-chip stocks, particularly the Vingroup cluster, played a pivotal role in the market’s recovery.

Bank Profits Surge 10x, Stock Prices Double Since Year’s Start

ABB Bank’s stock (ABB) has surged an impressive 100% since the beginning of the year, making it one of the top-performing bank stocks in the market. This remarkable rally coincides with the bank’s strong nine-month financial results and a strengthened management team. These positive developments are expected to propel ABBANK into a new phase of accelerated growth.

Q3 Non-Performing Loan Coverage Ratio Continues to Improve

The non-performing loan coverage ratio of the banking system continued its recovery trend in Q3. Effective management of bad debts has provided banks with additional time to rebuild their buffers following the previous sharp decline. Each bank implements distinct provisioning policies based on its strategic direction, leading to varying approaches in provisioning across different groups.