The recently released IPO prospectus of Hoa Phat Agricultural Development Joint Stock Company (stock code: HPA) reveals that leaders of Hoa Phat Group (stock code: HPG) have used HPG shares as collateral for loans taken by Hoa Phat Agriculture.

The total volume of HPG shares pledged as collateral exceeds 57.6 million units. With HPG’s current market price trading around VND 27,400 per share, the total value of this collateral is estimated at approximately VND 1,579 billion, significantly higher than the company’s current short-term debt.

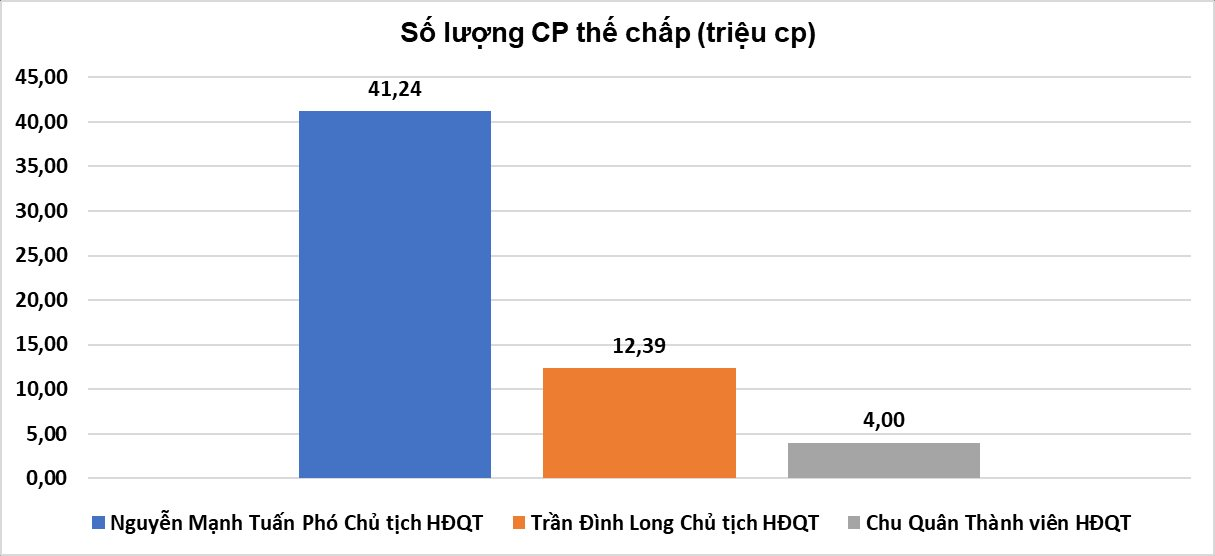

In terms of collateral structure, Mr. Tran Dinh Long, Chairman of Hoa Phat Group, has pledged 12,394,476 HPG shares from his personal holdings to secure credit obligations of Hoa Phat Hung Yen Animal Feed Co., Ltd. and Hoa Phuoc Livestock Co., Ltd. at Vietcombank’s Thanh Cong Branch.

The largest collateral comes from Deputy Chairman Nguyen Manh Tuan, who pledged 41,242,161 HPG shares for loans of the cattle farming and trading group. Additionally, Mr. Chu Quan pledged 4 million HPG shares to secure a loan for Hoa Phat Dong Nai Animal Feed Co., Ltd.

As of September 30, 2025, HPA’s total liabilities reached nearly VND 1,600 billion, a 11.4% increase from the beginning of the year. Short-term loans totaled more than VND 1,035 billion, rising by over VND 100 billion in nine months.

These loans primarily finance working capital, particularly inventory, which constitutes the largest asset share at 33%, valued at nearly VND 1,500 billion. This largely represents ongoing production costs for pigs and cattle in the farming cycle.

Additionally, HPA maintains a substantial cash and cash equivalents balance of nearly VND 570 billion to ensure liquidity.

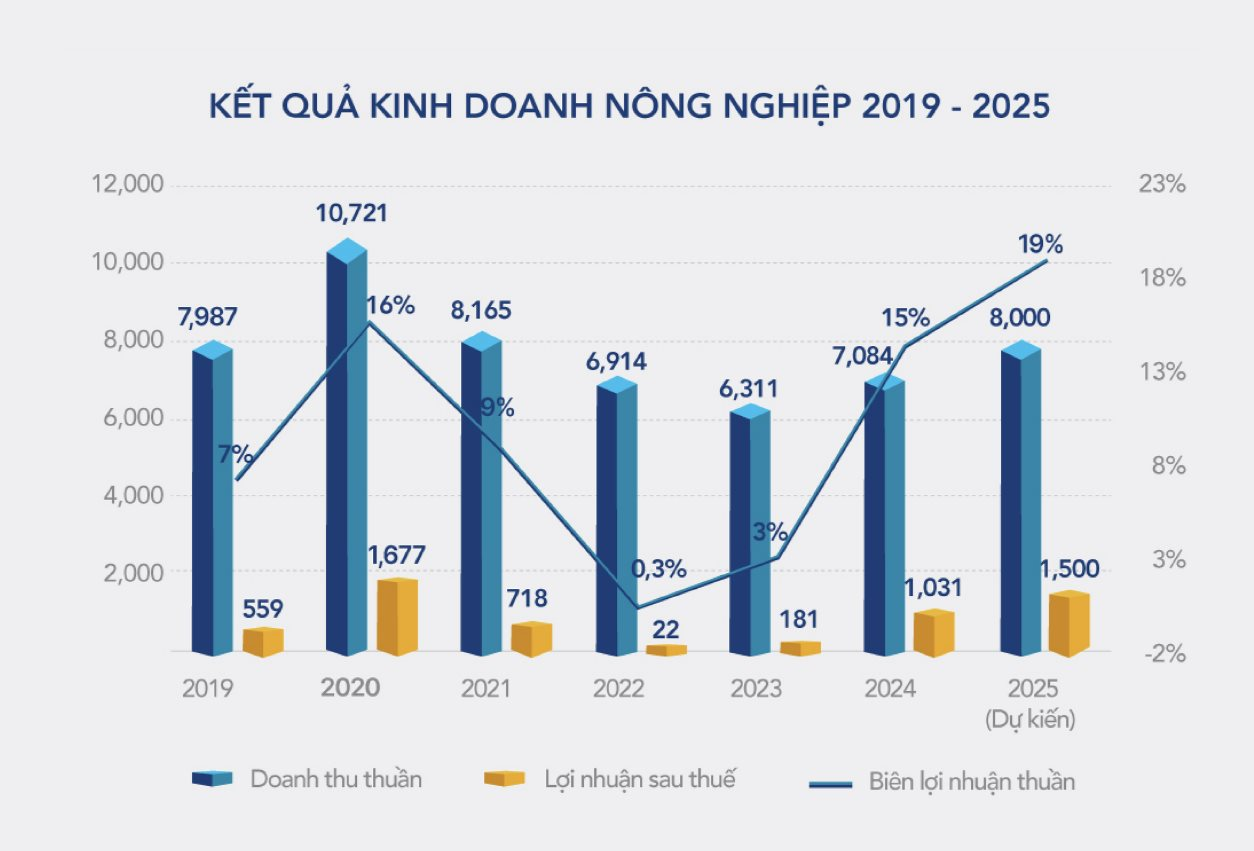

In terms of business performance, HPA recorded growth in the first nine months of 2025, with net revenue reaching VND 6,259 billion, a 12.3% increase year-on-year. After-tax profit was VND 1,297 billion, surpassing the VND 1,030 billion achieved in 2024. Gross profit margin rose from 8.8% in 2023 to 27% in the first nine months of 2025, driven by reduced production costs and favorable selling prices.

At the IPO price of VND 41,900 per share, HPA is valued at approximately VND 10,685 billion. This price corresponds to a P/B ratio of around 3.7 times, based on the book value of VND 11,365 per share as of September 30, 2025. Funds raised from the offering are expected to strengthen financial capacity and expand production in line with long-term strategic goals.

Daily Investment in HPG: Unlocking Astonishing Returns with Hoa Phat’s ‘Roller’ Strategy

From an initial investment of VND 127,000 on the first trading day, consistently purchasing one share daily for over 4,400 trading sessions would result in a portfolio valued at VND 1.76 billion, achieving a remarkable 1,158% return on investment.