According to preliminary statistics from the Customs Department, soybean imports of all types in the first 10 months of 2025 reached 2.16 million tons, valued at over $1 billion, marking a 19% increase in volume and a 7% rise in revenue compared to the same period in 2024. Notably, in October 2025 alone, imports surged by 47% in volume and 46% in revenue compared to September 2025.

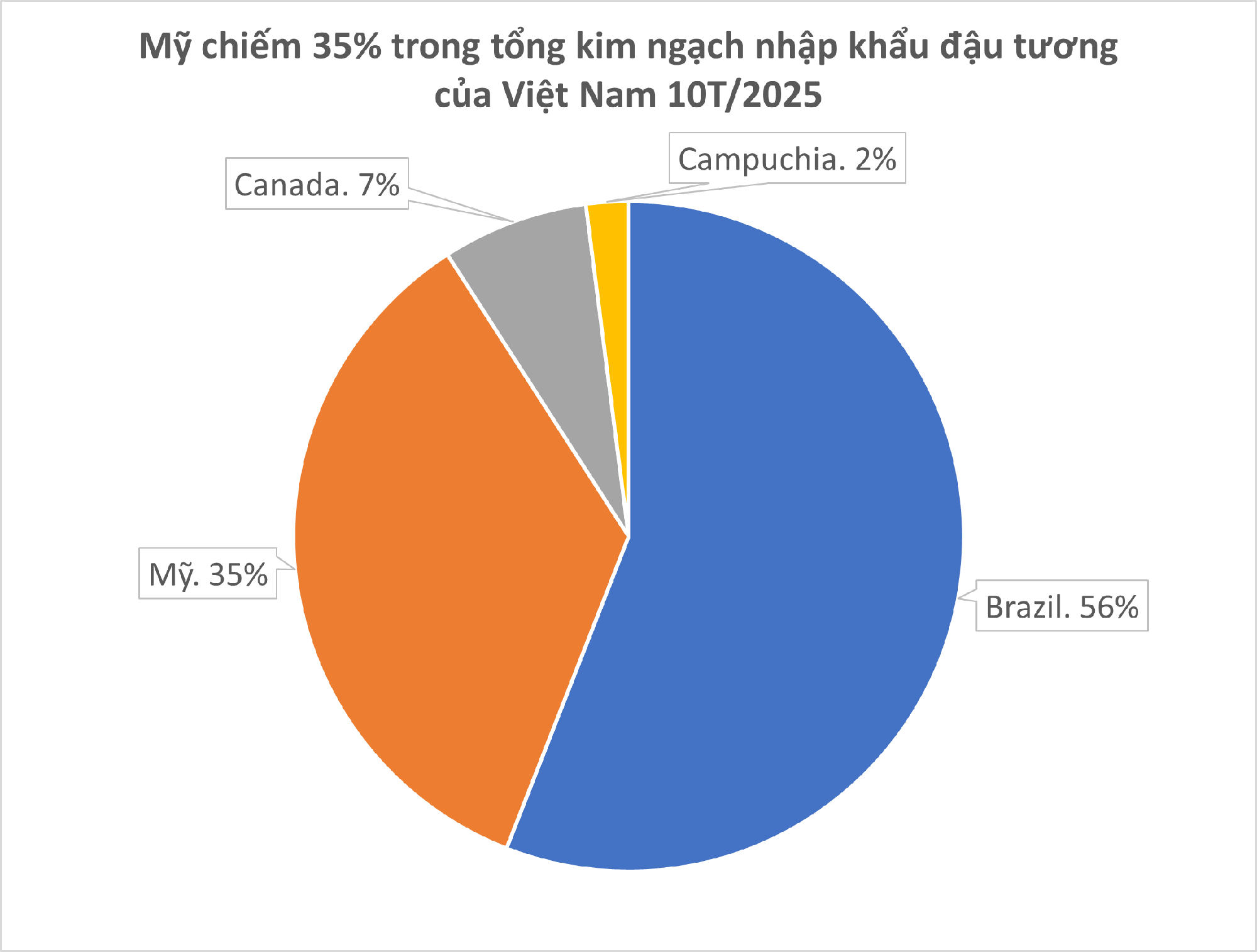

Brazil emerged as the largest supplier of soybeans to Vietnam in the first 10 months of 2025, accounting for 55% of the total volume and 56% of the total import revenue. The country exported 1.19 million tons, equivalent to nearly $561.28 million, with an average price of $469.7 per ton.

Remarkably, the United States, the second-largest market, is aggressively increasing its soybean exports to Vietnam. In the first 10 months of 2025, imports from the U.S. reached 773,000 tons, valued at $350 million, representing 35% of the total volume and revenue. This reflects a 36% increase in volume and a 16% rise in revenue. The average import price stood at $453 per ton, a 14% decrease compared to the same period in 2024.

The U.S. Soybean Export Council (USSEC) recognizes Vietnam as one of the “most dynamic markets for U.S. soybeans,” currently ranking as the third-largest buyer in Southeast Asia. The organization forecasts continued growth in Vietnam’s demand due to the robust expansion of its food and animal feed industries.

The preferential import tariff rate for dried soybean oil from the U.S. has been reduced from 1-2% to 0%.

Canada followed as the third-largest supplier, exporting 147,430 tons valued at $70.76 million in the first 10 months of 2025, accounting for 6.8% of the total volume and 7.1% of the total import revenue.

Nikkei Asia recently reported that the U.S. is experiencing extremely low soybean exports to China, despite Beijing’s commitment to resume imports during the meeting between President Donald Trump and President Xi Jinping on October 30 in South Korea.

Data released by China’s General Administration of Customs on November 20 revealed that soybean imports from the U.S. in October plummeted to zero, compared to 541,434 tons in the same period last year. This development has raised concerns among U.S. farmers, as agricultural products remain a focal point in trade negotiations between the world’s two largest economies.

According to the U.S. Soybean Export Council, China, the world’s largest soybean consumer, halted purchases of U.S. soybeans for several months due to trade tensions. Although Beijing announced a resumption of imports following the high-level meeting last month, significant transactions have yet to materialize.

Historically, China has been a major consumer of U.S. soybeans, particularly during the harvest season from September to November. However, China has not placed any large orders this year, in stark contrast to the same period last year when it purchased approximately 7 million tons.

Price disparities remain a significant barrier. Due to tariffs, U.S. soybeans are more expensive than those from South America, prompting Chinese companies to delay large-scale contracts. Some experts suggest that China may temporarily meet domestic demand without substantial U.S. imports.

Meanwhile, the U.S. harvest season is nearly complete, typically a period when importers increase orders. However, with the absence of orders from its primary traditional market, U.S. farmers are seeking new buyers to offload growing inventories, with Vietnam emerging as an attractive destination.

Real Estate Firms’ Listed Debt Surges 37% Since Year-Start

In line with industry trends, numerous publicly traded real estate companies have increased their borrowing in the first nine months of 2025, strategically positioning themselves for the anticipated market recovery ahead.

Vietnam Leads ASEAN in Consumer Optimism for 2025

Vietnam maintains its position as the regional leader in consumer optimism, according to the 6th edition of the ASEAN Consumer Sentiment Study (ACSS).