Will Land Certificate Costs Increase from 2026?

According to Article 257, Clause 1 of the 2024 Land Law, the land price table issued by provincial People’s Committees under the 2013 Land Law will remain effective until December 31, 2025. During this period, if local land prices experience significant fluctuations or no longer align with market realities, provincial authorities may adjust the land price table in accordance with new regulations to meet state management requirements and market conditions.

Additionally, Official Dispatch 5774 from the Ministry of Agriculture and Environment mandates that localities urgently review and evaluate the application of the land price table. If, in specific areas or locations, the current land prices do not closely reflect market values, provincial People’s Committees are authorized to make adjustments for application during the transitional period until December 31, 2025.

Thus, the land price table under the 2013 Land Law has just over a year of validity remaining. From January 1, 2026, provinces and cities will issue and implement new land price tables in accordance with the 2024 Land Law. Notably, land price tables will no longer be constructed on a 5-year cycle but will be adjusted, revised, and updated annually to closely track market fluctuations.

Under the 2024 Land Law, the new land price table will be detailed by area and location. In areas with digital cadastral maps and land price databases, land prices will be determined for each plot based on value zones and standard land plots (Article 159, Clause 2).

The application of new technical methods will bring land price tables closer to market values, enhance transparency, and reduce significant discrepancies between state-set prices and actual market prices.

However, this closer alignment may significantly increase the cost of obtaining a land certificate for the first time, as mandatory financial obligations such as land use fees, land rent (if applicable), and registration fees are all calculated based on the land price table.

Furthermore, specific land prices—determined using comparative, surplus, and income methods—must not be lower than the new land price table, effectively making the table a “floor price” in many cases.

Therefore, an increase in the land price table will lead to a corresponding rise in all financial costs associated with obtaining a land certificate for the first time. Many experts predict a significant increase in costs, particularly in rapidly urbanizing areas where current prices are substantially lower than market rates.

In this context, individuals seeking to obtain a land certificate for the first time are advised to complete their applications and procedures before January 1, 2026. Doing so will help avoid potential cost increases once the new land price table takes effect and is updated annually based on market prices.

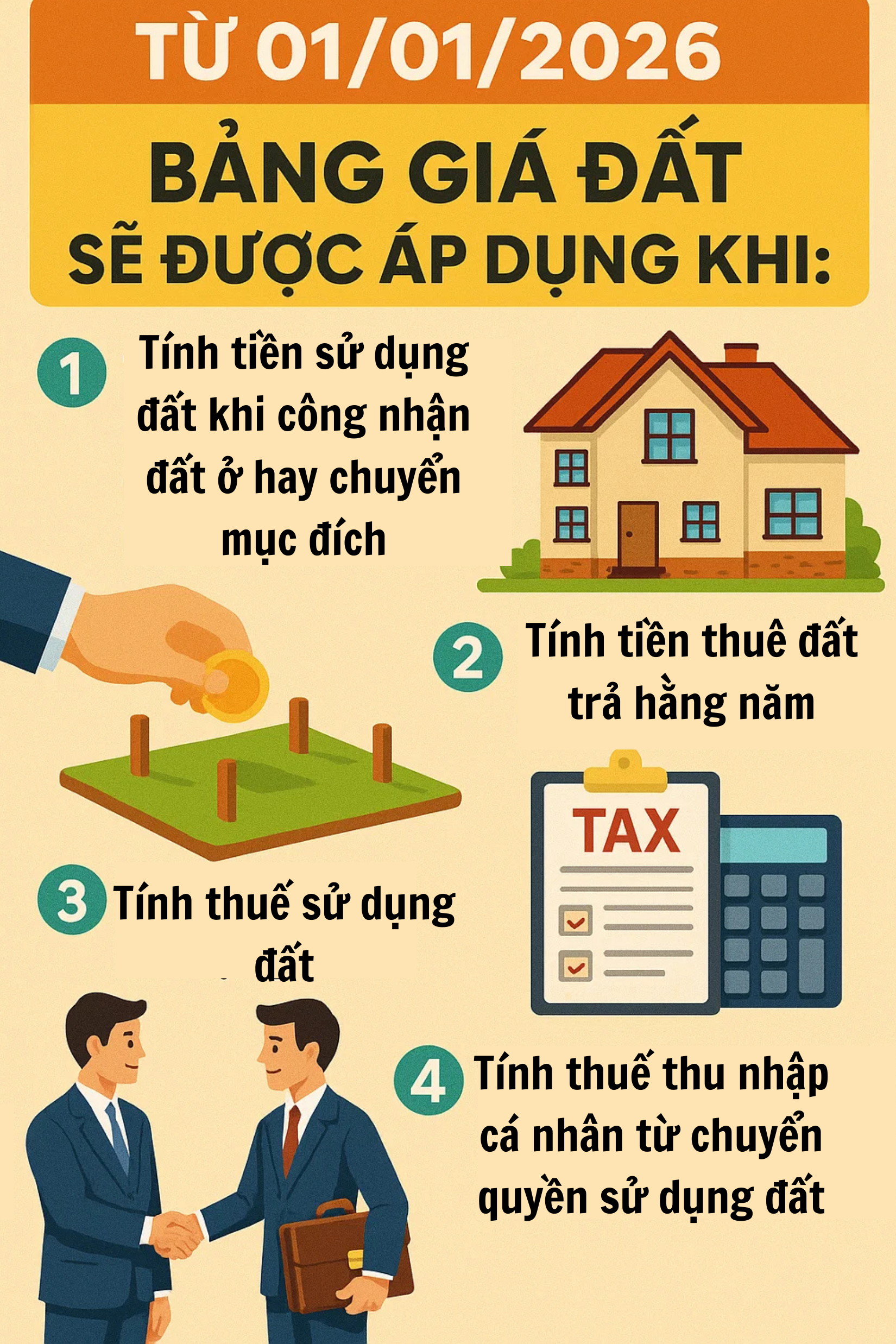

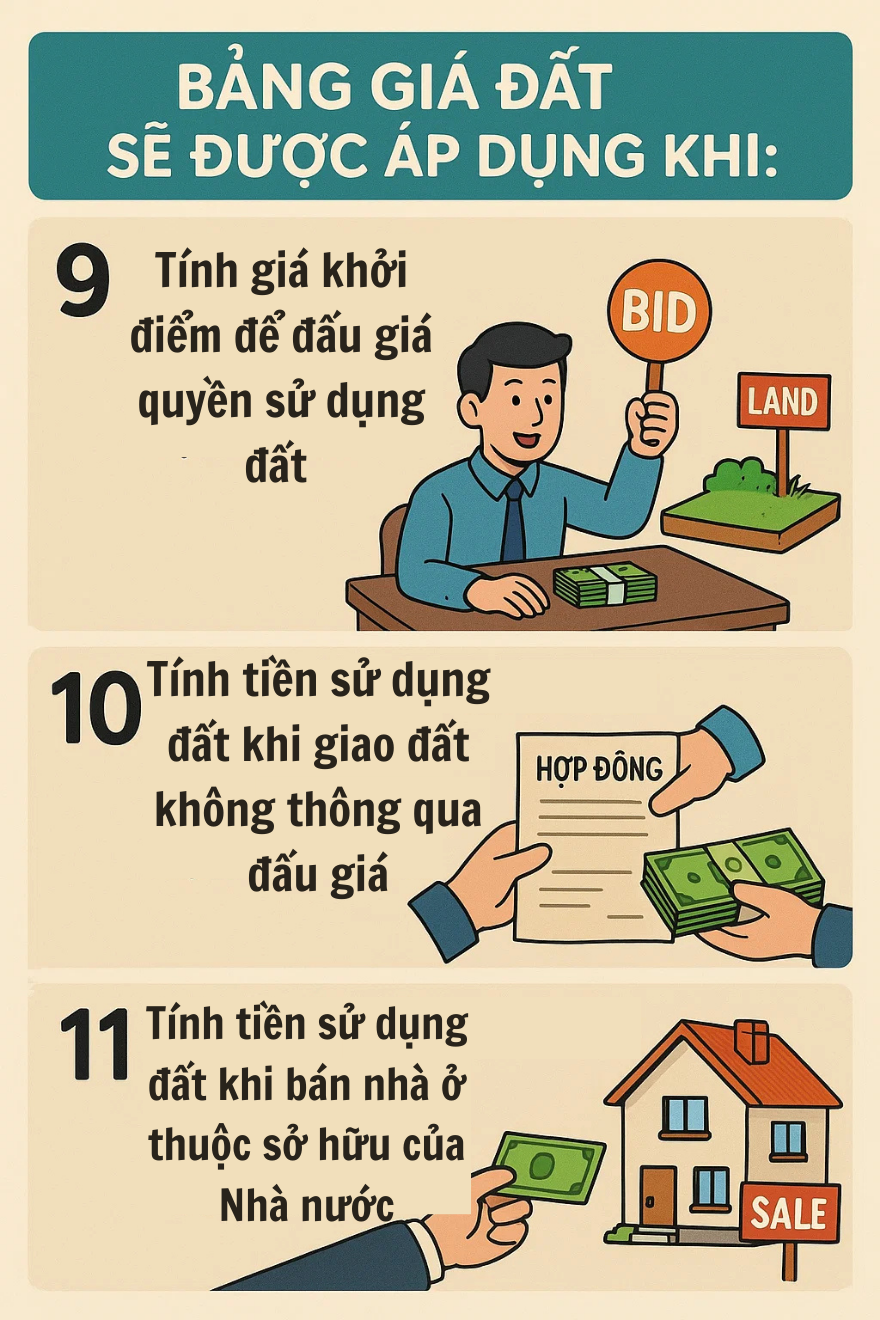

11 Cases Where the Land Price Table Applies from January 1, 2026

According to Article 159, Clause 1 of the 2024 Land Law, from January 1, 2026, the land price table will be applied in the following scenarios:

1 – Calculating land use fees when the state recognizes land use rights for households or individuals, or when land use purposes are changed; 2 – Calculating annual land rent when the state leases land on an annual payment basis; 3 – Calculating land use tax; 4 – Calculating income tax from land use rights transfers for households or individuals.

5 – Calculating fees for land management and use; 6 – Calculating fines for administrative violations in the land sector; 7 – Calculating compensation to the state for damages caused in land management and use; 8 – Calculating land use fees or rent when the state recognizes land use rights through allocation with payment or lease with a one-time payment for the entire lease term.

9 – Determining the starting price for land use rights auctions when the state allocates or leases land with developed technical infrastructure; 10 – Calculating land use fees for land allocation without auction; 11 – Calculating land use fees when selling state-owned houses to current tenants.

What Do National Assembly Deputies Say About Citizens Paying Billions to Convert Garden Land to Residential Land?

Presented to the National Assembly at its 10th session, the Government proposes solutions to resolve challenges related to land use fee calculations when converting garden land to residential land.

Implementing New Land Price List Effective January 1, 2026: Preventing Adverse Effects

The newly released land price list, effective from January 1, 2026, is expected to closely reflect market values. However, it has raised concerns among experts, who fear it may significantly increase investment costs, drive up selling prices, and potentially limit access to housing for the general public.