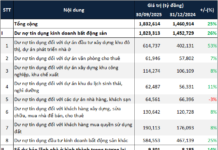

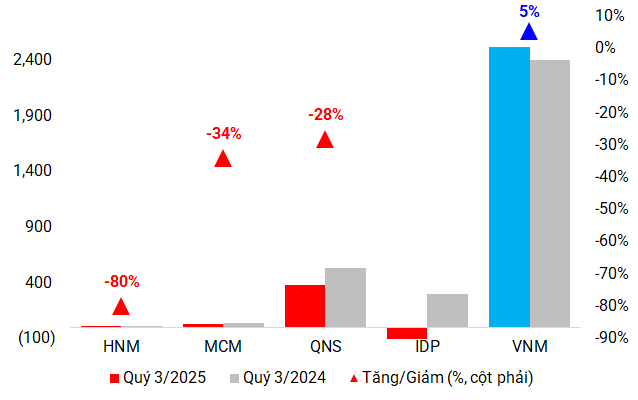

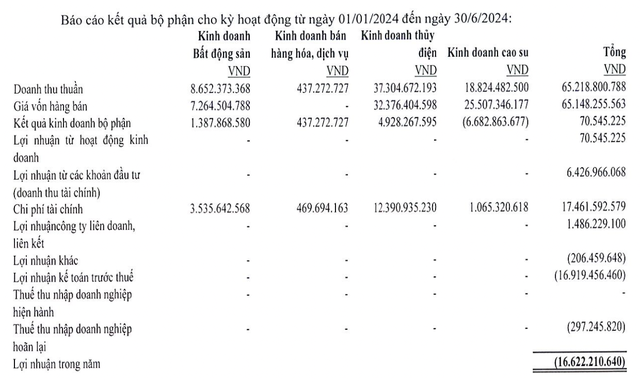

According to VietstockFinance data, out of five dairy companies listed on the stock market, four reported declines in both revenue and net profit for Q3 compared to the same period in 2024. The industry’s total revenue exceeded VND 22 trillion, a modest 4% increase, while net profit fell by nearly 15% to VND 2.8 trillion.

The most dismal performance came from International Dairy Products (UPCoM: IDP), which recorded its second consecutive quarterly loss, reaching a record high of VND 134 billion since its 2021 listing. Revenue dropped by 21% to VND 1.6 trillion, with profit margins plummeting to 29% from 40.7% year-over-year.

| IDP suffers heavy losses in Q3 |

Hanoi Dairy (UPCoM: HNM) also faced a bleak quarter, with revenue plunging 29% to VND 153 billion due to declining contract manufacturing orders. This marks the fifth consecutive quarter of revenue decline for HNM. Net profit barely reached VND 2 billion, an 80% drop and the lowest since 2021.

Moc Chau Dairy Cattle Breeding Joint Stock Company (HOSE: MCM) saw profits tumble 34% to VND 28 billion, the lowest since its 2020 listing, despite a slight revenue dip to VND 716 billion.

Quang Ngai Sugar (UPCoM: QNS) reported positive growth in its dairy segment, with a 4% increase in volume driven by effective marketing campaigns and lower input costs. However, net profit fell 28% to VND 381 billion, primarily due to intense competition in the sugar segment and weak demand.

Vietnam Dairy Products JSC (Vinamilk, HOSE: VNM) stood out with record-breaking revenue of VND 16.9 trillion, up 9.1% year-over-year. Gross profit margins improved from 41.2% to 41.8%. Net profit exceeded VND 2.5 trillion, a 5% increase and the highest in five quarters.

|

Dairy Companies’ Q3 Profits (Unit: VND billion)

Source: Author’s compilation

|

Soaring Selling Expenses

Most dairy companies faced mounting selling expenses in Q3, directly impacting profitability.

IDP exemplifies this trend, with selling expenses surging 40% to VND 590 billion. Its interim report also revealed VND 866 billion in marketing expenses for the first half of the year, double the previous year, contributing to prolonged losses.

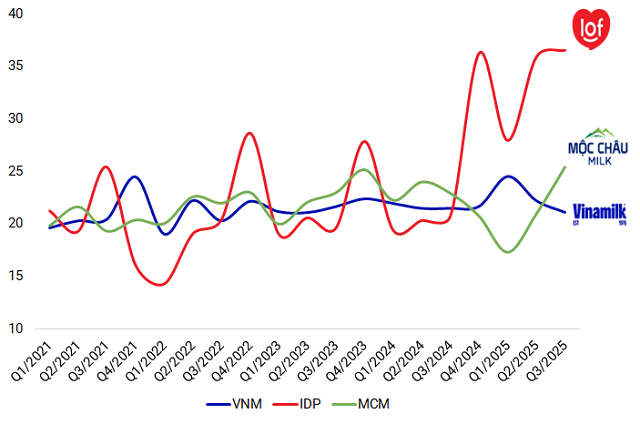

MCM’s selling expenses rose 7.7%, with advertising and promotions increasing by over 14%. The selling expense-to-revenue ratio climbed to 25.4%, the highest in years.

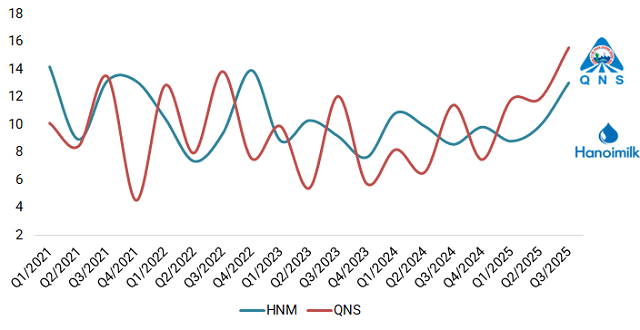

QNS spent VND 94 billion on promotions in Q3, 16 times higher than the same period last year, while agent commissions and sales support reached VND 25 billion, a fourfold increase. The selling expense-to-revenue ratio rose to 15.5%, surpassing any previous quarter.

HNM also struggled, with declining revenue pushing its selling expense-to-revenue ratio to 13%, the highest since 2022.

Meanwhile, VNM maintained its selling expense-to-revenue ratio at 21%, the lowest in three years. Despite an 11% increase in promotional spending, revenue growth and reduced production costs helped sustain efficiency.

|

Rising Selling Expense-to-Revenue Ratios in Q3 (Unit: %)

|

|

Source: Author’s compilation

|

Regarding gross profit margins, all companies except IDP, which faced increased depreciation, showed improvements compared to the same period last year. VNM rose to 41.8%; MCM increased to 28.2%; and HNM reached 18.3%, its highest in over a year despite significant revenue declines.

Looking ahead, analysts predict industry margins will improve in the coming months due to falling raw material prices, favorable livestock conditions, and controlled cattle diseases. VNM, in particular, is expected to further enhance its margins by securing raw material prices for Q4 2025 and Q1 2026.

– 09:00 24/11/2025

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.

What’s Happening to Vingroup, the Empire of Billionaire Pham Nhat Vuong?

Vingroup’s stock continues to soar, setting unprecedented records and consistently breaking new highs on the Vietnamese stock market.