After a week dominated by AI stock movements, traders and investors are looking to the U.S. Federal Reserve (Fed) for clear guidance, as gold prices continue to exhibit strong and unpredictable volatility.

Spot gold began the week at $4,100 per ounce, but as seen repeatedly this week, it failed to sustain any gains above this level. After a second failed attempt to surpass $4,100 shortly after 8:30 PM Eastern Time, gold slid to support near $4,058 per ounce just after midnight. European traders attempted to push gold back to $4,090 per ounce, but as North American markets opened, gold traded near $4,074 per ounce.

Following multiple failed attempts to break through this resistance level, gold witnessed its first significant sell-off of the week, dropping to $4,011 per ounce just before 3:00 PM. By 6:00 PM on Monday, gold had rebounded to $4,050 per ounce. However, this rally was short-lived, and by 2:15 AM Eastern Time, gold hit its weekly low, just above $4,000 per ounce.

At this level, the precious metal regained its appeal, and as North American markets opened on Tuesday, spot prices returned to $4,075 per ounce. A retest of short-term support near $4,060 per ounce during Asian trading further bolstered buyer confidence, and by 4:30 AM on Wednesday, gold was once again trading above $4,100 per ounce.

North American traders then entered the market, but after reaching a weekly high above $4,130 per ounce just 30 minutes after the open, gold experienced its second significant sell-off, falling to $4,065 per ounce by midday Eastern Time.

With clear support and resistance levels established, gold traded within the $4,030 to $4,100 per ounce range for the remainder of the week, ending near the $4,065 per ounce support level.

Kitco News’ latest weekly gold survey shows a majority of experts turning bearish or neutral, while investors remain optimistic.

“I’m bullish on gold for next week,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “Technically, gold has bounced off support at $4,000 and looks set to trade within the $4,000-$4,200 range.”

“Up,” said Rich Checkan, president and CEO of Asset Strategies International. “With fundamentals unchanged and central bank buying unabated, the pullback and accumulation in gold have been overstated.”

Checkan added that next week will also see subdued trading in the U.S. due to the Thanksgiving holiday. “Subdued markets often see exaggerated moves in one direction or another… and I think investors will want to be involved in gold rather than sitting on the sidelines,” he said. “I expect prices to move higher.”

However, Adrian Day, chairman of Adrian Day Asset Management, sees gold prices unchanged. “Gold may need more time before a sustained move higher, although the Fed’s rate decision next month could change the picture. I don’t see gold falling much from here; the fundamentals are still there, and buyers are on the sidelines in case of a pullback.”

Kevin Grady, president of Phoenix Futures and Options, noted that the market is awaiting guidance from the Fed.

“I think it’s mostly about interest rates,” he said. “People are waiting to see what they’re going to do with rates in December and starting to look at the minutes and previous speeches. Every time someone speaks, you see that’s what’s driving the market. I think the interest rate situation is what people are really focused on.”

Grady remains bullish on the precious metal even after its strong rally and despite the recent pullback.

“When you look at the S&P, it’s up 12% this year, gold is up 50% this year, and gold stocks are up 125%… I think this rally still has legs,” he said.

This week, 13 analysts participated in Kitco News’ gold survey. Only 2 experts, or 15%, predicted gold would rise next week, while 4 others, or 31%, predicted it would fall. The remaining 7 experts, or 54%, predicted the precious metal would trade sideways next week.

Image: Kitco

Meanwhile, 228 retail investors participated in the online poll. The results show that investor optimism has softened somewhat from last week. 138 investors, or 61%, predicted gold would rise next week, while 44 others, or 19%, predicted the precious metal would fall. The remaining 46 investors, or 20%, predicted prices would remain sideways next week.

Next week will see a slew of critical economic data released over the first three days, as the U.S. government continues to clear the backlog of reports following the previous shutdown.

On Tuesday morning, the market will receive PPI and September retail sales, along with October pending home sales.

On Wednesday, traders will monitor a slew of data ahead of the Thanksgiving holiday, including durable goods orders, preliminary Q3 GDP, personal consumption expenditures (PCE), new home sales, and weekly jobless claims.

U.S. markets will be closed on Thursday for Thanksgiving and, although they will reopen on Friday, no significant data will be released.

David Morrison, senior market analyst at Trade Nation, holds a bearish outlook for gold in the short term.

“The outlook for gold looks uncertain,” he said. “It appears the daily MACD needs to drop to a lower low to attract fresh buying interest. Despite the tech-led sell-off in equities, there’s no sign yet of investors seeking gold as a safe-haven asset.”

Sean Lusk, co-director of commercial hedging at Walsh Trading, believes gold’s remarkable stability suggests prices could defy seasonal trends and move higher.

“It looks like gold wants to retest recent highs,” he said. “The U.S. dollar is stronger on Fed expectations, but that hasn’t triggered a significant sell-off yet. Gold and silver were hammered overnight, but you have December options expiring on Monday… It could just be volatile silver markets, with no one knowing who’s involved and why.”

“Typically, November is a seasonally weak period, but after the government reopened, we saw a strong rally that gave back most of its gains,” he said. “Now we’re sideways here, so I’m not sure what the market is really focused on.”

Lusk believes the market will react to economic data through year-end.

“The September jobs report was slightly better, but nothing to write home about,” he noted. “I think there’s a lot of political complaining about the cost of living and related issues. That’s affecting consumer sentiment, along with polling data that’s having a big impact.”

“I think gold will trade sideways to slightly lower, then we’ll see if we get a slight rally in December,” he said. “I don’t know what the Fed will say in December if they don’t have enough data.”

“I don’t know what else the market can focus on,” he added. “We’ve had earnings season and are heading into year-end.”

Lusk noted he’s also unsure about gold’s direction in this phase, but current support levels remain strong.

“I think by now we would have seen a significant correction in one direction or another,” he said. “That could still happen, but there’s only one week left in the month. Globally, many stock markets are strong, but I keep hearing about central banks continuing to buy gold. Is that true? When they slow down, perhaps that’s when the trend reverses.”

“The charts look very solid,” Lusk added. “We haven’t seen any significant correction… which is unusual, as gold was only at $3,300 in late July. Most of the move to $4,000-$4,100 per ounce occurred in just three months. If there’s a correction, that could be the price level gold returns to.”

“As you know, markets go down much faster than they go up,” he added. “But so far, there’s no sign gold wants to reverse.”

Alex Kuptsikevich, senior market analyst at FxPro, forecasts lower gold prices next week and is monitoring the 50-day moving average to see if the trend breaks.

“Gold has held up well against pressure from a stronger U.S. dollar and rising bond yields,” he said. “However, the reduced odds of a Fed rate cut in December, now at 32%, have capped gains.”

Kuptsikevich cited Goldman Sachs estimates showing central banks bought 64 tons of gold in September, triple August’s figure. “TD Securities notes increased demand from large investors for ETFs, and UBS raised its 2026 gold price forecast by $300 to $4,500 per ounce,” he said. “About 26% of Bank of America survey respondents believe gold will outperform commodities and currencies next year.”

“However, we still believe the one-month pullback ended gold’s three-year uptrend,” he countered. “Yet, gold has held steady in recent weeks, shrugging off both a stronger dollar and progress in Ukraine peace plans. Earlier this year, these factors caused sharp declines. However, buyers are keeping gold above the trendline—the 50-day moving average. A break below this level could shift the current trading trend.”

Kitco’s senior analyst, Jim Wyckoff, noted that gold traders next week will watch how U.S. stock markets react after yesterday’s volatile session.

“Heavy selling pressure in equities could boost safe-haven demand,” he said.

“Technically, the next upside target for December gold futures bulls is to close above the strong resistance level at November’s high of $4,250,” Wyckoff said. “The next downside target for bears is to push prices below strong technical support at $4,000. First resistance is seen at $4,100, followed by this week’s high of $4,134.30. First support is at last night’s low of $4,018.10, then at $4,000.”

At the time of writing, spot gold was trading at $4,065.38 per ounce, down 2.68% for the week and 0.30% for the day.

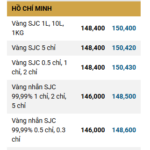

Gold Bar and Ring Prices Rebound on November 22nd Morning

This morning, the price of SJC gold bars surged by 600,000 VND per tael across major gold retailers, compared to yesterday’s closing session. Similarly, the price of gold rings at Bao Tin Minh Chau and SJC Company also saw a 600,000 VND per tael increase in both buying and selling rates.

Techcombank Maxes Out Savings Interest Rates

Techcombank (Vietnam Technological and Commercial Joint Stock Bank) has recently updated its deposit interest rates effective from November 20, 2025, with notable increases across various terms. Specifically, the interest rate for deposits under 6 months has been raised to the maximum allowable limit of 4.75% per annum, exclusively for Private customers utilizing online banking channels.