Grayscale is gearing up for a significant milestone as their Dogecoin ETF and XRP ETF are set to begin trading on the New York Stock Exchange on November 24. It’s rare for two major altcoin ETFs to launch on the same day, making this a pivotal moment for both communities.

Bloomberg analyst Eric Balchunas confirmed the approvals and noted that a Grayscale Chainlink ETF could soon follow, highlighting the company’s rapid expansion beyond its popular Bitcoin and Ethereum products.

Why These ETFs Matter

NYSE Arca has confirmed that both the Dogecoin and XRP ETFs meet all listing requirements, officially clearing them for trading. With this approval, the Grayscale XRP ETF and Grayscale Dogecoin ETF will transition from private investment vehicles to publicly traded ETFs.

This shift offers everyday investors an easier way to gain exposure to XRP and Dogecoin without directly purchasing the tokens. For existing holders, the conversion from a private trust to an ETF is straightforward and seamless.

While this will be Grayscale’s first Dogecoin ETF, another DOGE fund entered the market earlier this year. However, the strong and passionate communities supporting both XRP and Dogecoin provide solid backing for these ETFs ahead of their launch. Their debut adds more managed options for investors looking to explore digital assets beyond Bitcoin and Ethereum.

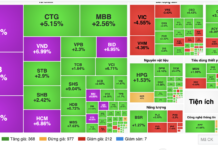

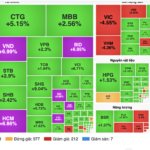

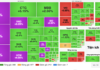

A Challenging Time for Crypto Markets

The ETF launch comes at a difficult time for the broader crypto market. Prices have been declining for six weeks, with Bitcoin down over 25% since October and more than a trillion dollars wiped from the market. Earlier this year, ETF approvals helped drive prices higher, particularly during a bullish market. This time, sentiment is more cautious as traders face significant losses and uncertainty.

Despite the weak market, both DOGE and XRP have seen increased activity. Dogecoin’s trading volume has surged as its price swings between recent lows and minor recoveries. XRP has been even more volatile, fluctuating rapidly between dips and short-term rebounds as traders prepare for the ETF launch.

A Major Test for Altcoin ETFs

November 24 is shaping up to be a critical test for the future of altcoin ETFs. If investor interest is strong, it could signal that demand for managed altcoin products remains even during a market downturn. For Grayscale, this marks another step in expanding its offerings and bringing more altcoins into mainstream investment channels.

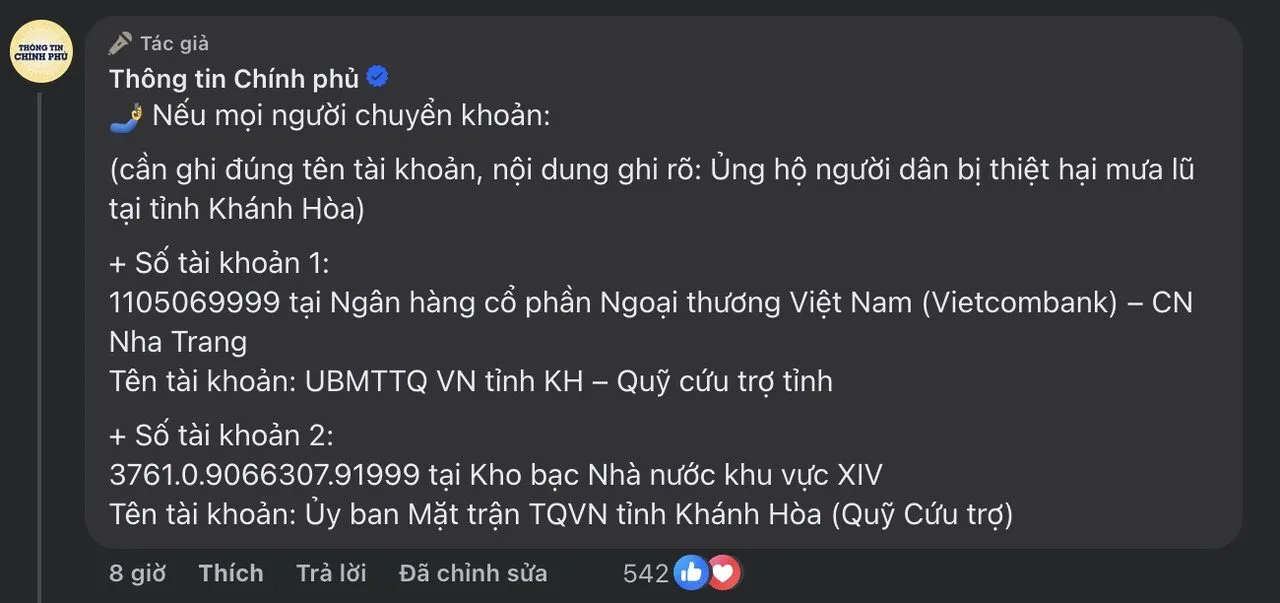

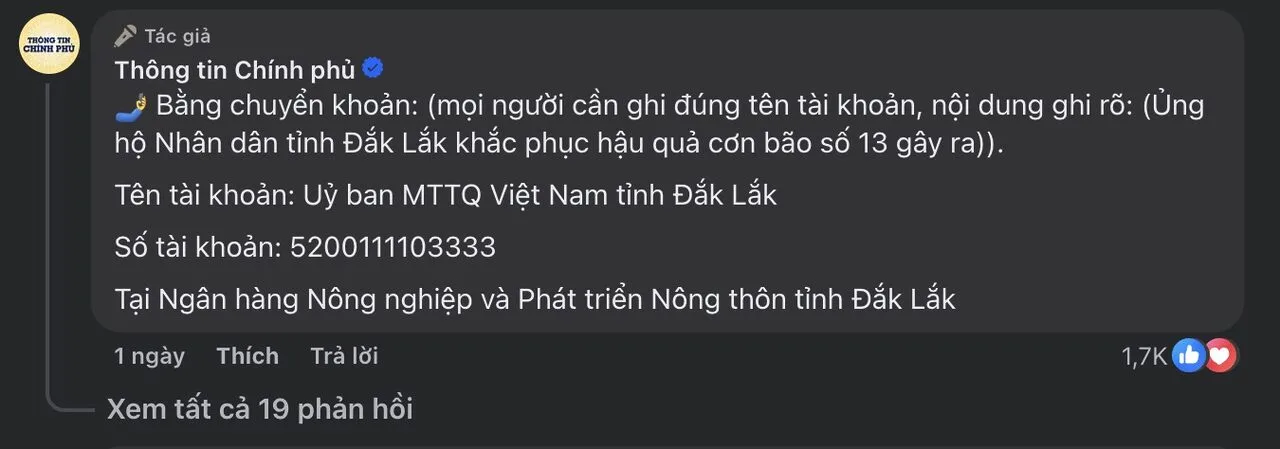

Additionally, donations in the form of goods, essentials, and clothing can be made at 14 relief stations for the people in the Central provinces.

The Crypto Conundrum: Vietnam’s Trillion-Dollar Opportunity Stalls Over Human Capital and Capital Hurdles

Resolution 05/2025/NQ-CP, which stipulates that only domestic organizations with a minimum charter capital of VND 10,000 billion are eligible to participate, poses a significant challenge for businesses, even when mobilizing capital in the traditional stock market.

The Crypto Market Today, September 7: Bitcoin Loses Key Support

The crypto market is ever-evolving, and analysts predict that Bitcoin could very well revisit the $75,000 mark. This prediction is not far-fetched, given the volatile nature of the cryptocurrency market and Bitcoin’s proven resilience. As we navigate these dynamic times, investors and enthusiasts alike await with bated breath, eager to witness Bitcoin’s next move.