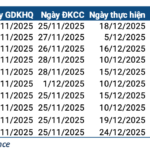

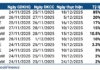

On November 21st, the final trading session of the week, GTD shares of Thuong Dinh Shoe Joint Stock Company surged to their upper limit, hitting the ceiling price of 17,300 VND per share (a 15% increase). This marked the third consecutive session of GTD reaching its price ceiling, resulting in a remarkable 47% gain over just three days.

During these three ceiling-hitting sessions, only 600 GTD shares were traded on November 19th, while the following two days saw a mere 100 shares traded each day.

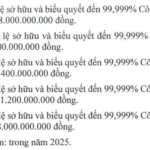

The consecutive surges in GTD shares followed the Hanoi Stock Exchange’s (HNX) announcement of an auction for 6,385,867 shares of Thuong Dinh Shoe Joint Stock Company, owned by the Hanoi People’s Committee. This represents the entirety of Hanoi’s stake in the company, equivalent to 68.67% of its charter capital.

The starting price is set at 20,500 VND per share. If the entire lot is successfully auctioned, the Hanoi People’s Committee stands to earn a minimum of 130.9 billion VND.

The auction is scheduled for the morning of December 16, 2025, and is open to domestic and foreign economic organizations, social organizations, and individuals.

Established in 1957, Thuong Dinh Shoe originated as Workshop X30 under the Military Supply Department of the General Logistics Department, specializing in producing hard hats and rubber sandals for the military. In 1993, the name Thuong Dinh Shoe was officially adopted, becoming a familiar brand in Vietnamese daily life.

In 2015, Thuong Dinh Shoe decided to IPO on the HNX and transitioned to a Joint Stock Company in 2016.

Over its 60-year history, Thuong Dinh Shoe has expanded its export markets to the EU, Australia, and several Asian countries. However, in the past five years, the influx of international brands like Adidas, Puma, and Nike into Vietnam has intensified competition, leaving Thuong Dinh Shoe at a significant disadvantage.

While other established brands like Biti’s have revamped their products and invested heavily in rebranding to align with trends, Thuong Dinh Shoe’s offerings have seen minimal changes in design.

In the eyes of consumers, Thuong Dinh Shoe remains synonymous with affordable sports shoes priced around 100,000 VND, often labeled as “occupational safety shoes.” This weakness has left the once-prominent brand struggling to maintain its market share.

Currently, 9.3 million shares of Thuong Dinh Shoe are traded on the UPCoM market under the ticker symbol GTD. The stock is under warning due to its financial statements receiving qualified opinions from auditors for three consecutive years or more.

According to the 2024 audited consolidated financial report, Thuong Dinh Shoe recorded net revenue of nearly 79 billion VND, a slight 2% decrease compared to the previous year.

After deducting taxes and fees, the company reported a net loss of nearly 13 billion VND in 2024, 2.6 times higher than the 5 billion VND loss in 2023. Accumulated losses as of December 31, 2024, totaled over 67 billion VND.

In the 2024 audit report, auditors issued a qualified opinion due to outstanding receivables. Additionally, they emphasized concerns regarding short-term debt. The company’s ability to continue operating hinges on its capacity to recover receivables, extend loans, and manage payables from commercial banks, suppliers, and future business performance.

According to the auditors, these conditions indicate significant uncertainty that raises substantial doubt about the company’s ability to continue as a going concern.

In 2025, Thuong Dinh Shoe plans to aggressively pursue export orders and stimulate domestic demand. The company is also seeking production management partners, particularly from China, and aims to diversify into manufacturing bags and cases to increase revenue and provide employment.

The company targets producing 700,000 to 900,000 pairs of shoes, with approximately one-third destined for export. It aims for revenue and other income of 100 billion VND, projecting a profit of around 100 million VND, thus escaping losses.

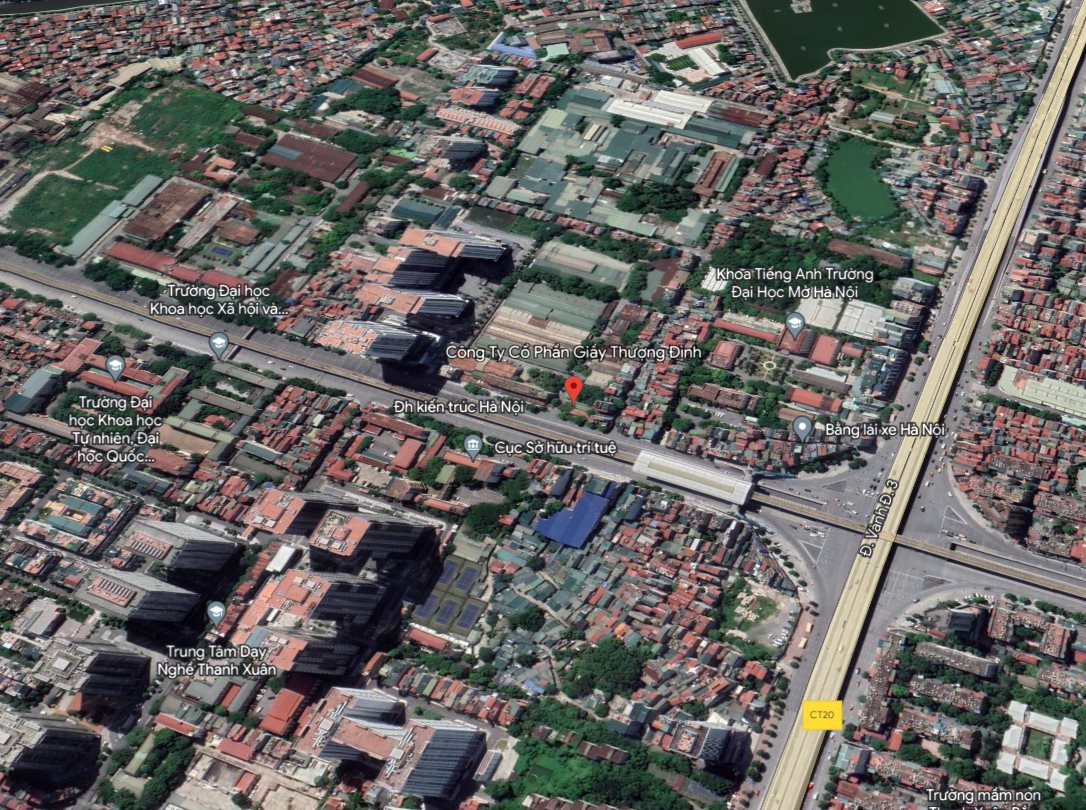

One notable asset of Thuong Dinh Shoe is its 36,105 m² plot of land at 277 Nguyen Trai, Hanoi. This prime location, with a large frontage on Nguyen Trai Street, is slated for relocation from the inner city under Hanoi’s urban planning policy.

According to the approved plan, this land will be developed into the Thuong Dinh Commercial Housing – Office – Service – K-12 School Complex, with Thuong Dinh Shoe as the primary investor. The total investment is estimated at 1.6 trillion VND, with completion targeted for 2030 after the factory relocation.

GTD Stock Surges to Upper Limit for Three Consecutive Sessions Following Hanoi’s Capital Withdrawal Announcement

Giầy Thượng Đình’s stock, GTD, soared to its third consecutive upper limit, with a nearly 50% surge in market price, following the news of Hanoi’s complete divestment from the company.

IPA Successfully Issues Over VND 1.4 Trillion Bond Tranche

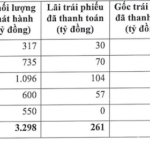

IPA has successfully issued a new bond series, IPA12501, with a total value of VND 1.416 trillion. This 5-year bond offers an attractive annual interest rate of 9.5%.

The Journey of IPA’s Newly Issued VND 1.4 Trillion Bond Series

IPA has successfully raised over VND 1.4 trillion through the issuance of “triple-zero” bonds with a fixed interest rate of 9.5% per annum over a 5-year term. The proceeds will be utilized to acquire newly issued shares of a subsidiary, which will subsequently employ the funds to purchase multiple additional subsidiaries.