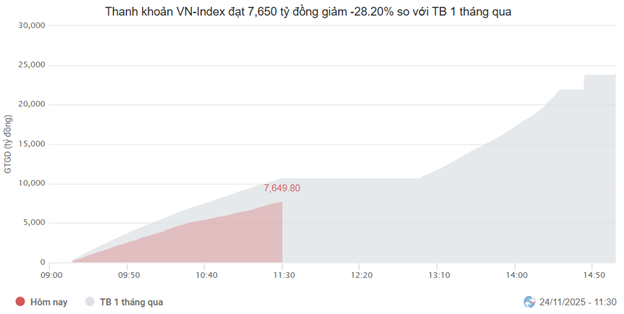

Investors remain cautious amid today’s market fluctuations. Trading value on the HOSE reached just over VND 7.6 trillion, a 13% decline from the previous session and 28% below the one-month average. Meanwhile, the HNX trading value stood at approximately half its one-month average, totaling VND 417 billion.

Source: VietstockFinance

|

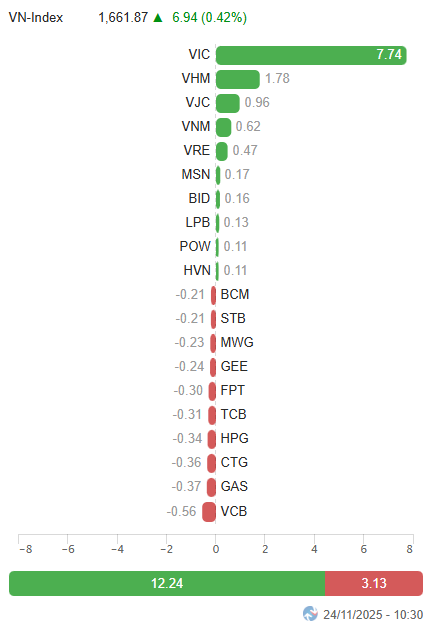

Vingroup’s leading stocks have cooled slightly from their morning highs, partly due to strong profit-taking pressure from foreign investors. VRE, VIC, and VHM topped the list of stocks with the highest net selling by foreign investors this morning.

| Top 10 Stocks with Strongest Net Buying and Selling by Foreign Investors – Morning Session, November 24, 2025 |

In contrast, VJC (+4.06%) and VNM (+5.01%) surged impressively toward the end of the morning session, helping to stabilize the benchmark index around 1,665 points. These were also the two stocks actively bought by foreign investors, despite their overall net selling pressure reaching VND 804 billion across all three exchanges in the morning session of November 24.

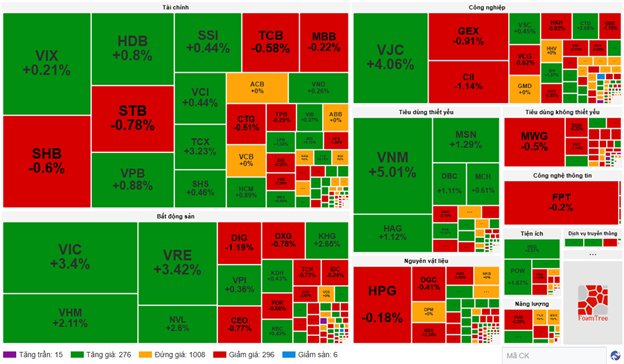

Sector performance remained narrowly mixed, with no industry index moving more than 0.5%, except for real estate and essential consumer goods. Market breadth was relatively balanced, with 291 gainers (15 at the upper limit) and 302 decliners (6 at the lower limit).

Source: VietstockFinance

|

10:30 AM: Market Shifts to Mixed Trading

Support from a few key stocks lifted the index, with the VN-Index briefly surpassing 1,670 points. However, the rally tapered off as trading volume failed to keep pace. By 10:30 AM, the VN-Index traded around 1,663 points, while the HNX-Index turned negative, falling below 263 points.

VIC alone contributed nearly 8 points to the VN-Index, with VHM and VRE adding over 2 points. The index’s gains were primarily driven by Vingroup stocks.

Source: VietstockFinance

|

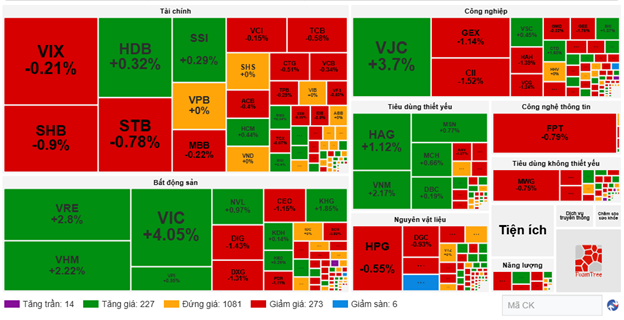

Elsewhere, the broad market’s early green trend shifted to noticeable divergence. Liquidity did not improve in line with the index’s gains, with trading value down over 7% from the previous session.

Within the VN30 basket, aside from the three Vingroup stocks and VNM (+2%), most stocks traded flat around the reference price. Notably, STB, GAS, TPB, and BCM corrected by more than 1%.

Beyond real estate, the essential consumer goods sector performed well, driven by VNM (+2.17%), MSN (+0.65%), MCH (+0.8%), HAG (+1.12%), MML (+6.16%), and DBC (+0.56%).

Other sectors traded narrowly mixed. The financial sector’s early gains also diverged, with securities stocks paring gains mid-morning and banking and insurance stocks increasingly turning red, including VCB, CTG, MBB, STB, SHB, EIB, BVH, and BMI.

Source: VietstockFinance

|

Market Open: Green Dominates Early Trading

The market opened the week positively, with green dominating. By 9:30 AM, the VN-Index rose over 8 points to around 1,663 points, while the HNX-Index surpassed 264 points.

Broad-based gains among large-cap stocks boosted investor confidence. The financial sector, particularly securities stocks, attracted early interest. Stocks like SSI, VIX, HCM, SHS, MBS, and VND saw strong demand, rising over 1% shortly after the open. This is a positive sign as liquidity is expected to improve.

Similarly, the real estate sector was led by NVL, VIC, VHM, VRE, KHG, KSF, and SJS.

Other early standouts included VNM, DBC, HAG, MML, CTD, VSC, and DPG.

– 11:50 AM, November 24, 2025

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.

Market Pulse November 20: Foreign Investors Return to Net Buying Amid Low Liquidity Session

At the close of trading, the VN-Index climbed 6.99 points (+0.42%) to reach 1,655.99, while the HNX-Index dipped 0.8 points (-0.30%), settling at 264.23. Market breadth tilted toward decliners, with 370 stocks falling and 298 advancing. The VN30 basket showed a balanced performance, featuring 13 decliners, 12 gainers, and 5 unchanged.

Market Pulse November 19: Red Dominates as VN-Index Reverses, Plunging Over 10 Points

At the close of trading, the VN-Index fell by 10.92 points (-0.66%), settling at 1,649 points, while the HNX-Index dropped 2.33 points (-0.87%), closing at 265.03 points. Market breadth was overwhelmingly negative, with 430 decliners outpacing 270 advancers. Similarly, the VN30 basket saw red dominate, as 23 stocks declined, 5 advanced, and 2 remained unchanged.