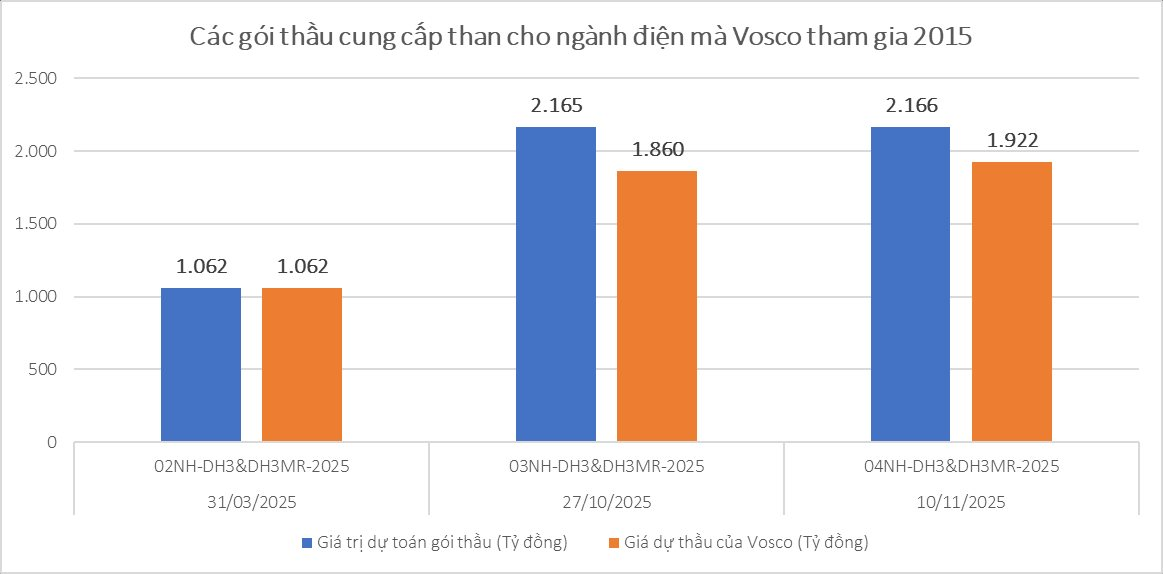

The imported coal market for thermal power plants is witnessing the participation of numerous domestic and international trading companies. Recently, Vosco has been increasingly present in power sector tenders, signaling its strategic expansion in business operations.

Notably, on October 27, 2025, in a VND 2,165 billion coal supply tender for Duyen Hai 3 and 3MR thermal power plants, the Vosco – Vosco Maritime Services consortium submitted the lowest bid of USD 72.93 million, outbidding competitors like Vinacomin – Noble (USD 73.76 million).

Subsequently, on November 10, 2025, Vosco participated in another tender of equivalent value with a bid of USD 75.38 million. However, this tender saw fiercer competition, with Dan Ka Mining Company offering the lowest bid of USD 74.2 million.

E

arlier in March 2025, Vosco secured a VND 1,062 billion contract

, setting the stage for its year-end trading activities.

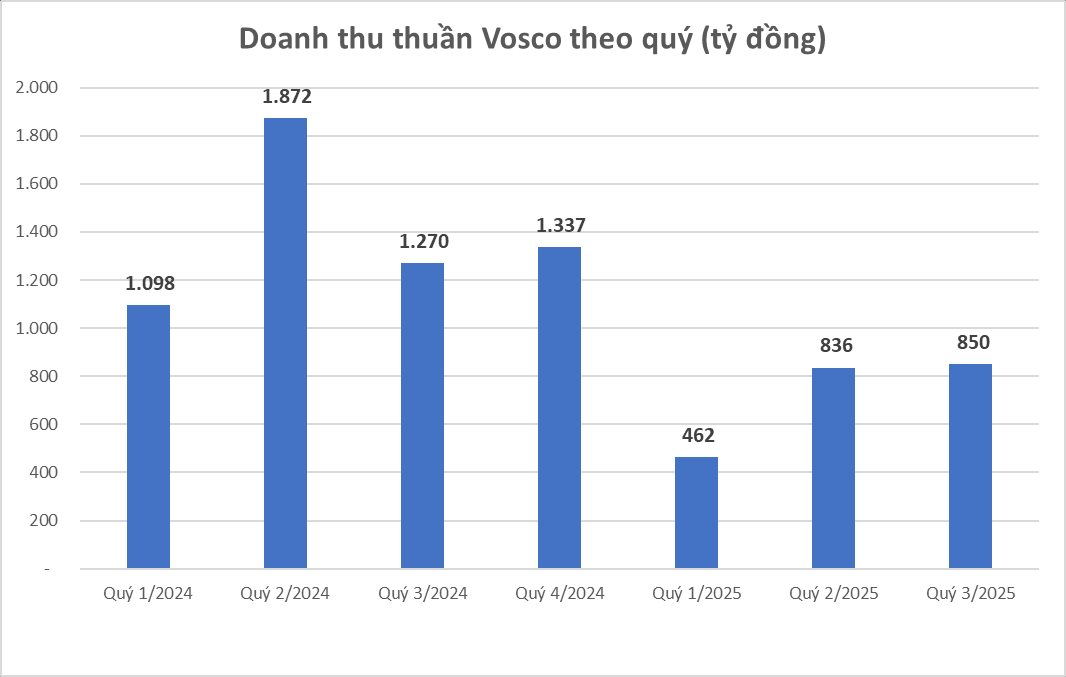

Financially, Vosco’s Q3 2025 report shows consolidated net revenue of nearly VND 850 billion, down from VND 1,270 billion in the same period in 2024. This decline is primarily due to a 70% drop in trading revenue to VND 650 billion and a reduced fleet size following the return of leased ships and disposal of old vessels.

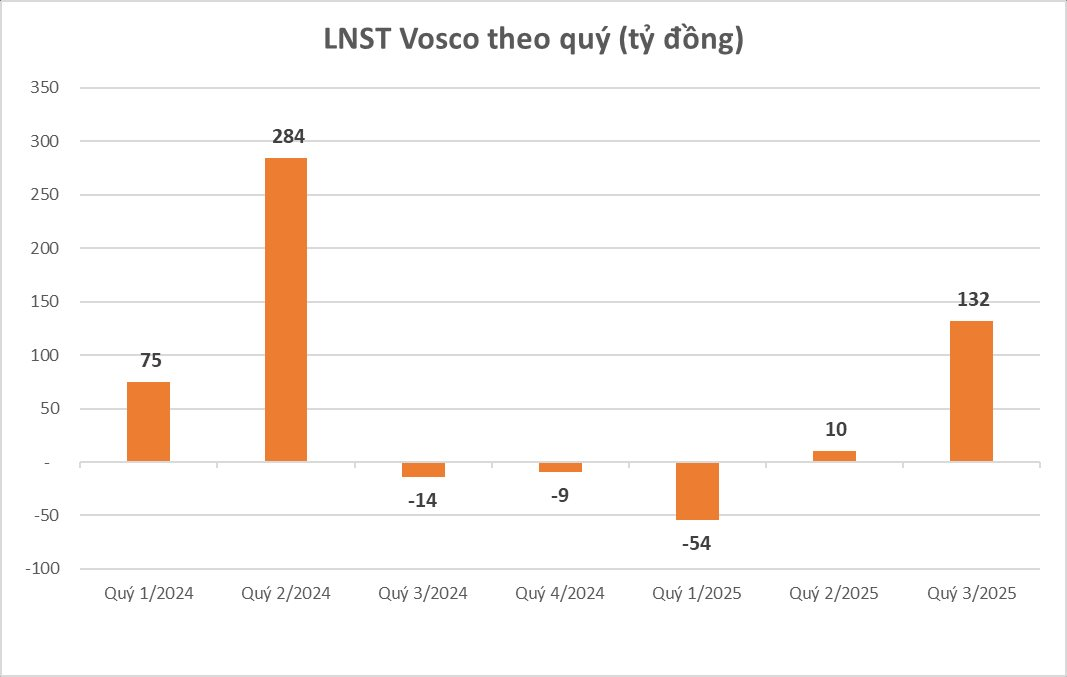

However, Q3 net profit reached nearly VND 132 billion, compared to a loss of over VND 14 billion in the same period last year. This turnaround is largely attributed to other activities, specifically a VND 99 billion gain from the sale of the Vosco Star vessel.

For the first nine months of 2025, Vosco’s revenue totaled VND 2,147.6 billion, 50% of the same period in 2024. Net profit stood at VND 88 billion, lower than the VND 344 billion recorded in 2024 (a year marked by significant profits from the sale of the Dai Minh vessel).

The company’s financial structure has also shifted. Total assets by the end of Q3 2025 increased by over VND 1,000 billion to approximately VND 4,000 billion, with fixed assets rising by more than VND 1,300 billion due to new vessel investments. Debt increased from zero at the beginning of the year to VND 856 billion, with interest expenses for the nine months reaching nearly VND 20 billion.

At the Extraordinary Shareholders’ Meeting on November 7, 2025, Vosco approved the sale of the Vosco Unity vessel (53,552 DWT) and considered selling or leasing back 1 to 3 Supramax vessels. Additionally, the company added shipbuilding and floating structure manufacturing to its business lines, aligning with its new strategic direction.

Historically, Vosco faced challenges from 2013 to 2020, focusing on addressing accumulated losses due to the maritime transport downturn, and successfully eliminated these losses by the end of 2022. The company currently has a charter capital of VND 1,400 billion, with Vietnam Maritime Corporation (VIMC) holding 51%. Notably, the tender partner, Vosco Maritime Services JSC, is a former 100% subsidiary, now chaired by Mr. Cao Minh Tuan, former CEO of Vosco.

Hodeco Chairman and CEO Register to Purchase Convertible Bonds

Chairman of the Board of Directors Doan Huu Thuan and CEO Le Viet Lien have registered to exercise their rights to purchase convertible bonds issued by Hodeco.