According to a recent analysis by Rong Viet Securities (VDSC) on Novaland Group (HoSE: NVL), the company is projected to deliver approximately 40,800 units between 2025 and 2030, generating over VND 513 trillion in revenue.

The years 2027 and 2028 are anticipated to be the peak growth period. In 2027, Novaland is expected to deliver nearly 18,000 units, contributing to approximately VND 226.5 trillion in revenue, primarily from Aqua City and NovaWorld Ho Tram. In 2028, deliveries are forecasted at 8,557 units, with revenue nearing VND 118 trillion, where Aqua City and NovaWorld Phan Thiet will play significant roles.

Alongside its long-term strategy, Novaland’s current business performance is showing signs of improvement. In the first 10 months of 2025, the company recorded VND 5.292 trillion in revenue, a 22% increase year-over-year.

This positive outcome is largely attributed to accelerated deliveries in key projects, including NovaWorld Phan Thiet, Aqua City, NovaWorld Ho Tram, and central Ho Chi Minh City developments. These results signify a clear recovery for the company following an extended period of restructuring and legal resolutions.

According to the latest report, revenue from most major project clusters has maintained double-digit growth. Aqua City contributed VND 1.339 trillion (up 11% YoY), central Ho Chi Minh City projects reached VND 1.130 trillion (up 12%), and NovaWorld Phan Thiet remained a key driver with VND 1.520 trillion (up 13%). Notably, NovaWorld Ho Tram saw a 70% increase, reaching VND 1.303 trillion, thanks to improved construction progress and legal clarity.

While the total number of units delivered in the first 10 months was 810, a 12.5% decrease year-over-year, NovaWorld Ho Tram alone saw a 35% increase due to multiple zones completing delivery conditions.

VDSC estimates the total construction limit for projects within the Novaland ecosystem to reach nearly VND 30.5 trillion by 2030.

VDSC reports that the total construction limit for projects within the Novaland ecosystem is expected to reach nearly VND 30.5 trillion by 2030. Aqua City accounts for over half of this, with VND 18 trillion, followed by NovaWorld Phan Thiet at over VND 7.5 trillion.

Legal processes for major projects are being expedited. At Aqua City, most zones have obtained 1/500 planning and are finalizing sales permits. Zones such as Waterfront, Riverside, and Marina are set for significant deliveries from 2025 to 2026, bringing the total delivered units to 670.

Central Ho Chi Minh City projects are also showing progress. The Grand Manhattan is expected to complete land financial obligations by late 2025; Victoria Village has finalized legal procedures and plans to relaunch sales in Q4/2025; Palm City’s high-rise zone is anticipated to receive 1/500 planning in Q4/2025 and begin deliveries in 2027.

At NovaWorld Ho Tram, zones like Habana Island, Happy Beach, Morito, and Wonderland have obtained construction permits and completed land obligations. The Tropicana and Wonderland zones have delivered 298 and 163 units, respectively.

Meanwhile, NovaWorld Phan Thiet has completed 1/500 planning and is expected to pay land use fees in full by Q1/2026; the project has already delivered 1,468 units.

Analysts note that the uniform recovery across four major project clusters indicates Novaland is steadily resolving legal bottlenecks and improving cash flow through accelerated deliveries.

Regarding financing, Novaland has secured credit from domestic banks for projects with approved legal status and feasible progress, while international capital continues to support restructuring and loan extensions.

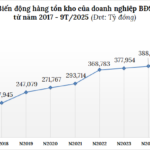

Record-High Inventory Squeeze Hits Real Estate Firms

The inventory landscape for real estate businesses reached unprecedented heights by the end of Q3 2025. Several firms saw their stockpiles surge by tens of trillions of Vietnamese dong.

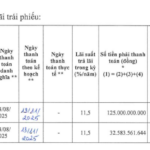

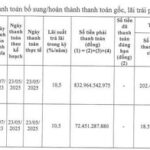

Gia Phú Real Estate Delays Bond Principal and Interest Payments

By November 13, 2025, Gia Phu Real Estate failed to settle a principal payment of VND 125 billion and nearly VND 32.6 billion in interest for the GPRCH2123001 bond tranche, citing inability to secure sufficient funds.