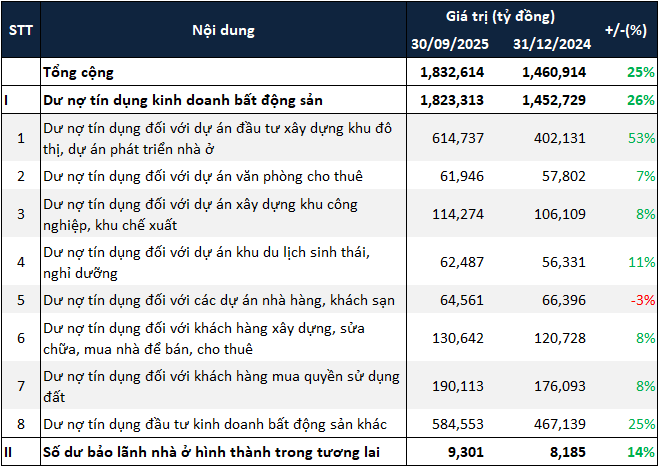

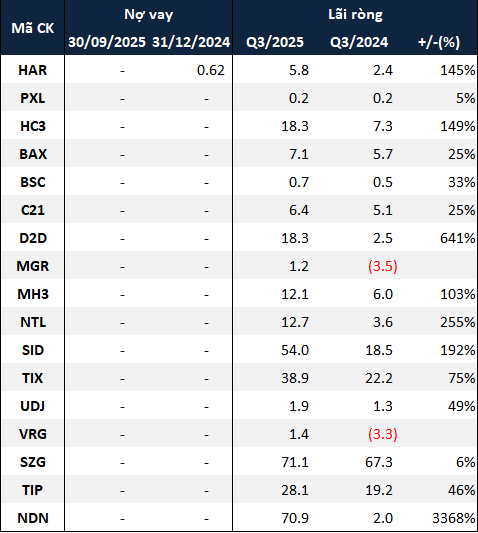

According to the Ministry of Construction, the total credit balance for real estate business activities exceeded VND 1,830 trillion by the end of Q3/2025, a 25% increase compared to the end of 2024. Of this, real estate business debt accounted for over 99% with VND 1,820 trillion, while the remaining VND 9.3 trillion was for future housing guarantees.

Within the VND 1,820 trillion, the highest proportion was debt for urban area and housing development projects, totaling nearly VND 615 trillion. This was followed by other real estate business activities (nearly VND 585 trillion), land use rights purchases (over VND 190 trillion), and construction, renovation, and property sales or rentals (nearly VND 131 trillion).

|

Real Estate Business Credit Balance as of Q3/2025

Source: Compiled by the author from the Ministry of Construction

|

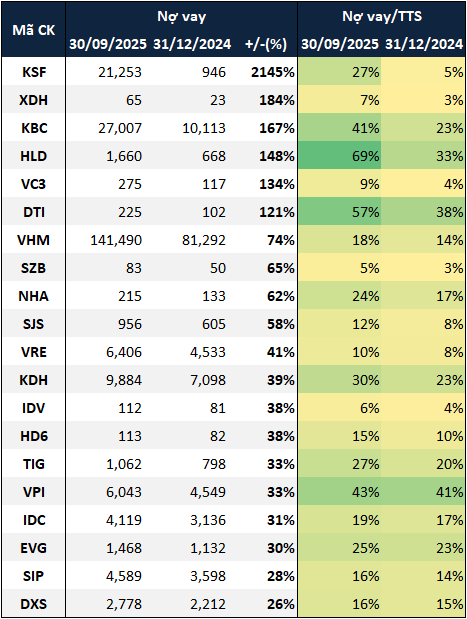

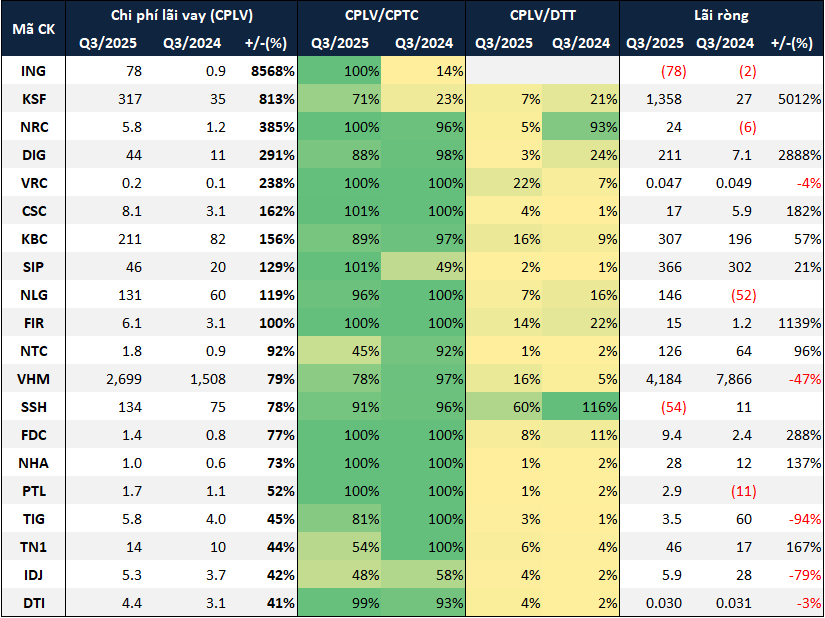

According to VietstockFinance, the total debt of 104 listed real estate companies (HOSE, HNX, and UPCoM) reached nearly VND 390.7 trillion by the end of September 2025, a 37% increase from the beginning of the year. Among these, 51 companies saw increased debt, 38 saw reduced debt, and 15 remained debt-free.

|

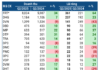

Top 20 Real Estate Companies with the Largest Debt Increase in the First 9 Months of 2025 (Unit: Billion VND)

Source: VietstockFinance

|

Leading the increase was Sunshine Group (HNX: KSF), with a debt balance of nearly VND 21.3 trillion by the end of September, over 22 times higher than at the beginning of the year. This was due to the company’s aggressive restructuring through share acquisitions in several subsidiaries during the first nine months, including Sunshine Tay Ho, SmartMind Securities, DIA Investment, and Sunshine Homes.

Among the consolidated debts, a long-term loan of nearly VND 12.4 trillion from MB became KSF’s largest debt. This loan included three credit agreements related to two consolidated companies, Sunshine Tay Ho and DIA Investment.

The first agreement, with a limit of VND 4.62 trillion, was signed by Sunshine Tay Ho in March 2025 for the development of 175 low-rise houses on lot 1.B.29.No in Nam Thang Long Urban Area. The second agreement, also by Sunshine Tay Ho, had a limit of VND 5.6 trillion, signed in May 2025 to cover costs for 234 low-rise houses on plots TT-01 to TT-19. The final agreement, by DIA Investment, had a limit of VND 4.67 trillion for the development of the Sunshine Grand Capital project in Hanoi.

Hanoi Civil Construction Investment Corporation (UPCoM: XDH) saw the second-highest debt increase, with a balance of over VND 65 billion by September 30, 2025, nearly three times higher than at the beginning of the year. This was primarily due to a VND 130 billion credit agreement signed with BIDV in late December 2024. By the end of September, the debt from this agreement had exceeded VND 42 billion.

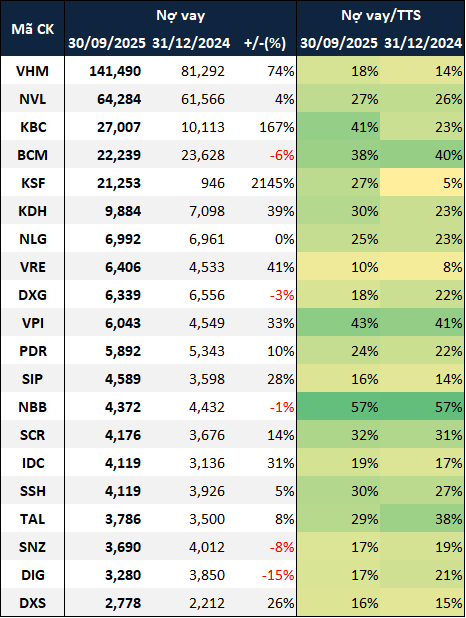

The top five companies with the largest debts remained unchanged: Vinhomes (HOSE: VHM), No Va Real Estate Investment Corporation (HOSE: NVL), Kinh Bac Urban Development Corporation (HOSE: KBC), Becamex Industrial Development Corporation (HOSE: BCM), and Sunshine Group (HNX: KSF). These companies maintained debts exceeding VND 20 trillion.

|

Top 20 Real Estate Companies with the Largest Debts as of September 2025 (Unit: Billion VND)

Source: VietstockFinance

|

Among other companies, Dat Xanh Real Estate Services (HOSE: DXS) entered the top 20 with a debt of nearly VND 2.8 trillion, a 26% increase, primarily due to long-term bank loans. Its parent company, Dat Xanh Group (HOSE: DXG), saw its debt rise by 8% to over VND 6.3 trillion by the end of September, also due to increased long-term bank loans. Notably, DXG spent over VND 200.5 billion to repurchase all of its DXGH2125002 bonds on July 9.

In the industrial real estate sector, alongside KBC’s significant debt increase in the first half of the year, IDICO Corporation (HNX: IDC) also stood out with a debt increase of over 30% to VND 4.1 trillion. IDC’s debt by the end of September increased by nearly 20% compared to the end of June, primarily due to short-term bank loans, which rose by nearly 84% to over VND 1.1 trillion. New loans in the Q3/2025 consolidated financial statements included a VND 417 billion unsecured loan from Techcombank at 5.1% interest, a VND 72 billion unsecured loan from Shinhan Bank at 4.5% interest, and a VND 6.5 billion loan from Vietcombank Tan Dinh branch at 5% interest, secured by land use rights and property owned by IDICO-LINCO (UPCoM: LAI).

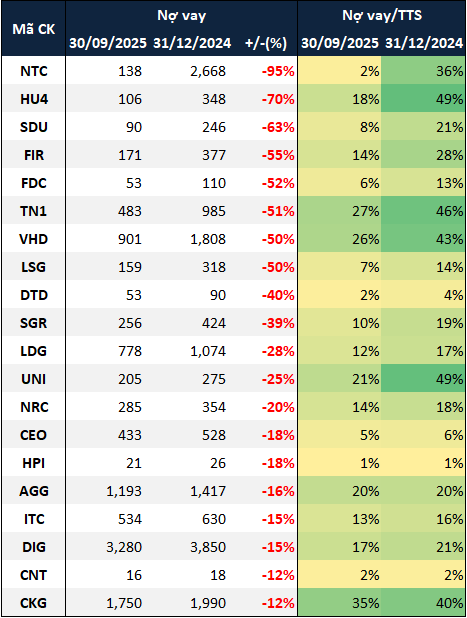

Several companies reduced debt through loan maturities.

In the industrial real estate sector, Nam Tan Uyen Industrial Park Corporation (HOSE: NTC) continued to reduce its debt in Q3, becoming the real estate company with the largest debt reduction since the beginning of the year, down 95% to VND 138 billion. This was due to the expiration of a VND 2.5 trillion short-term loan from Vietcombank in September 2023. The loan, with a limit of nearly VND 2.8 trillion and an interest rate of 3.9-4.2%, was used for dividend payments and the Nam Tan Uyen expansion project – Phase 2.

The remaining VND 138 billion debt was a long-term loan from Vietcombank, used for project-related expenses. The loan had an 18-month term and a 6% interest rate.

The second-largest debt reduction was by HUD4 Construction and Investment Corporation (UPCoM: HU4), which saw its debt decrease by 70% to VND 106 billion, thanks to the full repayment of a VND 127 billion long-term loan from TPBank.

|

Top 20 Real Estate Companies with the Largest Debt Reduction in the First 9 Months of 2025 (Unit: Billion VND)

Source: VietstockFinance

|

Among companies reducing debt, An Duong Thao Dien Real Estate Investment and Trading Corporation (HOSE: HAR) stood out by eliminating its debt entirely by the end of September, becoming the 16th debt-free real estate company.

The initial VND 600 million debt from early 2025 was part of a VND 2.8 billion credit agreement between HAR and Vietcombank Tan Son Nhat branch, signed in 2022. The loan had a 36-month term, with a 9% interest rate for the first 24 months. The purpose was to purchase a Hongqi car, using the car as collateral.

|

17 Debt-Free Real Estate Companies as of September 30, 2025 (Unit: Billion VND)

Source: VietstockFinance

|

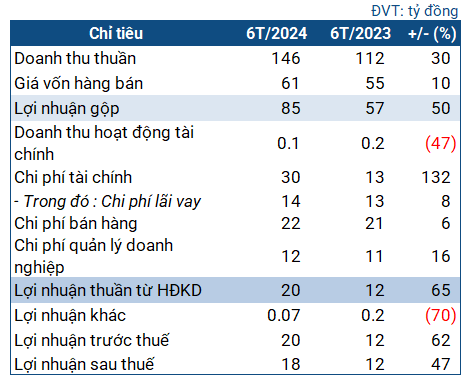

Interest expenses rose by 56% in Q3.

Amid a 37% increase in debt, interest expenses for real estate companies surged by 56% in Q3/2025, reaching nearly VND 5 trillion.

Leading the increase was Construction Investment and Development Corporation (UPCoM: ING), with interest expenses soaring to nearly VND 78 billion, compared to less than VND 1 billion in the same period last year, an 87-fold increase. This, combined with zero net revenue, resulted in a post-tax loss of over VND 78 billion in Q3 (compared to a loss of nearly VND 2 billion in the same period last year).

Companies with significant debt increases, such as KSF and KBC, also saw interest expenses rise sharply, with KSF’s expenses increasing ninefold to VND 317 billion and KBC’s nearly tripling to VND 211 billion in Q3/2025.

|

Top 20 Companies with the Largest Interest Expense Increases in Q3/2025 (Unit: Billion VND)

Source: VietstockFinance

|

– 10:00 24/11/2025

Unlocking Housing Supply: The Golden Key of Mega-Urbanization

According to experts, the development of megacities centered around public transportation will be the key to unlocking future housing supply challenges.

Unlocking New Growth Hubs: Navigating Da Nang’s Investment Landscape

As Da Nang expands its development southward, the Hoa Xuan area has rapidly emerged as a new urban hub. Capitalizing on this trend, Sun Group is crafting Sun NeO City—a strategically located project with synchronized infrastructure and a sustainable vision, poised to become the focal point of southern Da Nang.

Iconic Tower in Ho Chi Minh City Elevates Every Home Within Its View

Landmark 81 stands as not only an architectural icon of Ho Chi Minh City but also a new benchmark for apartments with breathtaking views. Real estate agents reveal that often, clients are so captivated by the sight of Landmark 81 that they instantly decide to purchase a unit with this stunning vista.