In Q3-2025, the new supply of the real estate market saw an absorption rate of over 80%, indicating strong demand for newly launched projects. Pictured: A construction site of a real estate project in Dong Anh district. Photo: Do Tam

High Prices, Yet Strong Absorption

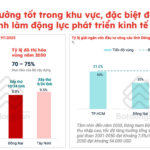

This paradox in the real estate market was highlighted by Dr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association. The association’s data for the first nine months of 2025 reveals a highly positive absorption rate of nearly 70%, corresponding to approximately 60,000 transactions, double that of the same period in 2024. Notably, most projects launched during this period had higher prices compared to the previous year but still recorded strong absorption rates, with some even selling out immediately upon launch. This reflects a resurgence in market demand, despite rising prices. Direct surveys of multiple projects also confirm this trend.

Savills’ Q3-2025 report shows that new supply achieved an absorption rate of over 80%, demonstrating robust demand for newly introduced projects. Projects with strong liquidity typically share common strengths, such as prime locations, reputable developers, complete legal documentation, modern designs, and comprehensive amenities. Additionally, flexible payment policies have been a key factor in encouraging buyers to make quick decisions.

Tran Quang Trung, Business Development Director at One Housing, noted that despite the concentration of supply in the high-end and luxury segments, “whatever is released is quickly absorbed.” According to One Housing’s latest report, the absorption rate for these segments reached nearly 90%. This imbalance has driven the average apartment price in Hanoi to a record high of 85.6 million VND per square meter.

Despite strong absorption, Dr. Nguyen Van Dinh cautions that most transactions currently come from investors purchasing second properties, rather than end-users. This indicates that market activity is primarily driven by investment capital, while genuine housing demand remains constrained by prices that exceed the affordability of most residents.

Notably, Le Dinh Chung, a member of the Real Estate Market Research Task Force at the Vietnam Real Estate Brokers Association, observed that despite higher prices, new projects are still attracting large deposits, with some selling out on the first day of launch. This is driven by both genuine demand and investment needs, as low-cost capital and inflationary pressures push individuals toward real estate as a safe-haven asset.

Effectively controlling speculative capital will ensure fairness and transparency in the real estate market. Photo: Nguyen Quang

Potential Consequences

One of the primary drivers of soaring property prices, according to Dr. Nguyen Van Dinh, is speculative activity and market manipulation. “In some cases, developers collaborate with distribution agencies to control supply by releasing units in small batches, creating artificial scarcity and fostering a fear of missing out among buyers. Speculative groups also hoard properties, creating fake shortages and profiting from price differences,” he explained.

Economist Dinh The Hien warns that behind the phenomenon of “sell-out” projects lies evidence of credit capital being funneled into short-term speculation. With 80% of current transactions driven by speculation and flipping, genuine demand remains subdued.

Dr. Nguyen Van Dinh highlights the social risks associated with this trend, including housing insecurity, reduced homeownership opportunities, and distorted investment structures. The overheated market attracts significant capital, impacting other productive sectors. Additionally, widespread use of financial leverage by investors increases systemic financial risk and potential bad debt. If interest rates fluctuate or property prices stagnate, the risk of bad debt escalates. Artificial price inflation distorts market values, disconnecting them from real worth.

Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, suggests that speculation and investment are inherent in any market. However, excessive speculation can stifle long-term liquidity. “International experience shows that personal income tax on property transactions can curb speculation. For example, in Japan, selling a property within five years of purchase incurs a 39% tax, while sales after five years are taxed at 19%. Vietnam could adopt a similar approach, taxing sales within 3-5 years at 15% and reducing it to 5-7% thereafter, encouraging long-term asset holding,” he proposed.

The Vietnam Real Estate Association advocates for comprehensive solutions, including expediting amendments to the Land Law, Housing Law, and Real Estate Business Law. Implementing new land price schedules should be accompanied by mechanisms to adjust financial obligations based on land use purposes, ensuring fairness and minimizing public impact.

Will the National Two-Tier Housing Fund Officially Cool Down Property Prices?

Experts suggest that only when the actual supply from the National Housing Fund materializes will house prices have a chance to stabilize. In the initial phase, this policy primarily influences investor sentiment.

“Small Rear House Suddenly ‘Upgraded’, No Longer Criticized for Poor Feng Shui”

Once dismissed for poor feng shui and perceived difficulty in selling, back-tapering houses are now in high demand due to their prices being 15-30% lower than those of square plots in the same area.